Cattle futures markets remained volatile last week but tended to rebound following the sharp selloff generated by the discussion of plans to lower beef prices. Given a couple of weeks, we now have a better picture of how cattle auction cash prices reacted to the futures market uncertainty.

The CME December Live Cattle contract traded below $224 for part of the day on October 27th, but has since recovered some and is trading above $232 at the time of this writing. This is sharply lower than the $248 price on October 16th. However, it is just a few dollars below the average trading price of the December contract during the month of September ($235.80). Similarly, the CME November Feeder Cattle contract traded below $330 for part of the day on October 28th but has since recovered some and is trading above $342 at the time of this writing. For context, this contract topped $380 on October 16th but averaged $353.72 during trading in September. The market uncertainty over the past few weeks has not crashed the futures market to low levels, but it has erased the rally seen in futures markets over the past month or two.

Most auction markets operate sales one day per week, compared to the futures market that trades every weekday. Local auctions have now had at least one sale since the futures market selloff and rebound, so we have the opportunity to better gauge the local cash market reaction. Auction market prices saw sizable drops last week across the Southeast. The table shows selected averages for various states across the southeast. Prices were lower across all states in the table for both 500-600lb steers and 700-800lb steers. Prices dropped the most in Oklahoma City and in Missouri. Averaging across all states, the value of a 550 lb. steer was about $150 lower per head in the southeast compared to the week prior. The value of a 750 lb. steer was about $120 lower per head. The impacts were certainly larger in some states.

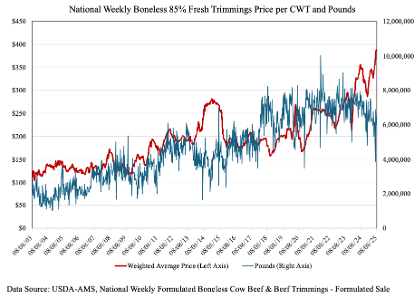

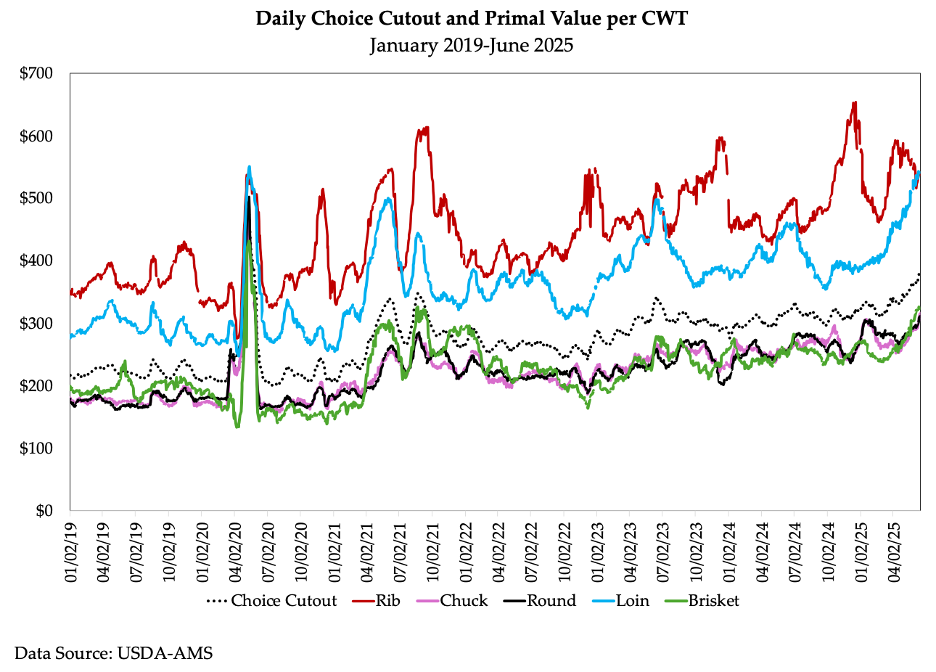

Fed cattle prices also dropped last week. The average live negotiated fed steer price fell $7 per cwt to $230.86, which is the lowest weekly average since the last week of September. Boxed beef cutout values did not decline. The choice cutout was about $7 higher last week and is $12 higher than it was two weeks ago. It’s worth remembering that the cutout reflects the values of the 7 primal cuts weighted by their pounds in the carcass. Imports would largely have more of an impact on lean beef trimmings for ground beef. While some chucks and rounds go into ground beef, along with some sirloins and occasionally some briskets, the impact of more imports might have a more indirect effect on the boxed beef cutout.

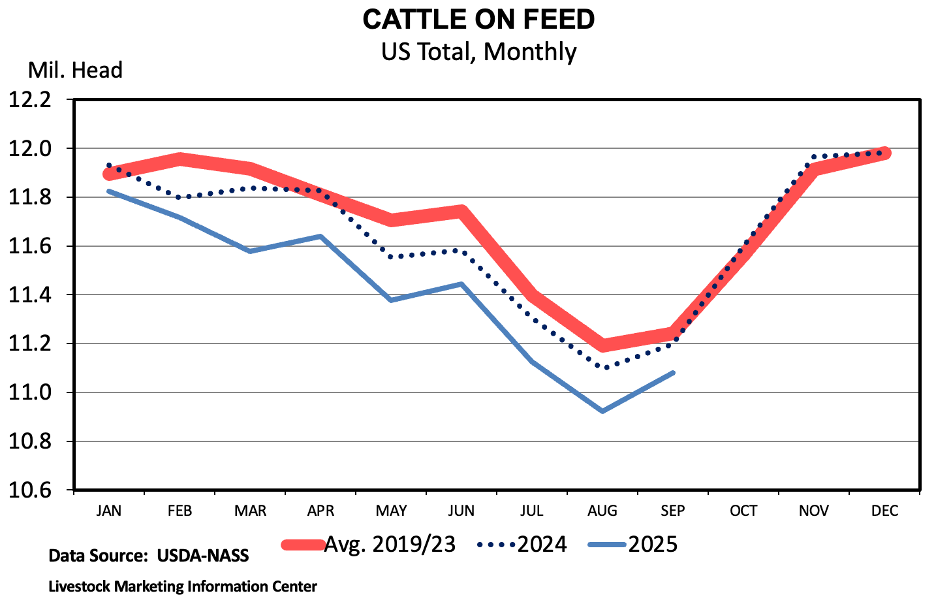

There remains significant fundamental strength for cattle markets given the tight supplies of cattle and strong demand for beef. However, the past few weeks have shown that uncertainty can have swift impacts on cattle prices – not only for traders in futures markets but also at cattle auctions in towns across the U.S.

| Southeast Cattle Prices Prices $/cwt. | For Weeks Ending On 10/31/25 10/24/25 11/1/24 | %Chg Prev. Week | %Chg Prev. Year | Chg Prev. Week | |||

| 500-600lb. Feeder Steers | Mississippi MIL #1-2 | $355.63 | $374.66 | $252.68 | -5% | 41% | ($19.03) |

| Arkansas MIL#1 | $379.93 | $406.43 | $267.74 | -7% | 42% | ($26.50) | |

| Kentucky MIL#1-2 | $370.00 | $396.52 | $267.74 | -7% | 38% | ($26.52) | |

| Oklahoma MIL#1-2 | $378.76 | $428.54 | $265.80 | -12% | 42% | ($49.78) | |

| Alabama MIL#1 | $382.54 | $405.10 | $263.25 | -6% | 45% | ($22.55) | |

| Tennessee MIL #1-2 | $351.26 | $361.37 | $257.56 | -3% | 36% | ($10.11) | |

| Texas MIL #1-2 | $347.73 | $374.21 | $263.65 | -7% | 32% | ($26.48) | |

| Missouri MIL#1-2 | $365.08 | $406.06 | $269.15 | -10% | 36% | ($40.98) | |

| 700-800 lb. Feeder Steers | Mississippi MIL #1-2 | $299.22 | $318.83 | $211.66 | -6% | 41% | ($19.60) |

| Arkansas MIL#1 | $341.16 | $355.77 | $226.06 | -4% | 51% | ($14.61) | |

| Kentucky MIL#1-2 | $332.35 | $341.63 | $238.65 | -3% | 39% | ($9.27) | |

| Oklahoma MIL#1-2 | $334.26 | $356.95 | $246.09 | -6% | 36% | ($22.69) | |

| Alabama MIL#1 | $327.36 | $333.72 | $231.67 | -2% | 41% | ($6.36) | |

| Tennessee MIL #1-2 | $315.63 | $322.00 | $226.65 | -2% | 39% | ($6.37) | |

| Texas MIL #1-2 | $312.50 | $334.24 | $241.60 | -7% | 29% | ($21.74) | |

| Missouri MIL#1-2 | $334.58 | $362.91 | $240.18 | -8% | 39% | ($28.33) | |

| Negotiated Fed Steers | Live Price | $230.86 | $237.89 | $189.82 | -3% | 22% | ($7.03) |

| Dressed Price | $358.54 | $369.30 | $296.97 | -3% | 21% | ($10.76) | |

| Boxed Beef Cutout | Choice Value, 600-900 lb. | $379.06 | $372.13 | $319.50 | 2% | 19% | $6.93 |

| Select Value, 600-900 lb. | $360.32 | $354.47 | $288.37 | 2% | 25% | $5.85 | |

Maples, Josh. “Cattle Auction Prices Follow Futures Prices Lower.” Southern Ag Today 5(45.2). November 4, 2025. Permalink