From 2015 to 2023, crop insurance programs played a critical role in protecting American farmers from financial risk, particularly in the face of increasing climate volatility. By combining basic policies—such as Actual Production History (APH), Yield Protection (YP), Revenue Protection (RP), and RP with Harvest Price Exclusion (RP-HPE)—with supplemental options like the Supplemental Coverage Option (SCO) and Enhanced Coverage Option (ECO), producers saw substantial improvements in both revenue stability and risk reduction.

Under baseline conditions, the integration of these supplemental insurance layers resulted in a 27.9% increase in the chance to receive insurance funds that offset weather revenue losses, compared to farming without insurance. This revenue loss reduction comes from both subsidized premiums and indemnity payments that compensated for losses. More importantly, the variability in farm revenue dropped by nearly half—49.05%—and downside risks were dramatically reduced. Relative downside risk fell by 83.6%, while absolute downside risk declined by 80.98%. These figures reflect a significant buffer against income shocks, achieved at a relatively low cost: an actuarially fair premium rate of just 12.34 cents per dollar of liability, with 63.67% of that cost covered by federal subsidies. Farmers paid only 4.35 cents per dollar out of pocket.

However, the benefits of crop insurance were not evenly distributed across all crops and regions. Cotton emerged as the crop with the highest reduction in downside revenue risk at 88.47%, followed closely by corn (85.91%), canola (83.41%), and wheat (82.42%). Other major crops such as soybeans, peanuts, and rice also saw meaningful reductions, but were lower than the crops above. Geographically, states like Arizona (cotton), Iowa (corn), Indiana (soybeans), Minnesota (corn), and Illinois (corn) led the nation in risk reduction, with rates exceeding 86%. In contrast, states such as Arkansas, California, Vermont, Louisiana, and West Virginia reported lower reductions, often below 71%.

Further analysis revealed a trade-off: programs that delivered the greatest risk protection also tended to involve higher revenue transfers and greater out-of-pocket costs for producers. The One Big Beautiful Bill (OBBB or OB3) that passed in July 2025 included an increase in premium subsidy for SCO and ECO, increasing subsidy rates to 80%. Further, underlying basic policy subsidies increased by 5 percentage points. This balance between security and affordability remains a key consideration for producer decision making going forward.

Together, these results underscore the importance of crop insurance as a cornerstone of agricultural risk management. As climate-related disasters become more frequent and severe, the role of insurance in stabilizing farm income and supporting rural economies will only grow more vital.

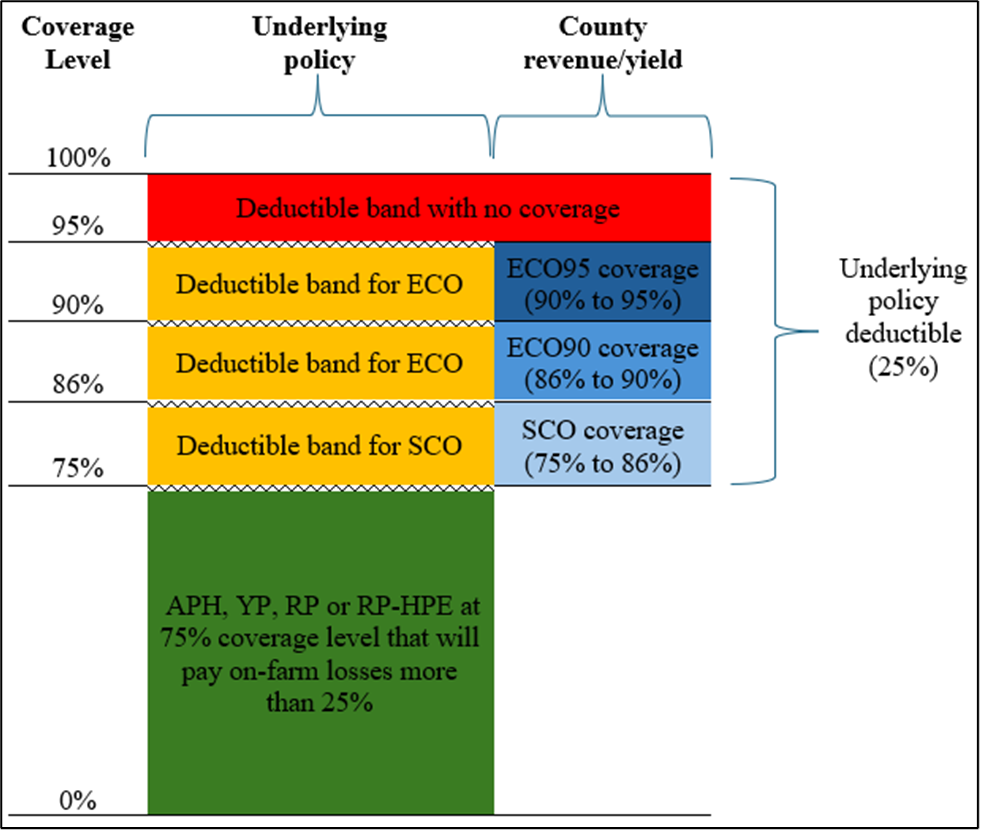

Illustration of supplemental coverage combined with an underlying individual policy at 75% coverage level

Tsiboe, Francis, Hunter Biram, and Amy Hagerman. “Measuring the Revenue Risk Reduction of Supplemental Crop Insurance Policies.” Southern Ag Today 5(37.4). September 11, 2025. Permalink

Leave a Reply