Every January, there is talk of New Year’s resolutions—a time to commit to improvements and set new goals. While health and personal finance often top the list of resolutions, there is no reason not to think about the farm business and marketing commitments in the same way. Farm profitability depends on effective management across many areas. Producers devote significant time and effort to decisions that affect crop production, but just as important is having a marketing plan for how the crop will be sold. Marketing is a continuous process that can span multiple production years, but it should be revisited for possible updating. With a solid marketing plan, producers can approach selling their crop as a year-round process rather than a single decision at one point in the year. This article highlights key considerations for developing a successful marketing strategy.

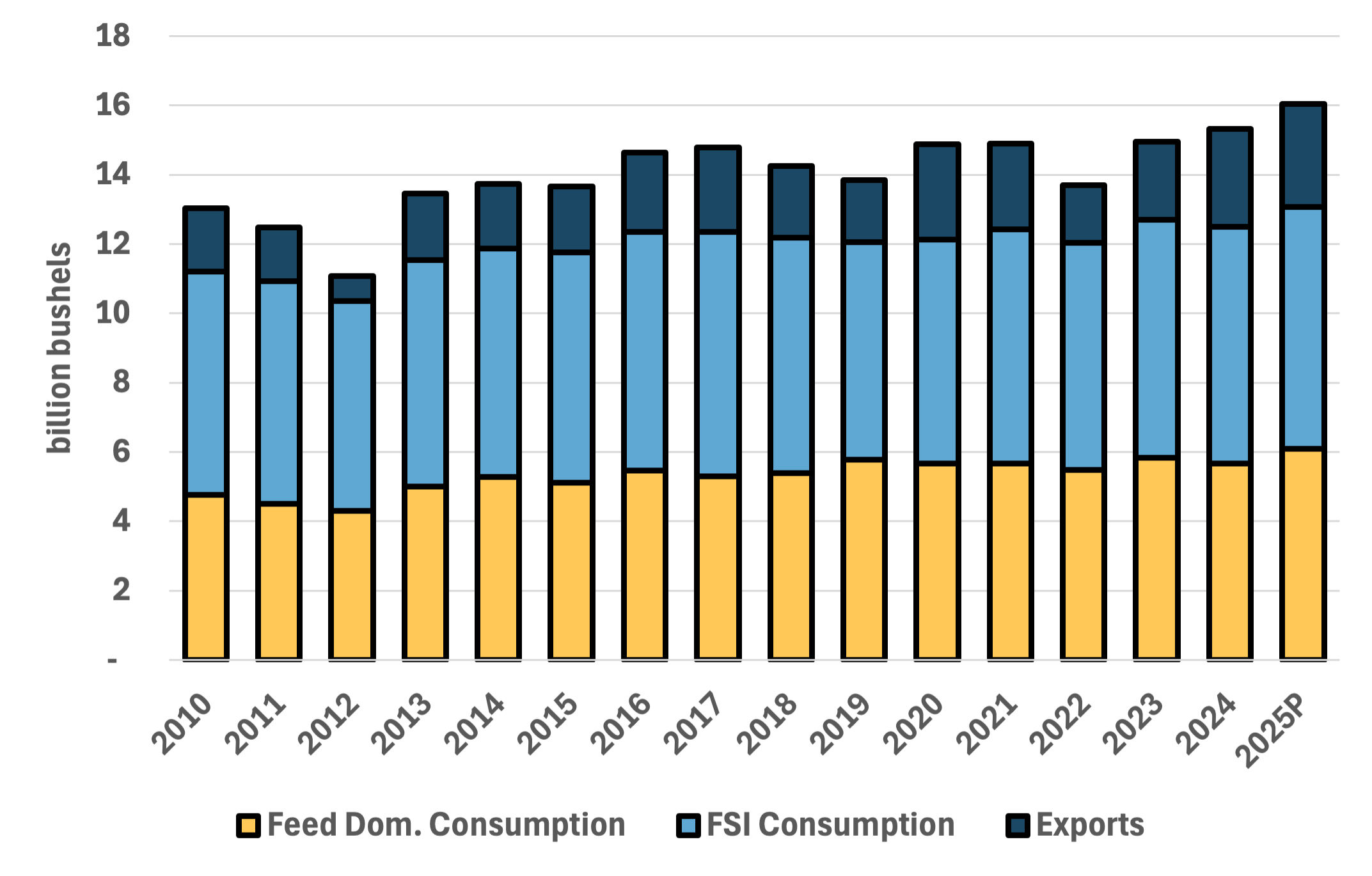

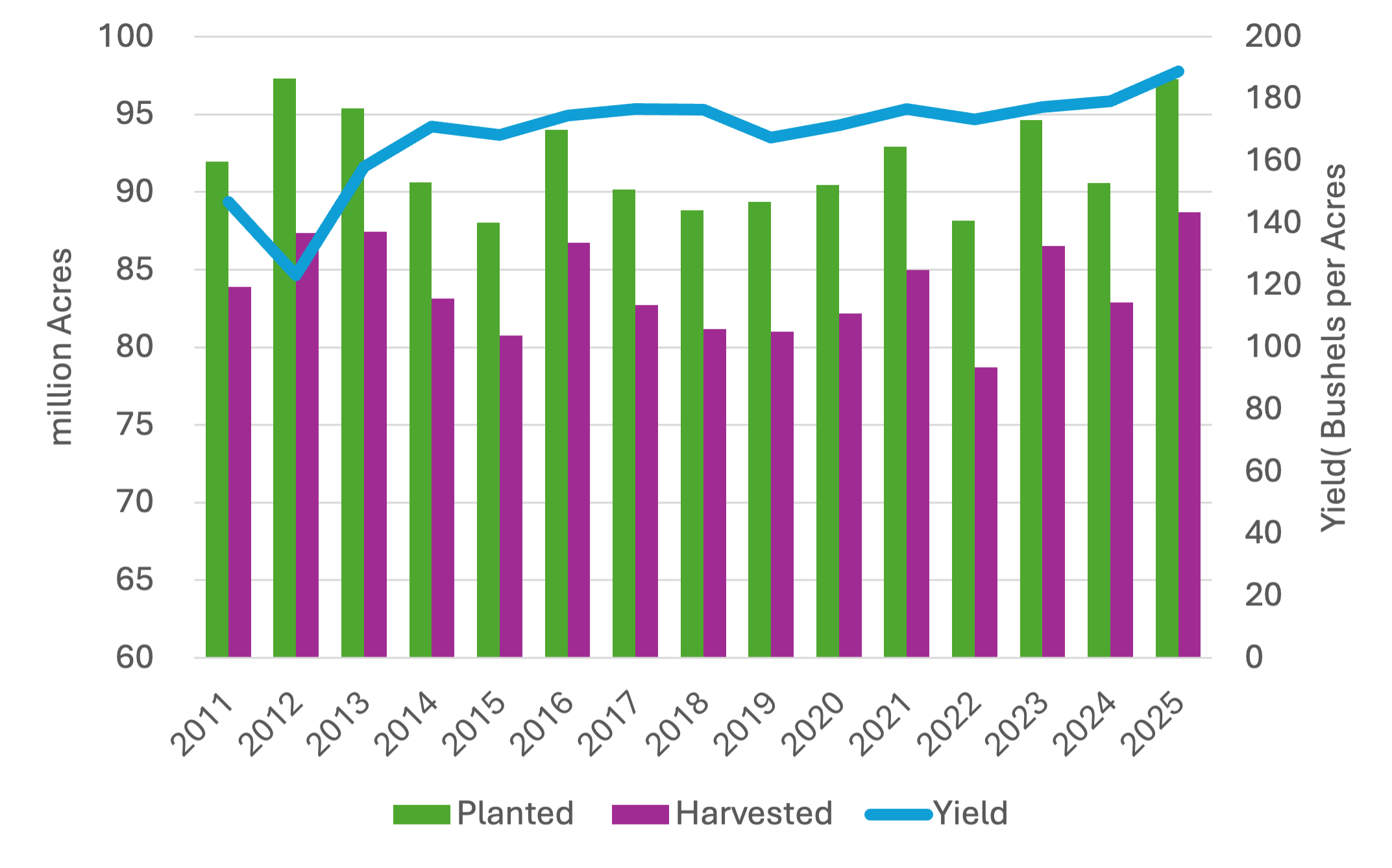

First, it is important to understand what a marketing plan is not. It is not a one-time silver bullet that guarantees sales at the highest price. While some producers may ‘beat’ the market in certain years, few can do so consistently. Commodity prices reflect supply and demand fundamentals, but in the short run, they are influenced by unpredictable events and new information. Even long-term outlooks are subject to shocks such as trade wars or other geopolitical developments. Expecting a marketing plan to always capture the top of the market sets up unrealistic goals. Instead, the value of a marketing plan lies in its ability to manage risk through consistent, disciplined decisions.

Every marketing plan should be anchored in the farm’s business goals. Those goals set the operation’s risk tolerance, cash-flow needs, and planning horizon. A producer nearing retirement may prioritize capital preservation, while a younger producer focused on growth may accept more price variability to preserve upside and liquidity. The plan should explicitly tie tactics to goals and assess which risks (price, basis, yield, liquidity, etc.) would most threaten those goals. In short, the marketing plan should serve the business plan, not the other way around.

Cost of production is the foundation of any marketing plan. Without a current, credible breakeven, you can’t judge whether a sale protects margin. Prices are volatile and mostly outside the producer’s control, so the most reliable gains come from managing inputs and operating efficiently. A sound approach is to build price objectives directly from breakeven, setting a minimum price that locks in a base margin. Additional targets can then be layered at predefined margin levels (for example, breakeven + $0.20 and + $0.40) based on the farm’s goals and cash-flow needs.

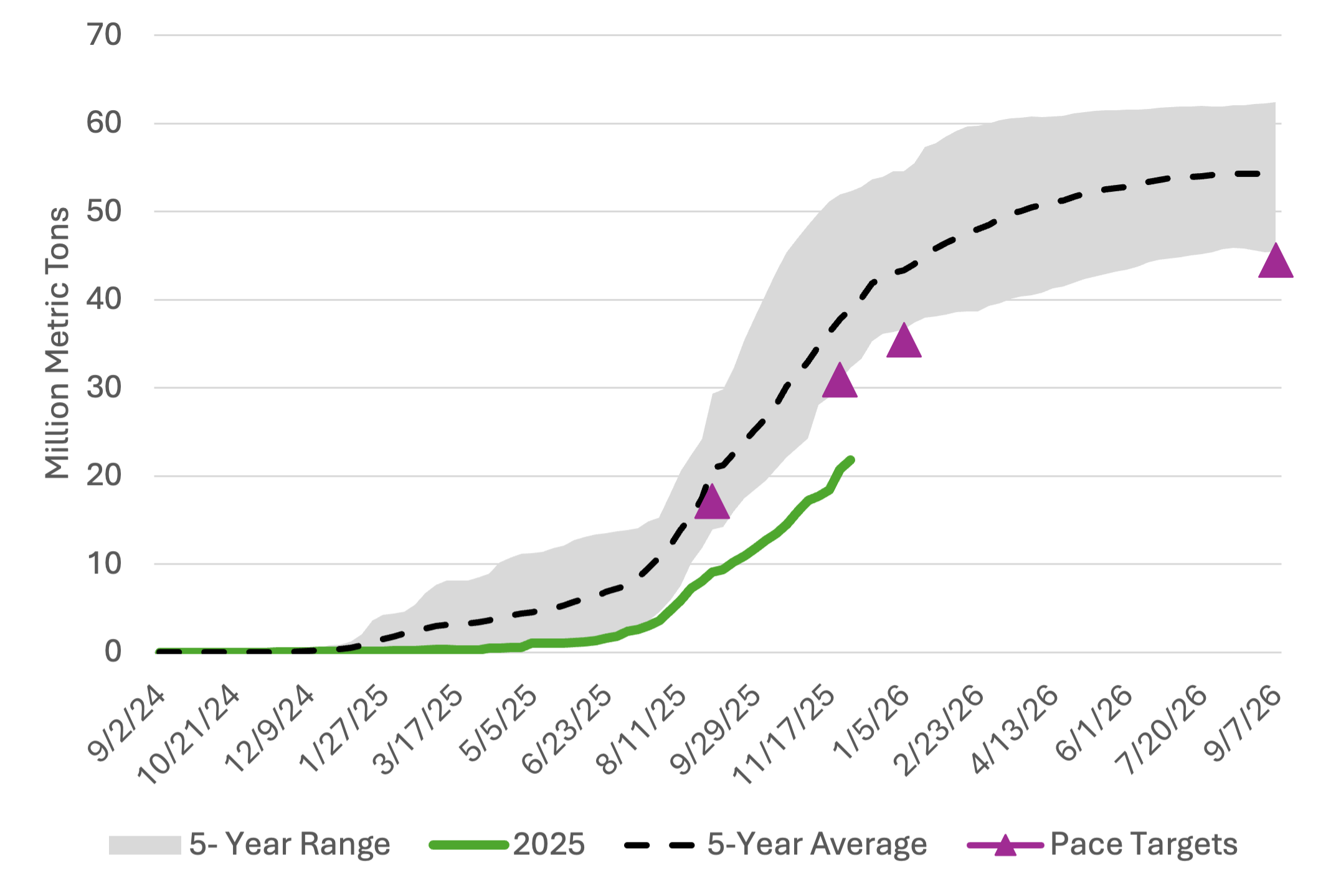

Marketing plans are most effective when they encourage proactive, rather than reactive, sales. Often, the worst sale is a forced sale, such as selling grain at harvest due to limited storage or pulling grain from the bin to meet a loan payment. Coordinating decision dates with price targets allows sales to be spread throughout the year. Crop markets frequently show seasonal strength in spring and early summer, making that window a natural fit for higher targets. Extending the marketing window, considering preharvest sales within the operation’s risk tolerance, and using crop insurance to backstop commitments can all help create more opportunities to lock in margin. Maintaining strong relationships with local buyers can also expand contract options and delivery flexibility.

Finally, it is essential to document the reasoning behind every marketing decision. A simple decision log noting the trigger, target price, quantity, tool, and rationale can reinforce discipline when action is required. The biggest threats to good marketing decisions are emotion, fear of making a mistake, and the temptation to hold out for just a little more. If a sale aligns with business goals and protects margin above breakeven, it is a sound decision, even if prices later move higher. Long-term success comes from steady, margin-protecting progress, not perfection on every sale. Now is an excellent time to make a New Year’s resolution for the farm by committing to a clear, disciplined marketing strategy for 2026 and beyond.

Maples, Will. “A New Year, A Better Marketing Plan for the Farm.” Southern Ag Today 6(2.3). January 7, 2026. Permalink