Since 2011, the USDA’s Farm Service Agency (FSA) has provided monthly reports of crop acreage beginning in August. This information is based on farmer reports of planted, prevented planted, and failed acres received and summarized to date. A final acreage summary is released in January. Beginning in October (occasionally in September), these data are used by USDA’s National Agricultural Statistics Service (NASS) for comparison to survey-based planted acreage estimates in the monthly Crop Production report.

In this article, we examined the relationship between the preliminary August FSA planted acreage and final FSA planted acreage for cotton. We also looked at the relationship between final FSA planted acreage and NASS planted acreage.

While FSA acreage data represents a census of planted acreage enrolled in farm programs, the FSA acreage data does not function as official USDA planted acreage estimates (because not all farms are enrolled in the farm programs administered by the FSA). The official planted acreage estimates are the responsibility of NASS, the statistical agency of the USDA.

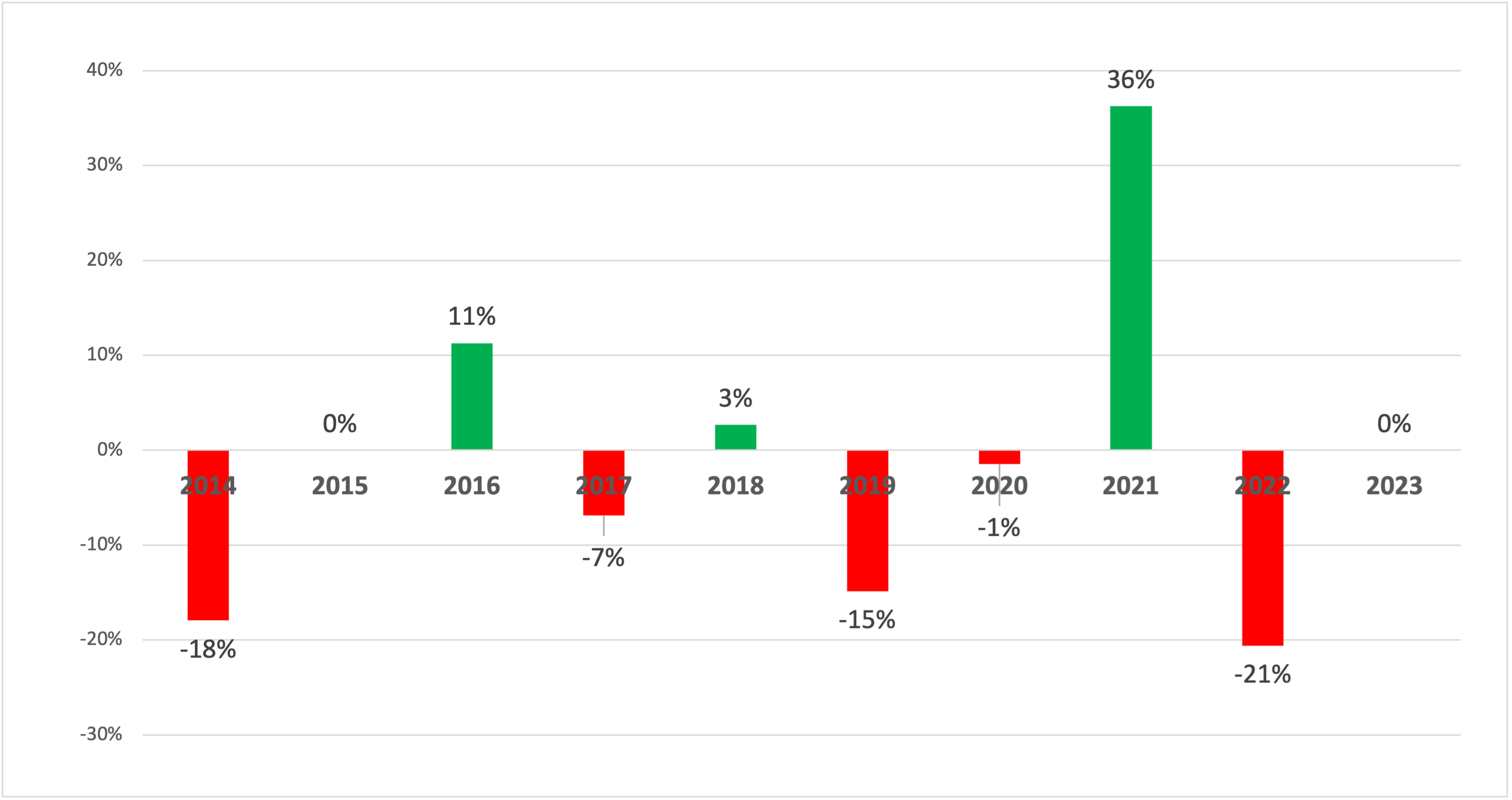

As a starting point, we reviewed the relationship between the August and final (i.e., January) FSA planted acreage estimates for cotton (upland and Pima combined). As noted in Figure 1, reporting during August 2020 was off significantly due to the reporting extension during the COVID pandemic. The data pre-2020 and post-2020 indicate all but a small percentage of planted acreage for cotton is generally reported to the FSA by August. For example, over the 2015-2019 period, the average ratio of preliminary to final FSA planted acreage for cotton was 98.9 percent. In recent years, 2021-2024, the average ratio increased to 99.7 percent in August. Arguably the period 2021-2024 is the most representative part of the sample for making 2025 forecasts.

Figure 1. Ratio of August to Final January FSA Estimate of U.S. Cotton Planted Acreage, 2015-2024

We also looked at the relationship between the final FSA planted acreage and final NASS planted acreage (Table 1). In the years 2015-2024, the acreage relationship is quite consistent. For cotton, the final FSA estimate of planted acreage averages 98.2 percent of final NASS planted acreage with a range of 0.9 percent. The consistency of the relationships can be attributed to the fact that enrollment in FSA farm programs varies relatively little from year to year.

TablTable 1. U.S. Planted Acres of Cotton Estimated by NASS and Reported to FSA, 2015-2024

| Year | NASS | FSA | Difference | FSA/NASS(%) |

| 2015 | 8,580,500 | 8,450,939 | 129,561 | 98.5% |

| 2016 | 10,073,500 | 9,927,191 | 146,309 | 98.5% |

| 2017 | 12,717,500 | 12,413,314 | 304,186 | 97.6% |

| 2018 | 14,081,300 | 13,824,448 | 256,852 | 98.2% |

| 2019 | 13,722,700 | 13,405,957 | 316,743 | 97.7% |

| 2020 | 12,086,000 | 11,834,619 | 251,381 | 97.9% |

| 2021 | 11,206,500 | 11,025,710 | 180,790 | 98.4% |

| 2022 | 13,749,000 | 13,530,779 | 218,221 | 98.4% |

| 2023 | 10,230,000 | 10,077,091 | 152,909 | 98.5% |

| 2024 | 11,183,000 | 10,997,089 | 185,911 | 98.3% |

| Average | 214,286 | 98.2% | ||

| Low | 129,561 | 97.6% | ||

| High | 316,743 | 98.5% | ||

| Source: USDA Farm Service Agency and National Agricultural Statistics Service. | ||||

In 2025, historic spring rainfall disrupted cotton planting in some states, which has made for a challenging year. Many industry observers questioned the NASS June Acreage survey that delivered much higher-than-expected cotton acreage estimates for the Midsouth region. The findings in USDA’s first monthly acreage report of 2025 will be of particular interest to the cotton industry. The report will be released on August 12th and can be found at this link: FSA Crop Acreage Data. The information in these reports is widely followed by the market for clues about possible future revisions to the official USDA planted acreage estimates. Based on recent history, this report is expected to provide a strong indicator for overall cotton acreage in 2025.

Stiles, H. Scott. “Examining August FSA Data to Forecast Final Cotton Acreage.” Southern Ag Today 5(32.3). August 6, 2025. Permalink