Historically, tobacco has been an important crop in several U.S. southern states. However, due to a variety of factors, including health issues surrounding the crop, international competition, and policy/regulatory changes, the U.S. tobacco industry has declined by nearly 70% over the past 25 years.

A previous article in Southern Ag Today, highlighted some of the major structural changes following the elimination of the federal tobacco program (better known as the tobacco buyout) in 2004. Another important part of the modern day tobacco story that has not received much attention has been the significant “investment” dollars made available for tobacco farmers and rural communities evolving from tobacco’s Master Settlement Agreement (MSA).

In 1998, 46 state attorney generals signed the MSA with the major U.S. tobacco companies to settle state lawsuits to recover health care costs associated with treating smoking-related illnesses. [1] To date, the MSA represents the largest civil lawsuit settlement in U.S. history.

Under the MSA, tobacco manufacturers agreed to make annual payments to the settling states into perpetuity, as long as cigarettes are sold in the United States. While encouraged to use these funds for tobacco cessation, tobacco control, and other health-related issues, participating states were given complete control over how to use these settlement funds. Most state governments have used these funds over the past 25 years for at least a portion of public health care expenses, but many states have opted to distribute these funds for other state priorities including funding for education, childhood development, infrastructure investment, and balancing state budgets. Given the significant impact of the MSA on tobacco economies and rural communities, three traditional tobacco-producing states, Kentucky, North Carolina, and Tennessee have elected over the years to use a significant share of their MSA dollars to fund ag diversification in their state’s farm economy.

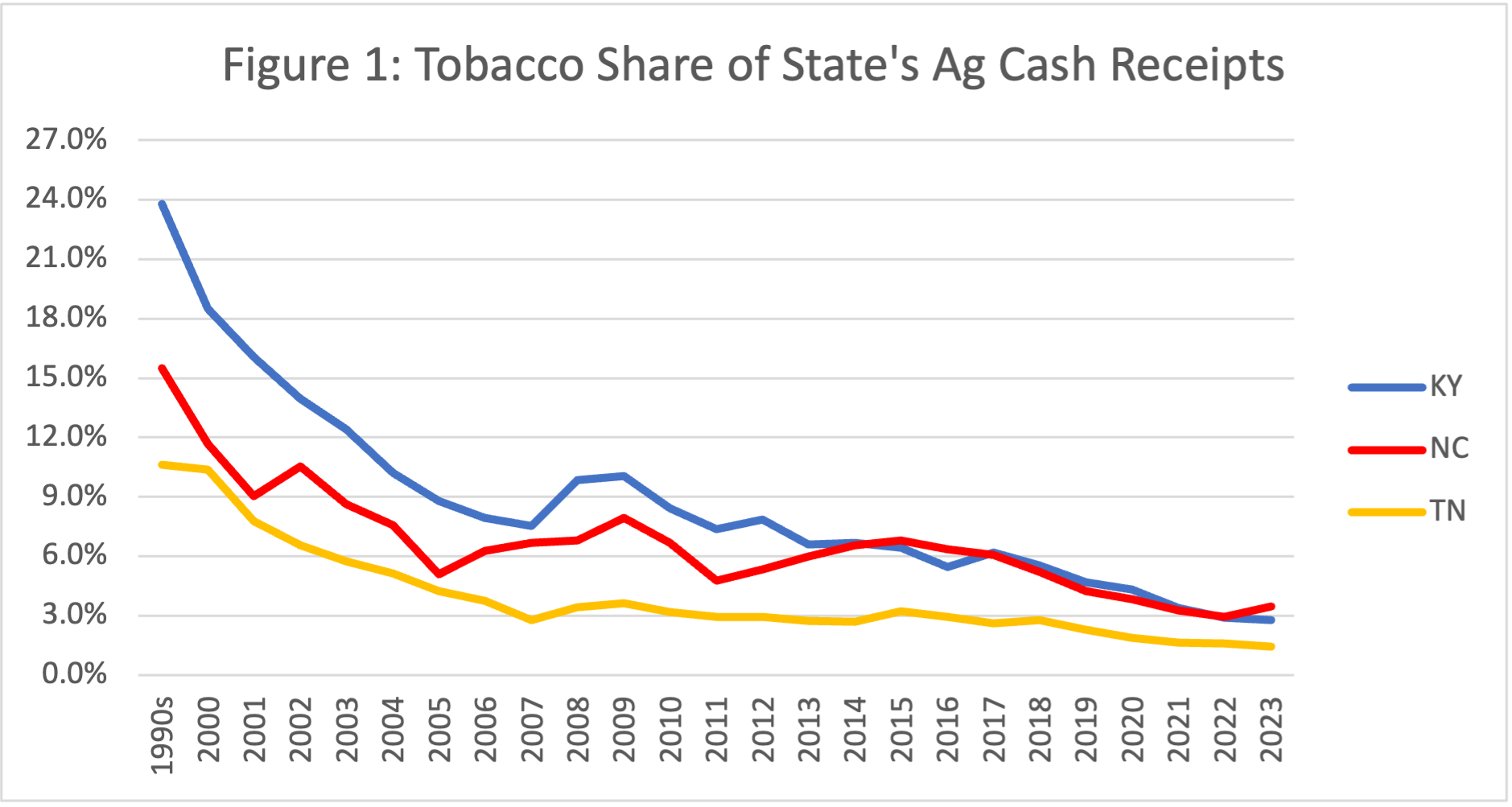

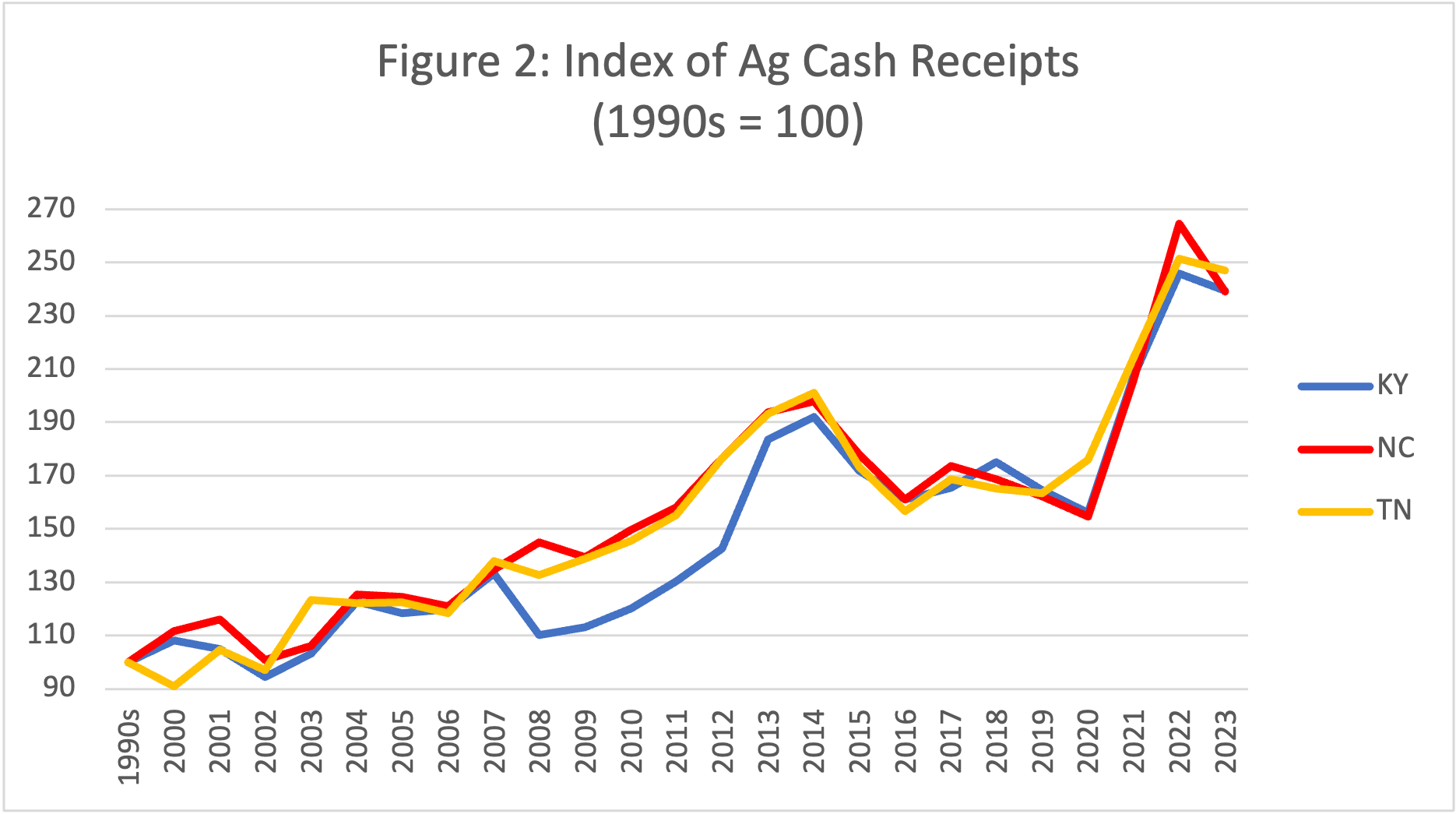

During the 1990s, tobacco accounted for 24% of Kentucky ag cash receipts, 16% in North Carolina, and 11% in Tennessee – representing the number one cash crop in each state (Figure 1). Since the 1990s, tobacco cash receipts in Kentucky have declined by 72%, compared to a 66% loss in Tennessee and a 47% loss in North Carolina. However, ag cash receipts have more than doubled in all three states on a nominal basis since 2000 (Figure 2) and are up around 30% when adjusted for inflation. Tobacco now accounts for only around 3% of ag cash receipts in Kentucky and North Carolina and less than 2% in Tennessee.

Given the magnitude of the tobacco losses, the growth in ag cash receipts in these historically tobacco-dependent states has been very impressive. Imagine the outcome of any state’s ag economy losing over half of its top ag enterprise such as a mid-western state experiencing a greater than 50% reduction in their grain sales or a Wisconsin losing over half of its dairy receipts. Not only have ag cash receipts increased substantially in North Carolina, Kentucky, and Tennessee over the past 25 years, but ag sales in these three tobacco states have actually increased on a percentage basis more than the aggregate receipts in the remaining eleven states in the Southern region since 2000. Arguably, access to these diversification funds evolving from the MSA (along with tobacco buyout dollars) have contributed greatly to this growth in the ag economies in these major U.S. tobacco states.

North Carolina has had two entities that have accessed MSA funds over the past 25 years to support agriculture and its tobacco-dependent rural communities — the North Carolina Tobacco Trust Fund and the Golden LEAF Foundation. The Kentucky Agricultural Development Fund (KADF) also recently celebrated 25 years of existence of providing 50% of their MSA dollars to agriculture, while the Tennessee Agriculture Enhancement Program )TAEP) have utilized a portion of these MSA funds to support ag diversification since 2005. In aggregate, these entities have invested more than one billion dollars of MSA dollars among tobacco producers and their rural communities over the past 25 years, covering more than 100,000 projects. These projects are all over the board, including funding alternative ag enterprises, farm and rural community infrastructure, programs supporting beginning farmers, improving crop and livestock marketing/management, investing in regional and local food markets, agritourism, food processing, ag education, workforce development, leadership and ag promotion programs along with a host of other initiatives to help offset tobacco incomes in tobacco-dependent regions in the South.

[1] Florida, Minnesota, Mississippi, and Texas were not signatories to the MSA as they had their own individual settlements with U, S. tobacco companies.

Snell, Will. “Tobacco Master Settlement Agreement Investment in Diversification of Southern Agriculture.” Southern Ag Today 5(33.4). August 14, 2025. Permalink

Leave a Reply