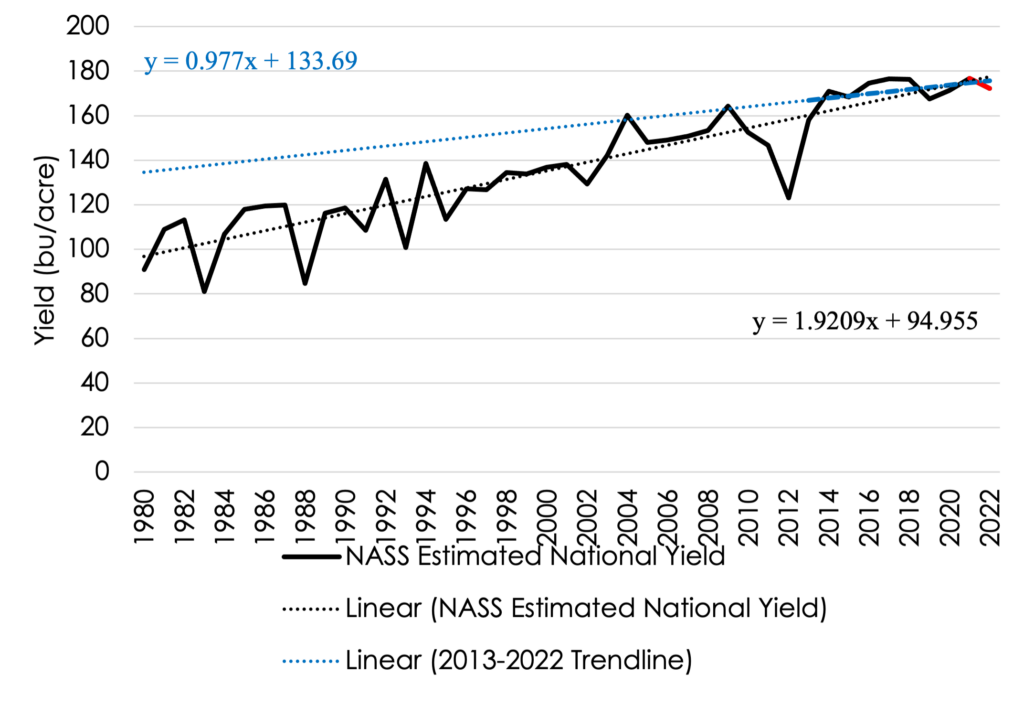

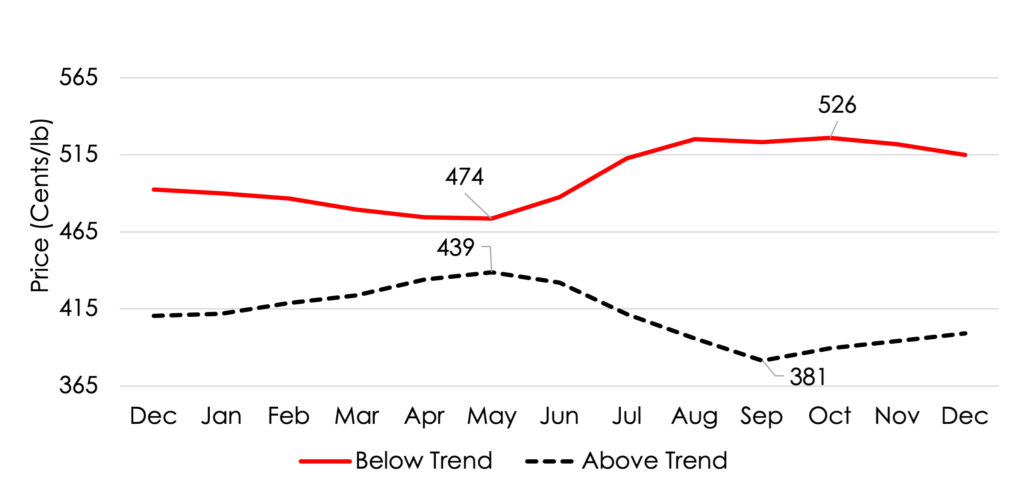

The risk faced by producers in the 2022 growing season was unprecedented. As farmers were in the field preparing to plant their crop, Russia invaded Ukraine fueling uncertainty across the world and in agricultural input markets. A few months later, rain fell across the midsouth causing a great deal of yield losses stemming from late planting and prevented planting (Figure 1). Of the $1.4 billion in rain-related losses across the U.S., $0.4 billion were primarily in the midsouth states (USDA-RMA, 2022). In the summer, drought struck the entire United States which resulted in significant crop losses in Texas, Oklahoma, and parts of the east coast (Figure 2). Of the $3.9 billion in total drought-related losses across the U.S., $2.4 billion were in the southeast (USDA-RMA, 2022).

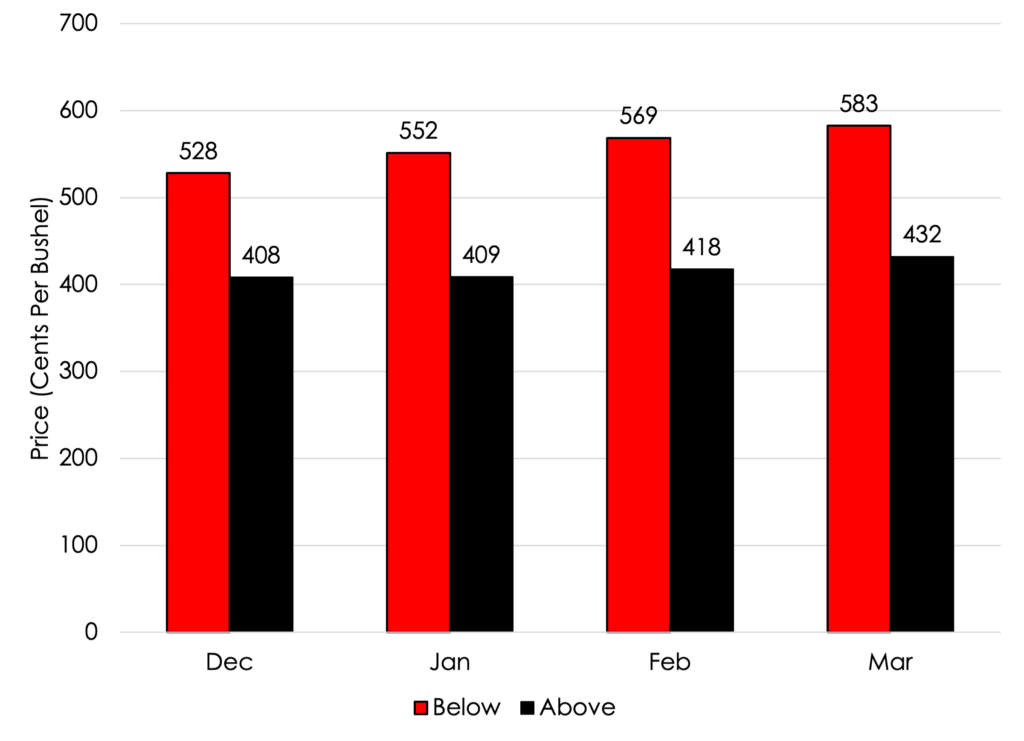

In addition to the production losses stemming directly from weather, many farmers experienced indirect price losses stemming from the low water levels in the Mississippi River. These price losses at the local grain elevator came in the form of extremely weak basis during arguably the most unfortunate time: harvest. During the usual harvest window, basis, or the local cash price less the relevant futures price, fell from about 40 over to 125 under (Figure 3). Once the river levels increased, basis strengthened to about 50 over and has stayed relatively consistent at this level even though most new crop delivery from the 2022 harvest is finished. However, farmers with on-farm grain storage may want to take advantage of the strong basis and deliver either grain from the 2021 old crop or newly stored grain from the 2022 new crop.

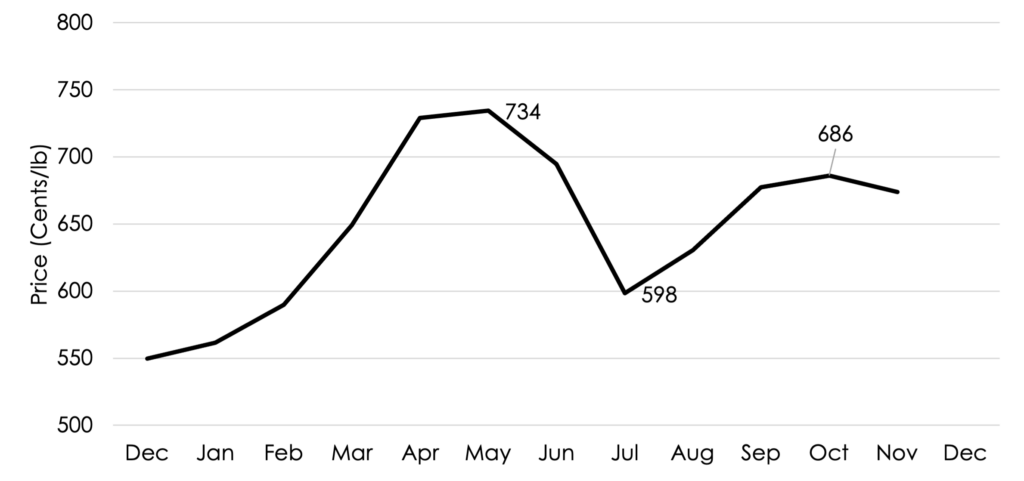

While measuring crop yield losses generally occurs throughout the growing season, USDA-RMA harvest prices are determined in the months of August through November depending on the state and crop. In the southeast, the harvest price was greater than the projected price, except for cotton and a few soybean exceptions (Figure 4). While corn, sorghum, and rice experienced a 10-21 percent increase in the harvest price relative to the projected price, cotton experienced between a 20-21 percent decrease in the harvest price over the projected price. Harvest prices for soybeans experienced between a 4 percent decrease and a 5 percent increase over the projected price.

Using the information on production losses and finalized harvest prices, it is useful to consider options to managing risk in the 2023 growing season. One option is to construct a marketing plan by pricing bushels and inputs which will reduce uncertainty revolving around tight margins (Maples, 2022). Another option is to begin considering alternative plans for crop insurance. The product which comprises most insured acres is Revenue Protection (RP) crop insurance which insures against price and production risks, both of which have been prominent in the 2022 growing season. RP provides one layer of protection against low prices and another layer of protection against crop losses which is best represented by the 2022 cotton crop characterized by significant yield and price losses. Another option is to use both strategies jointly which will allow a producer to be more aggressive in pricing bushels to be delivered at a later specified date (Biram et al., 2022). Using forward contracting in addition to RP crop insurance will provide one layer of price protection in the cash market, another layer of protection in the futures market, and third layer of protection from yield losses resulting from drought and early-season rains.

While the southeast saw a relatively quiet hurricane season, excess rainfall and drought still caused significant yield losses across the southeast and caused some farmers to lose out on cash prices at a critical time. Having a risk management plan which covers multiple layers of protection will help provide financial certainty greater peace of mind.

Figure 1. Rain-Related Losses as a Percentage of Total Liability (2022)

Figure 2. Drought-Related Losses as a Percentage of Total Liability (2022)

Figure 3. Daily Soybean Basis (ZSX) at Helena, Arkansas (2018-2022) (September 17th through November 14th)

Figure 4. Percent Changes in Projected Prices and Harvest Prices

References

Biram, H.D., J.D. Anderson, S. Stiles, and A.M. McKenzie. “Risk Management Tools and Strategies for Arkansas Corn and Soybean Producers: Implications of Mississippi River Transport Disruptions.” Fryar Price Risk Management Center of Excellence. Technical Report No. FC-2022-05. October 2022. (Link)

Maples, Will. “Considerations for Developing a Pre-Harvest Marketing Plan.” Southern Ag Today 2(47.1). November 14, 2022. (Link)

Cause of Loss Historical Data Files | USDA Risk Management Agency. November 21, 2022. (Link)

Report-Arkansas Daily Grain Bids | MARS. November 21, 2022. (Link)

Author: Hunter Biram

Assistant Professor

hbiram@uada.edu

Biram, Hunter. “Risk Management Considerations for the 2023 Growing Season.” Southern Ag Today 2(49.1). November 28, 2022. Permalink