This is not a question of which came first, we all know the answer to that. But, as was discussed in an earlier SAT for cattle, hogs and lambs, this is a question of productivity for the chicken and egg segments of the U.S. poultry market this coming year. (A turkey outlook previously discussed here)

Chicken

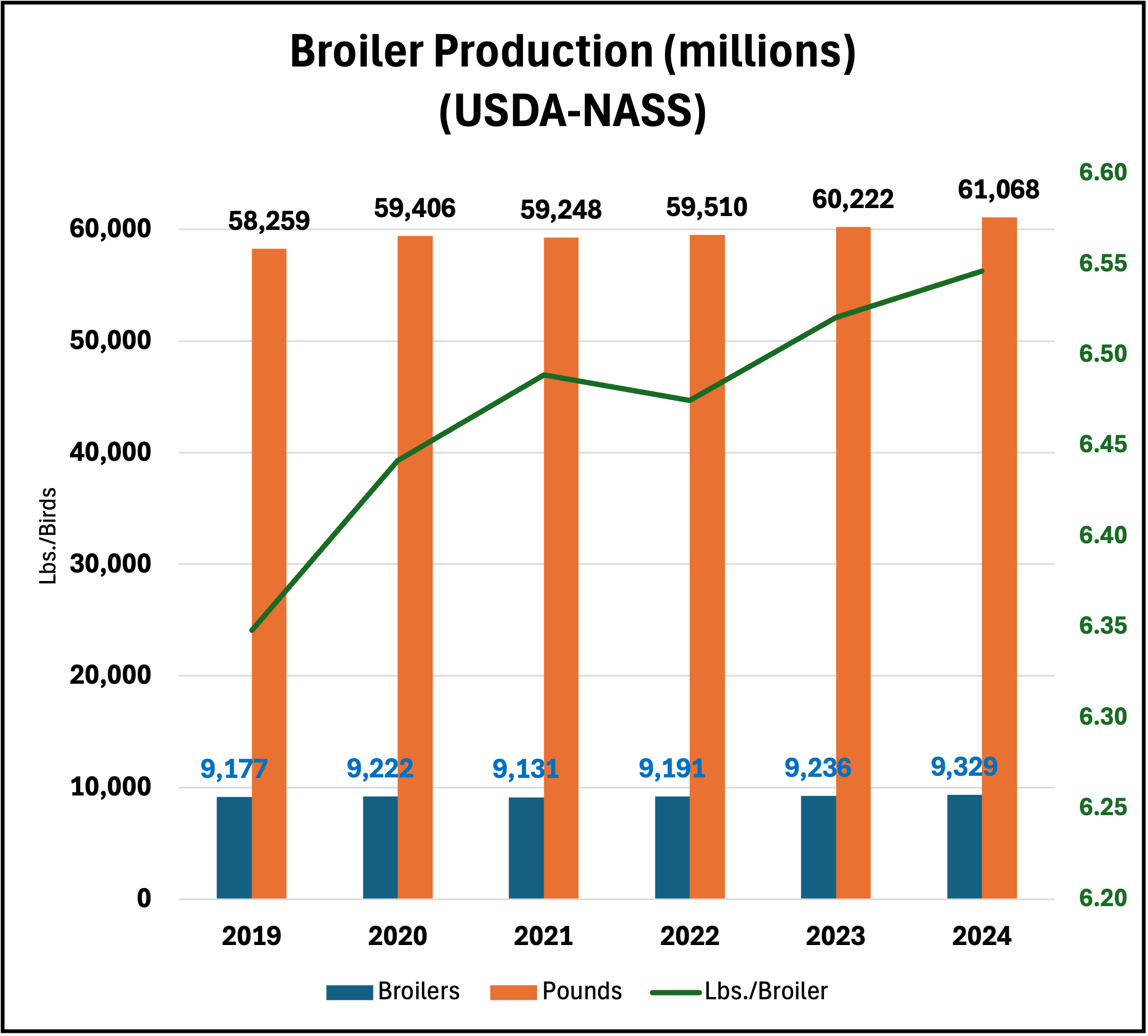

Broiler production increased by 846 million pounds in 2024 over 2023, a 1.4 percent increase (Fig. 1). Increased production came from two sources: more birds and more pounds per bird. On the bird side, 93 million more broilers were produced, a 1 percent increase. As has happened in 5 of the last 6 years, increased chicken production also came from producing a heavier bird, on average, 6.55 lbs. in 2024 vs. 6.52 lbs. in 2023.

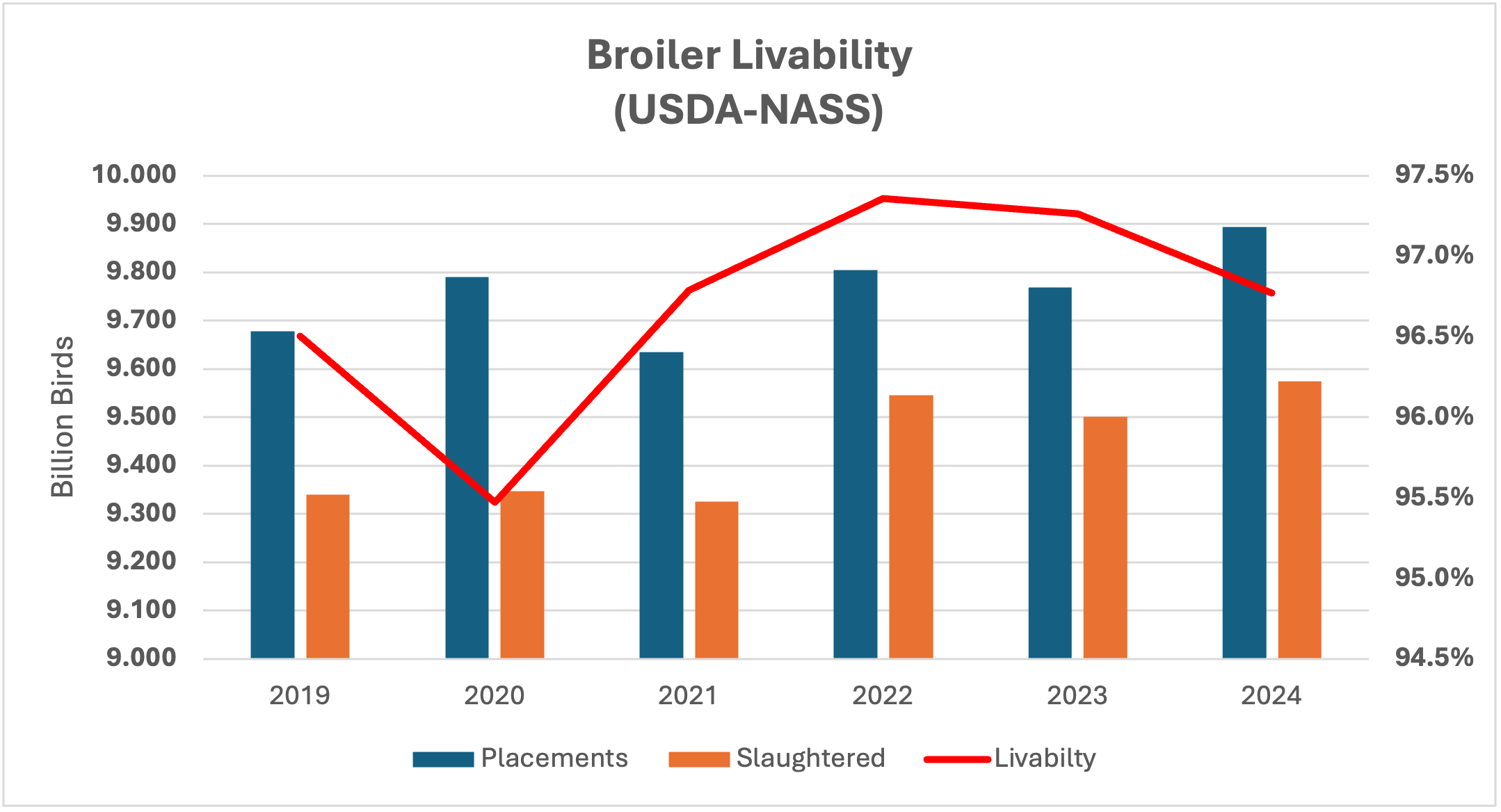

Production increases have been supported by profitable prices and falling feed costs. Broiler demand has likely benefited from increasing prices for beef and pork. So far in 2025, the increased productivity trend continues with the weekly average production maintaining about a 30-million-pound lead on historical weekly production back to 2019 and staying slightly above 2024 production. Though chick livability declined again in 2024, the lost birds were offset by placing more chicks overall (Fig. 2).

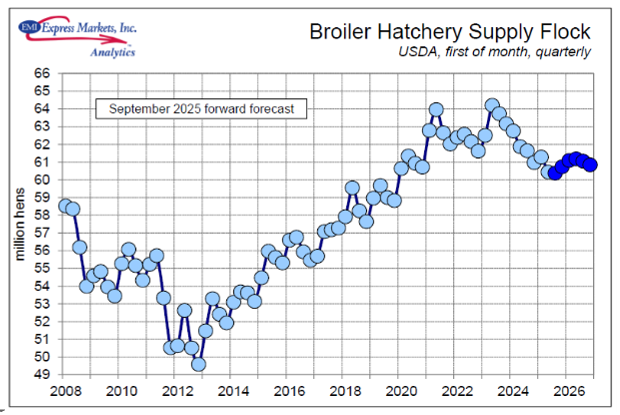

One important question for broiler productivity is if the chicken industry can continue to boost the supply of additional chicks for broilers. This problem goes all the way back to the supply of broiler type pullets. These are the pullets that become laying hens that supply broiler chicks. The broiler hatchery supply flock had seen a steady increase since 2012. But, beginning in 2023, the supply flock began decreasing steadily, with only a slight reprieve being projected (Fig. 3). Just like fewer cows equals fewer feeder calves, fewer breeder hens equal fewer broiler chicks. This supply crunch may start hitting broiler production as early as Q1 2026.

Eggs

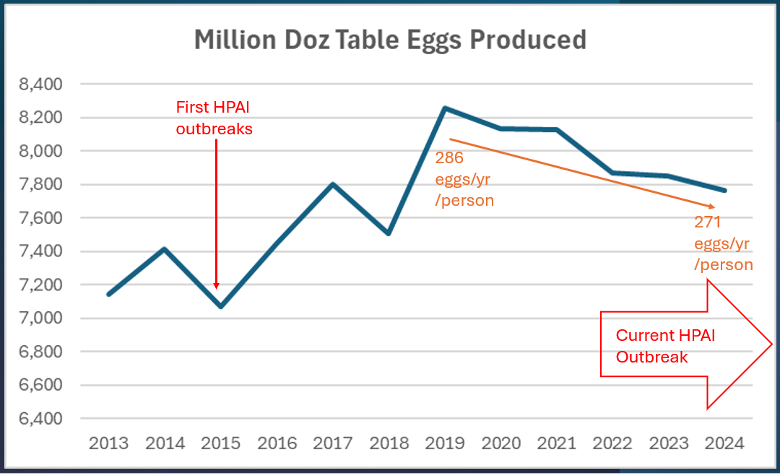

The same old scourge the industry has been fighting since February 2022 continues to haunt table egg supply – Highly Pathogenic Avian Influenza (HPAI). Since this outbreak began in 2022, 127 million laying hens have been lost. As outbreaks continue, new hens entering production must make up for lost birds and normal turnover. While HPAI has sharply reduced the number of table egg layers since 2022, a longer term look at supplies reveals that the number of table eggs produced has been falling since 2019 (Fig. 4). Egg prices hit all-time highs in late 2022 and again in early 2025. But, during the interim period, prices were relatively stable. Price volatility seems to be mostly due to short-term supply challenges.

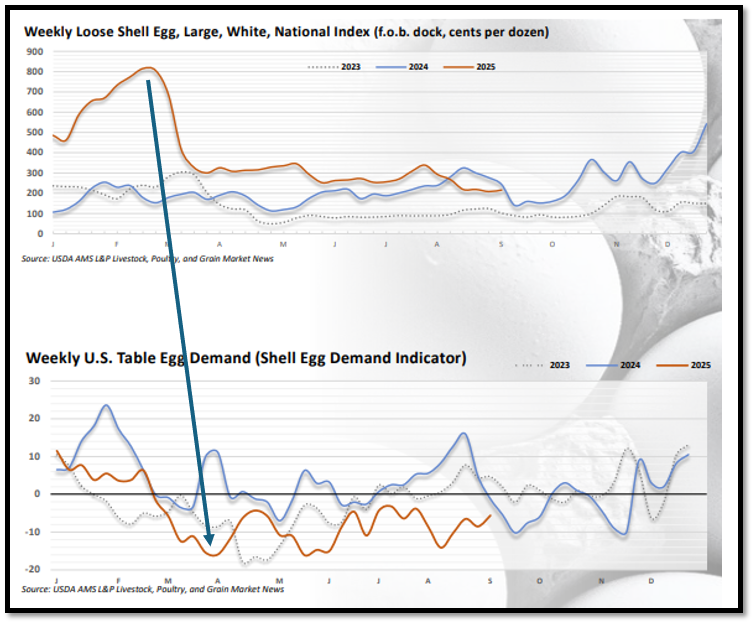

Total per capita egg consumption is down from 286 eggs in 2020 to 271 in 2024 (egg-news.com sourced). While consumption tends to equal production (e.g., we eat all we produce), the question remains whether people are eating fewer eggs in general, or if consumption is down because of price and supply dynamics? The sharp price spike in 2025 was followed by a marked decrease in egg demand (Fig. 5), which suggests price as a primary driver. But since then, prices have moderated, and demand hasn’t seemed to have rebounded much, which suggests this is more than just a price story. Interest in production and productivity is likely to remain important as HPAI occurrences are ramping up as Fall begins and wild bird migrations resume their normal patterns.

Fig. 1: Broiler production (chicken) in the us has been on a slower year over year increase in pounds for many years. Over the last 6 years, pounds of chicken produced have increased 5%. 1.4% in ’23 to ’24 alone, with 2025 projected to be another slight increase.

Fig. 2: Increased placements of broiler chicks has overcome an increase in mortality to maintain increasing production of chicken meat.

Fig. 3: Broiler laying hen supply has been decreasing the past several years, possibly stressing the future supply chain broiler chicks.

Fig. 4: Total Table Eggs being produced has been decreasing since 2019, as well as the number of eggs consumed per person annually. (USDA-NASS)

Fig. 5: Egg prices can cause noticeable reactions to egg demand, especially when those prices are extremely high, as in early 2025.

Brothers, Dennis. “The Chicken or The Egg…. Productivity in 2026.” Southern Ag Today 5(40.2). September 30, 2025. Permalink

Leave a Reply