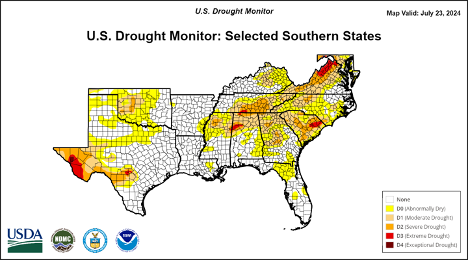

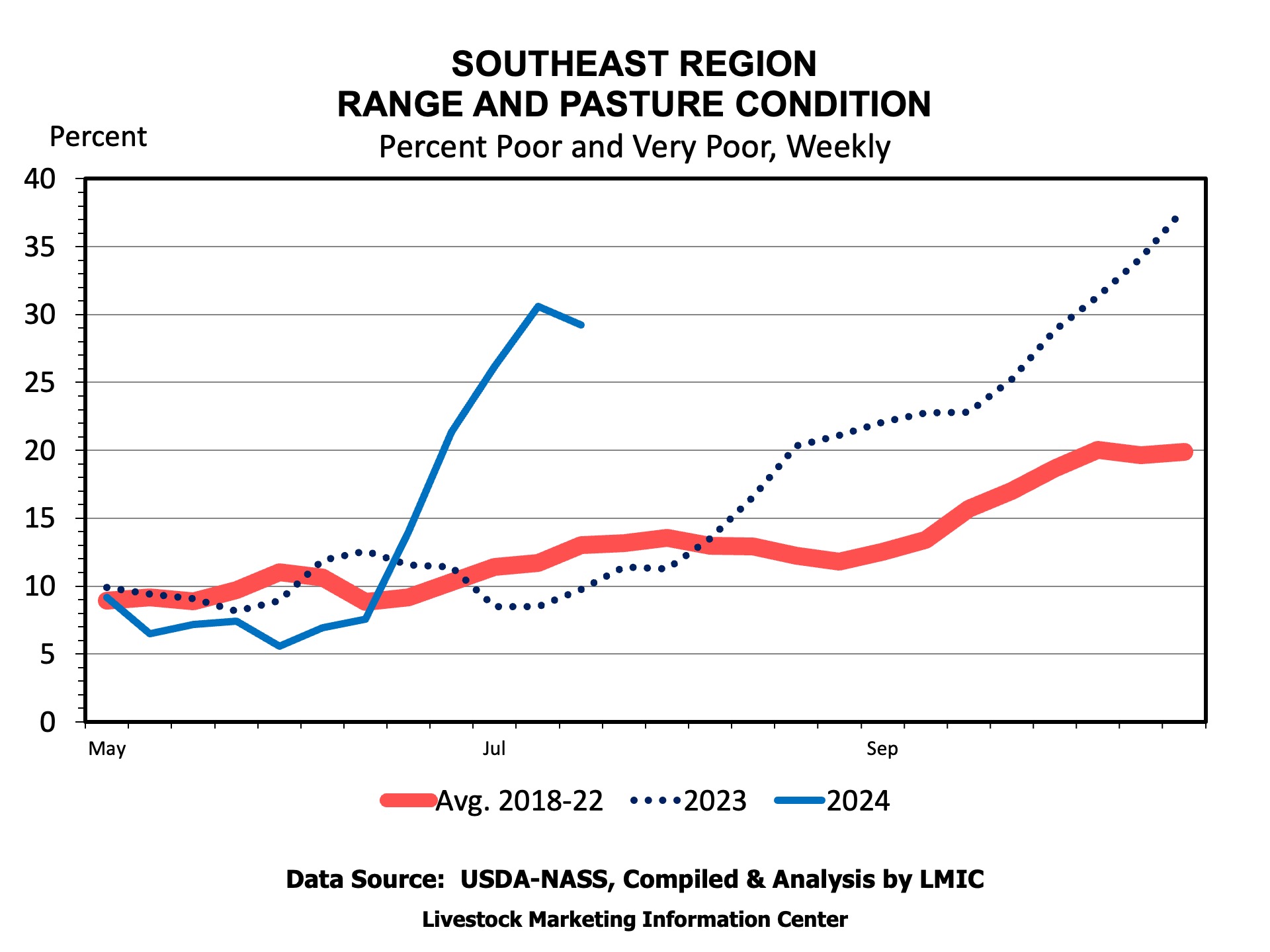

Drought gripped the Southeast U.S. starting in June and has continued into July. More than 60 percent of the Southeast (AL, FL, GA, NC, SC, and VA) is experiencing drought. These drought conditions have hurt pasture and rangeland conditions in the Southeast. According to the USDA in mid-July, about 30 percent of the pasture in the Southeast (AL, AR, FL, GA, KY, LA, MS, NC, SC, TN, VA, WV) are in poor or very poor condition. Some drought conditions persist in other areas of the South, as well, including approximately half of Texas, 60 percent of Oklahoma, and 70 percent of Tennessee.

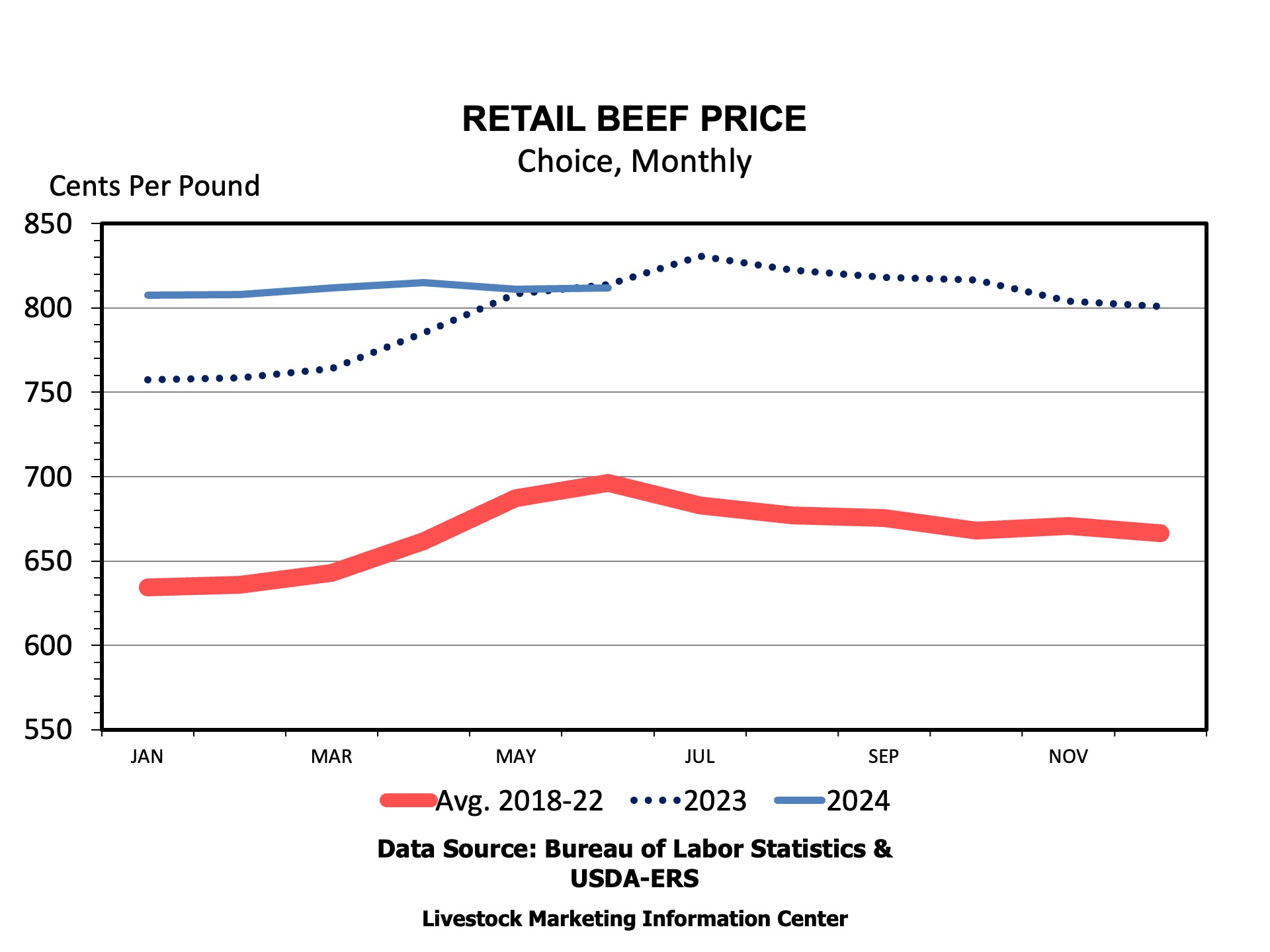

Figure 1: Drought Conditions in the South

Should these drought conditions persist, producers will have several decisions to make related to feeding alternatives, forage management, marketing, and other areas. These decisions have implications for a host of different producer outcomes. Economics calls on producers to assess each decision along the following lines: How do revenues and costs change with each decision? This is the essence of a partial budget. A partial budget assesses the change in revenue and the change in costs associated with a change in practice. If changing practices increases net returns, you should change your practice. If not, continue with your baseline practice.Drought creates some uncertainty to the price outlook for this fall. If drought incentivizes producers to bring more calves to market compared to normal, while still remaining high compared to recent history, calf prices may see a more pronounced seasonal dip this fall.

Drought creates some uncertainty to the price outlook for this fall. If drought incentivizes producers to bring more calves to market compared to normal, while still remaining high compared to recent history, calf prices may see a more pronounced seasonal dip this fall. Timing may play a role, too. If calves are sold early, the fall low may be more spread out over time and not as deep. Lastly, if the weather improves, any expectations of more cattle this fall may evaporate pushing prices higher than expected. The next several weeks will be important in assessing where cattle markets will be in the months ahead.

Secor, William. “Cattle and Drought in the South and Southeast.” Southern Ag Today 4(31.2). July 30, 2024. Permalink