Authors Kevin Kim and Brian Mills

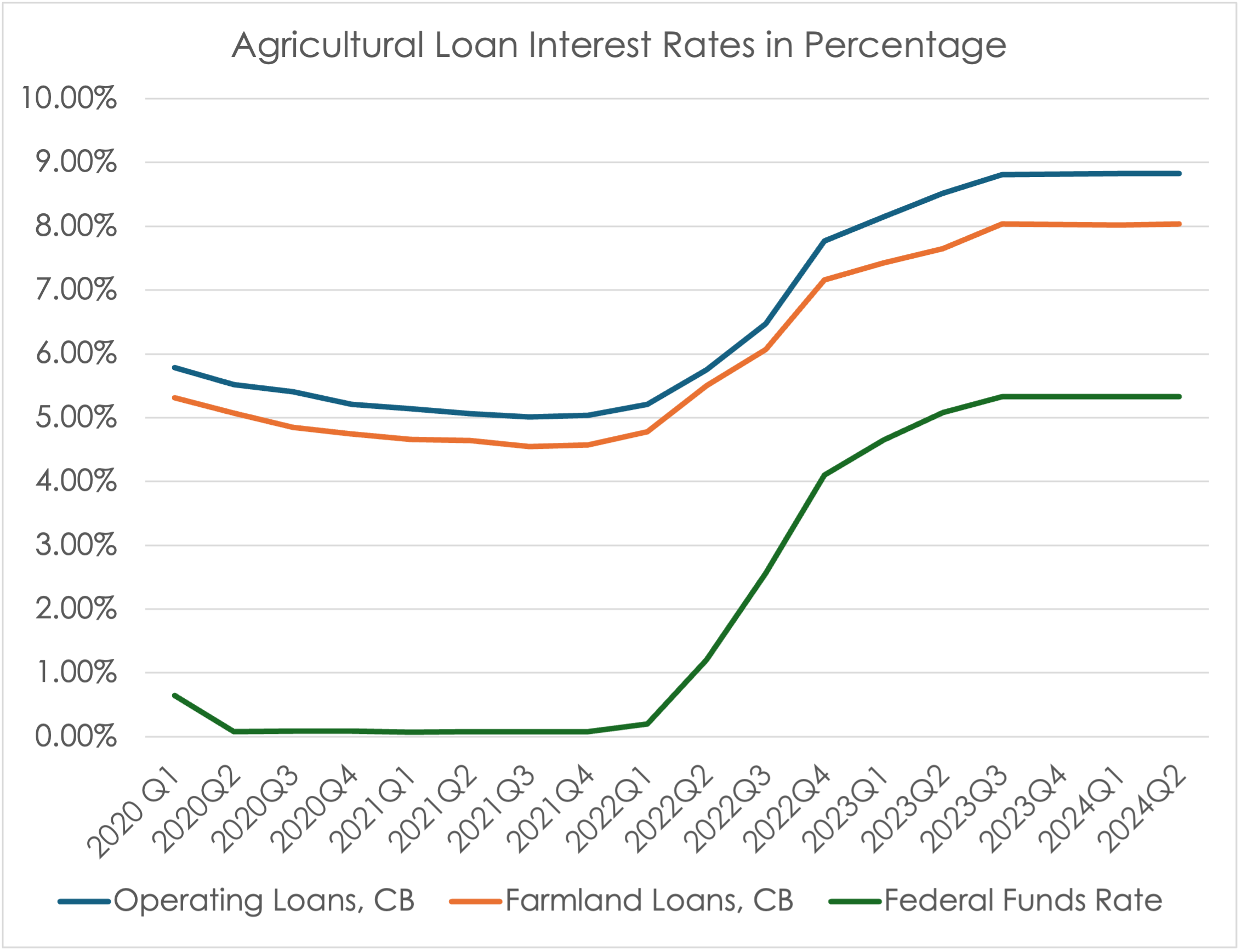

According to the latest forecast from USDA ERS, net farm income in 2026 is expected to decline modestly, even after factoring in substantial government payments. If realized, this would represent several consecutive years of compressed profitability, particularly for row crop producers. In this context, what do current indicators reveal about emerging farm financial stress?

A recent survey conducted by Mississippi State University Extension offers additional insight into agricultural credit conditions in Mississippi and Alabama. Because these states are not included in the agricultural credit surveys published by the Federal Reserve Banks of Dallas or Kansas City, this regional data provides a valuable perspective. The survey gathered responses from commercial banks, Farm Credit System institutions, agricultural consulting firms, and insurance companies operating across the region.

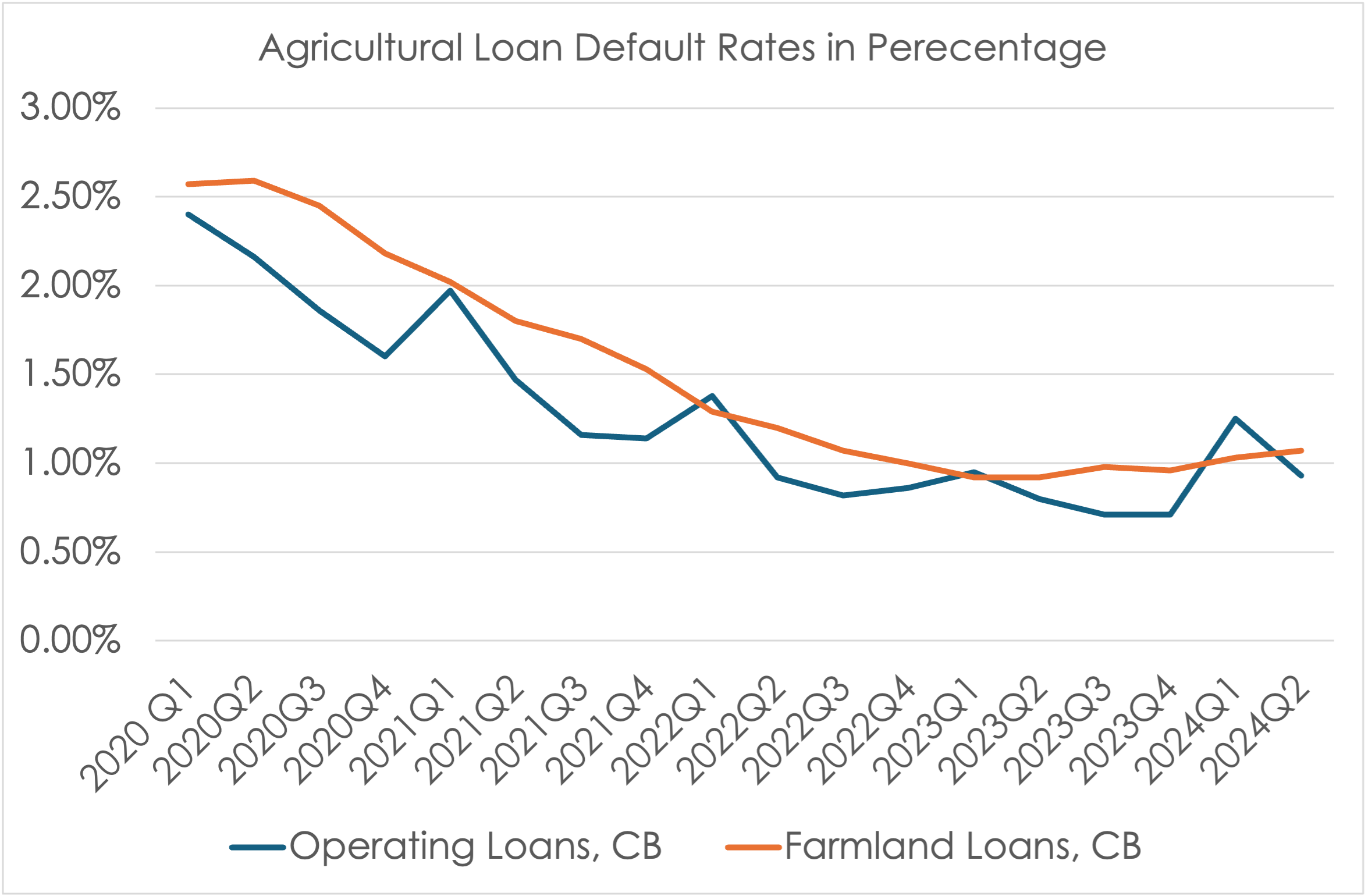

Farm loan repayment performance worsened in 2025, with none of the respondents reporting that the loan repayment rates had improved when compared to the previous year. Farm loan renewals generally showed signs of stability to modest softening relative to 2024. Compared to the most recent agricultural surveys conducted by the Federal Reserve Banks of Dallas and Kansas City, there were more respondents who answered that the loan repayment rates were worse than the year before.

Liquidity and solvency measures provide indicators of short- and long-term financial stress. Several respondents reported that liquidity and solvency positions for crop producers weakened in 2025 relative to the previous year, whereas livestock producers were more often characterized as stable or slightly improved. These differences reflect the commodity-specific price trends observed over the past year.

Despite lower crop receipts, farmland values remain resilient. Most respondents reported that irrigated and non-irrigated cropland values either increased or held steady in 2025 relative to 2024, and there was no reporting of decreased cropland value. Expectations for the next six months are largely neutral to slightly positive despite the expected low price outlook in 2026. Pasture values followed a similar pattern.

Overall, the newly conducted survey shows that the agricultural credit environment reflects tighter margins and growing financial stress, but not widespread financial disaster. Continued monitoring of repayment trends, working capital positions, and interest rate movements will be essential as producers and lenders navigate the production cycle.

Kim, Kevin, and Brian Mills. “2026 Agricultural Credit and Farmland Conditions Update.” Southern Ag Today 6(10.1). March 2, 2026. Permalink