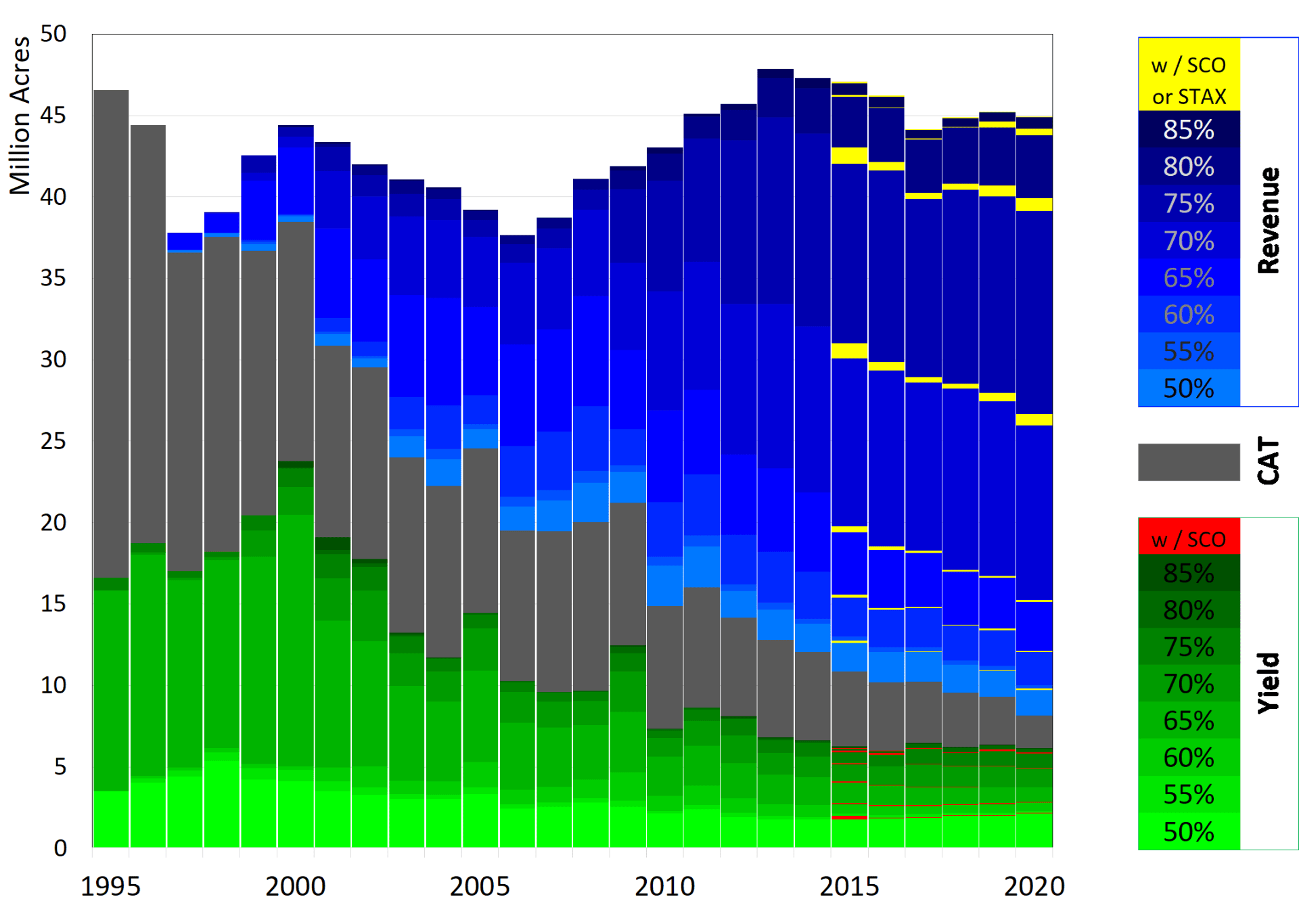

From 1995-2020, available products and program changes have dramatically shifted the profile of crop insurance products used by Southern ag producers. In that time, producers in 13 Southern states have typically covered around 40 to 45 million combined acres across 7 major commodities.

In 1995, over 45 million acres across the South were covered by a limited offering of yield only type products. Two products covered almost 91% of insured acres. Catastrophic coverage (50% yield and 55% price) carried nearly 30 million acres with another 12.35 million under 65% APH. As revenue products [Revenue Assurance, Crop Revenue Coverage, and Revenue Protection (RP)] were developed and incentive structures evolved, producers (and in no small part, their lenders) have come to rely heavily on revenue protection at higher buy-up levels. By 2007, 50% of the acres were covered by a revenue type product, and by 2020 that share had grown to over 80%. Two coverage levels, 70% RP and 75% RP, dominate all other product types/levels, accounting for over half of the acres (24.7 of 44.9 million acres) covered in 2020.

Southern Crop Acres Insured by Product Type/Level

Total annual acres covered across 13 Southern states (AL, AR, FL, GA, KY, LA, MS, NC, OK, SC, TN, TX, and VA) for 7 crops (Corn, Cotton, Grain Sorghum, Peanuts, Rice, Soybeans, and Wheat).

Yield Coverage includes: APH, YP, and PNT. Revenue Coverage includes: CRC, RA, RP, and RPHPE

Klose, Steven. “Revenue Protection Dominates Crop Insurance Coverage.” Southern Ag Today 1(43.3). October 20, 2021. Permalink