Following strong prices in 2022 and 2023, soybean values have fallen sharply from highs above $14 per bushel to current levels near $10.00 across much of the United States. While prices have recently rebounded on news of renewed Chinese buying, soybeans are still projected to generate negative returns during the 2025/26 marketing year. Looking ahead to 2026/27, November 2026 soybean futures are trading near $11.10. Assuming a -$0.50 harvest basis, a trend yield of 55 bushels per acre, and $650 per acre in input costs, estimated returns still imply roughly a $67 per-acre loss.

While it is still early and profitable prices could emerge, the signal remains clear: soybean supply continues to outpace demand at current production levels, and without stronger and sustained demand growth, profitability will remain elusive.

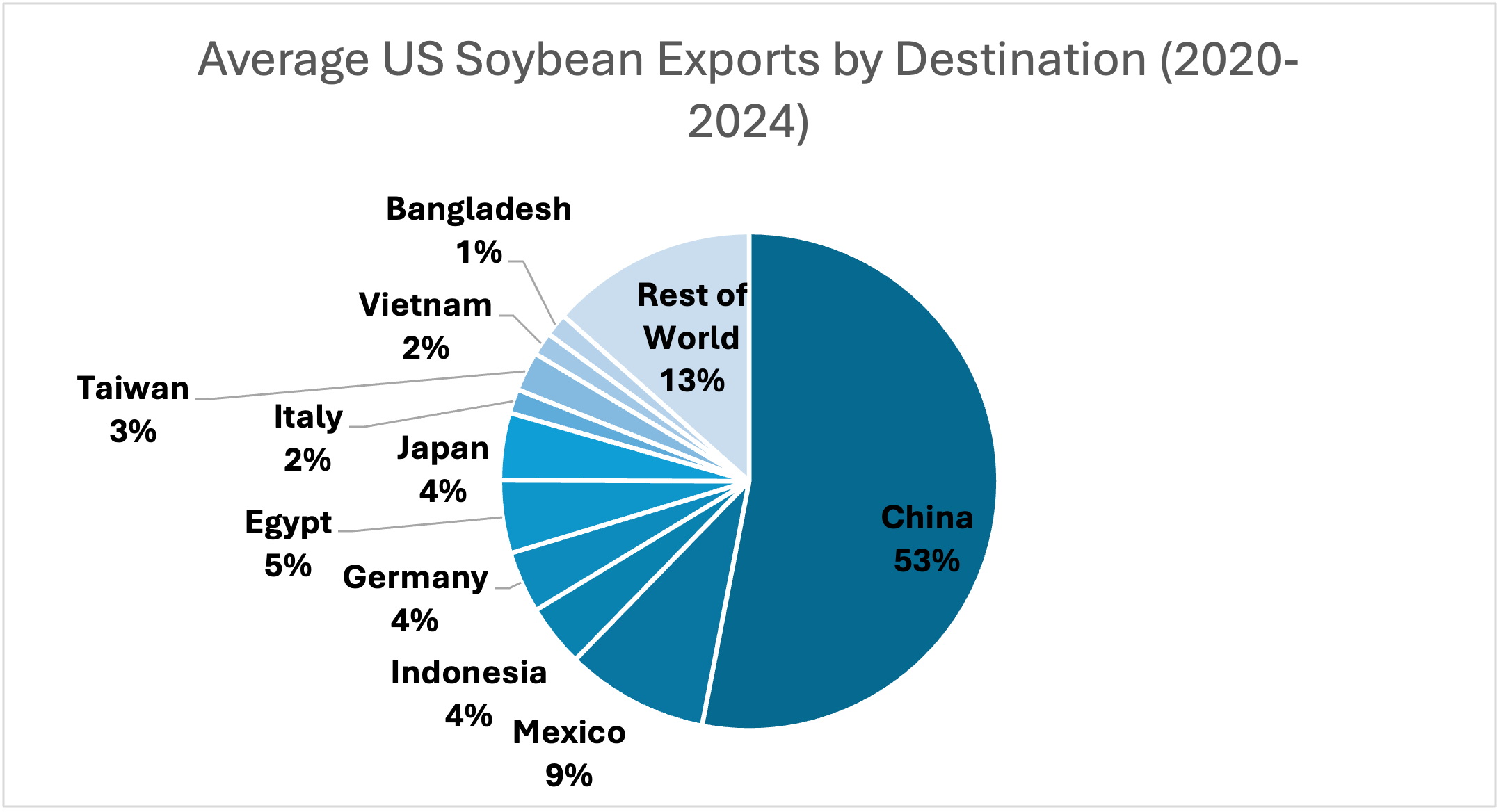

Between 2019 and 2022, U.S. soybeans were split roughly between exports (44%) and domestic crush (47%), with the remainder going to seed, feed, residual use, or ending stocks (Oilseed Yearbook, 2025). Recently, crush expansion has boosted domestic demand, but exports have declined, particularly due to reduced Chinese purchases (Gerlt, 2025). The U.S. recently negotiated a trade agreement under which China will purchase 12 million metric tons (MMT) of U.S. soybeans by January 2026, followed by 25 MMT annually from 2027 through 2029. This level would return Chinese buying close to 2024/25 volumes (Clayton, 2025). While the agreement provides some near-term support, questions remain about fulfillment and what happens beyond 2029.

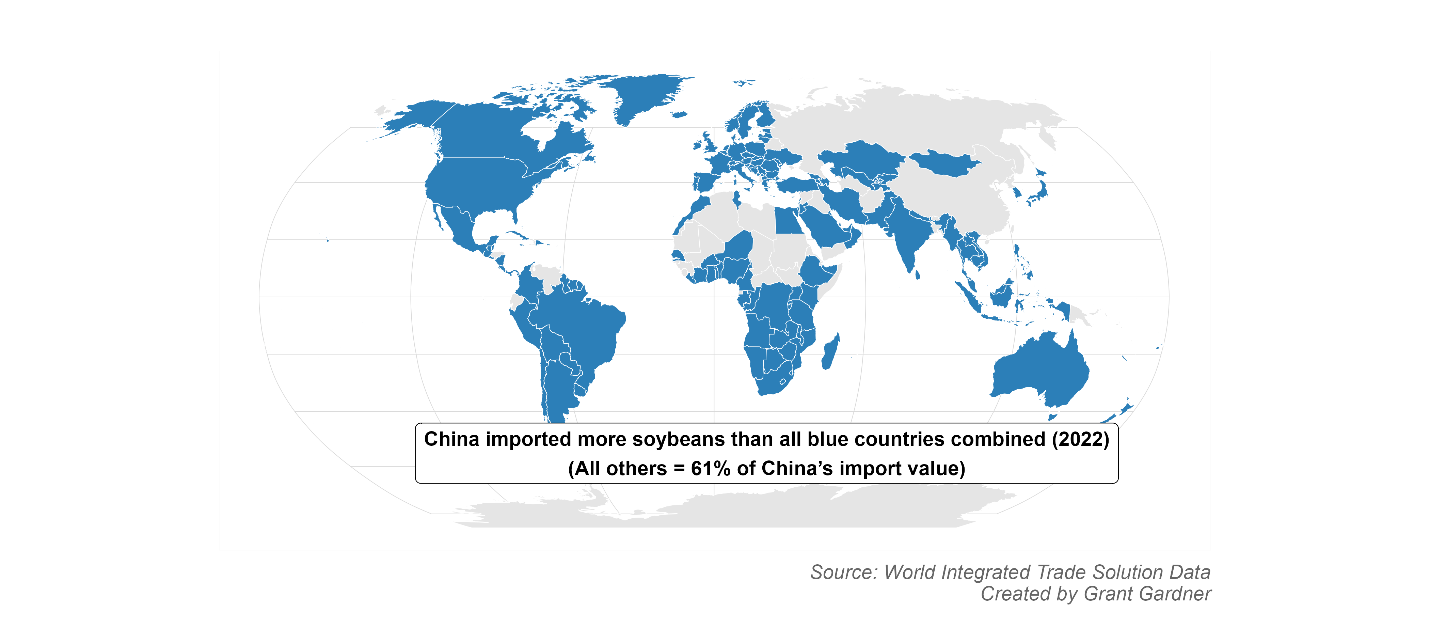

In the near term, renewed Chinese buying represents the most direct path back to profitability. Crush expansion is important but largely anticipated by markets and will ramp up gradually; it cannot immediately offset recent export weakness. Meanwhile, China remains by far the dominant global buyer: in 2022, China imported more soybeans than all other countries combined, with the rest of the world accounting for just 61% of China’s import value (Figure 1). Over the long run, diversifying export markets can reduce reliance on China and lower price risk, but fully replacing Chinese demand is unrealistic.

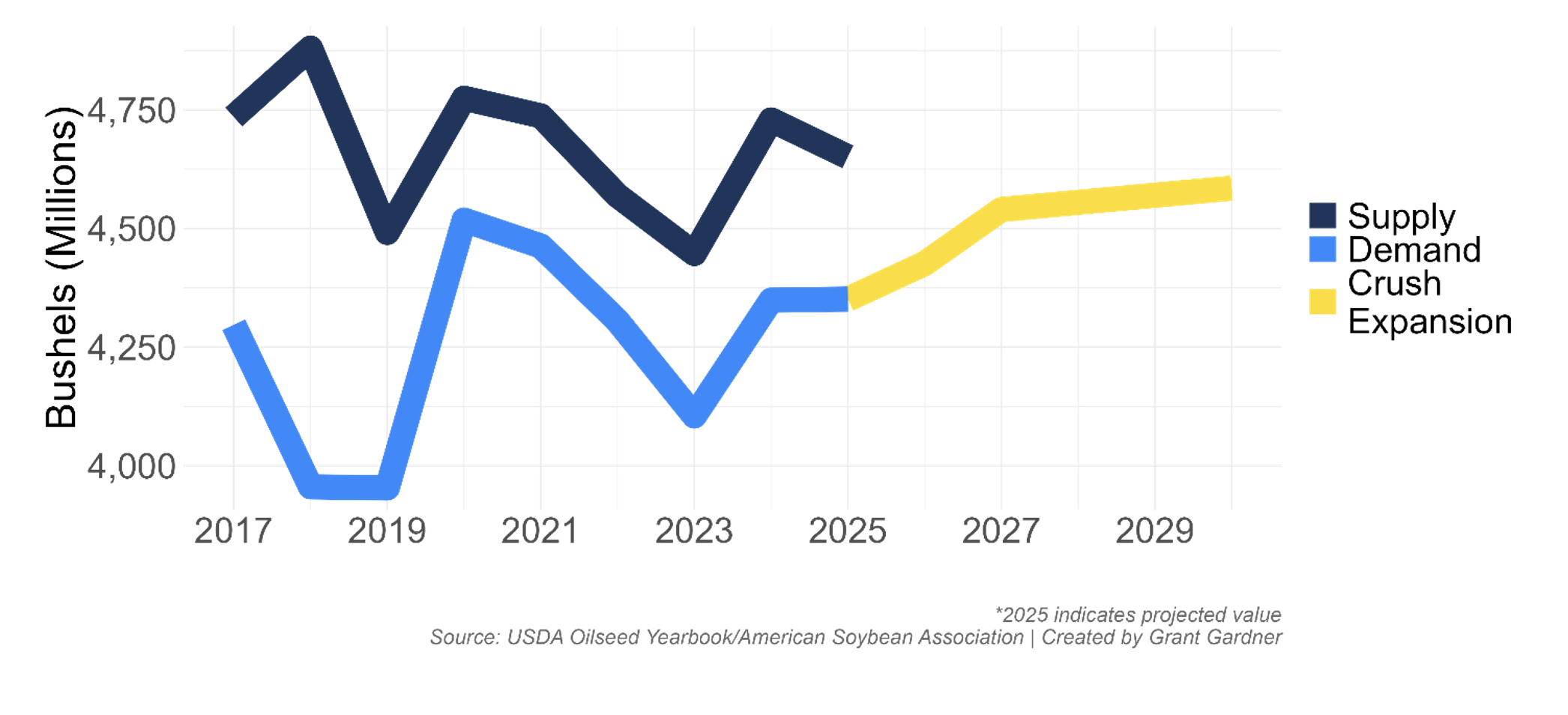

Longer-term, continued crush growth provides a pathway to tighter balance sheets. Figure 2 illustrates how expanded crush capacity could increase domestic use even if Chinese purchases do not return to prior highs. Projected crush use climbs steadily after 2025 (Gerlt, 2025), supported by renewable diesel and other biofuel investments that may anchor domestic soybean demand going forward. If exports can stabilize near current projections, or strengthen modestly, the combination of incremental trade growth and rising domestic crush could gradually restore profitability. The recent trade agreement may buy time, but building durable demand outside of China will be essential to a more resilient soybean market beyond 2029.

Figure 1: World Demand for Soybeans Outside of China, 2022

Figure 2: Soybean Supply, Demand, and Projected Crush Expansion

Citations:

Clayton, Chris. “Trump Champions Soy Deal for Farmers.” Progressive Farmer. October 30, 2025. https://www.dtnpf.com/agriculture/web/ag/news/article/2025/10/30/bessent-china-agrees-buy-nearly-1-us

Gardner, Grant. “Major Players in US Trade and Grain Market Volatility.” Southern Ag Today 5(15.3). April 9, 2025. Permalink

Gerlt, Scott. (2025, April 10). Soybean Crush Expansion, 2025 Update. American Soybean Association. Retrieved from https://soygrowers.com/news-releases/soybean-crush-expansion-2025-update/

U.S. Department of Agriculture, Economic Research Service. (2025). Oil Crops Yearbook [Data set]. U.S. Department of Agriculture.

World Bank (n.d.). World Integrated Trade Solution (WITS) [Data set]. Accessed via WITS: https://wits.worldbank.org/

Gardner, Grant. “Soybeans Stage a Comeback: Chinese Demand and Biofuel Growth Lead the Way.” Southern Ag Today 5(45.3). November 5, 2025. Permalink