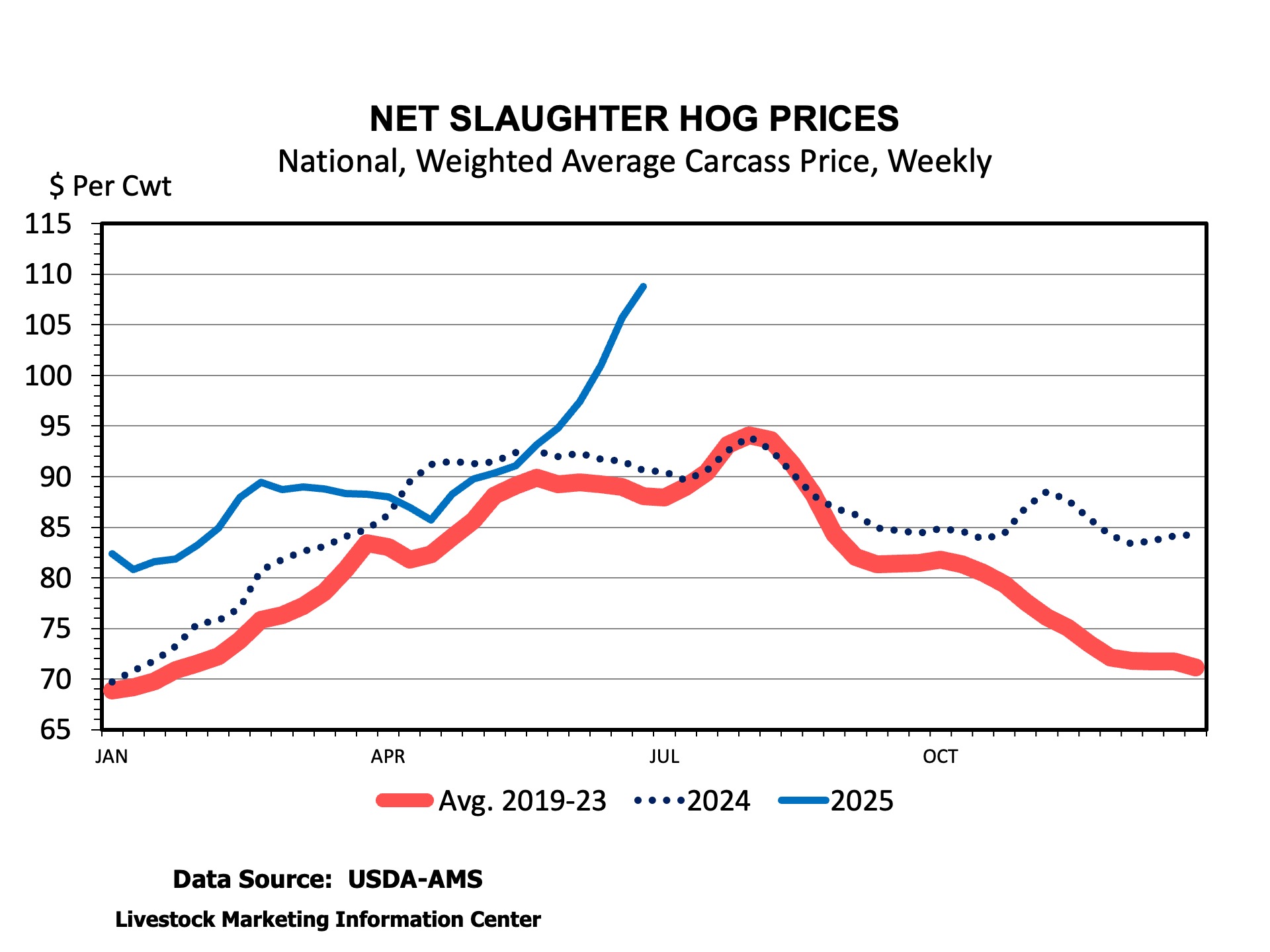

We’ve written a lot in Southern Ag Today over the last couple of months on cattle and beef prices, but some other things are happening in livestock markets. Hog prices have jumped to their highest level in three years, bringing some needed profits to the industry.

Weekly national average barrow and gilt carcass prices, net of premiums and discounts, hit $113.14 per cwt at the end of June. That was the highest price since the beginning of September 2022. The average price a year ago was $88.79 per cwt. Higher hog prices are showing up in higher wholesale pork prices, as well. Wholesale hams, pork bellies, loins, ribs, and trimmings for sausage have all been increasing in price in recent weeks.

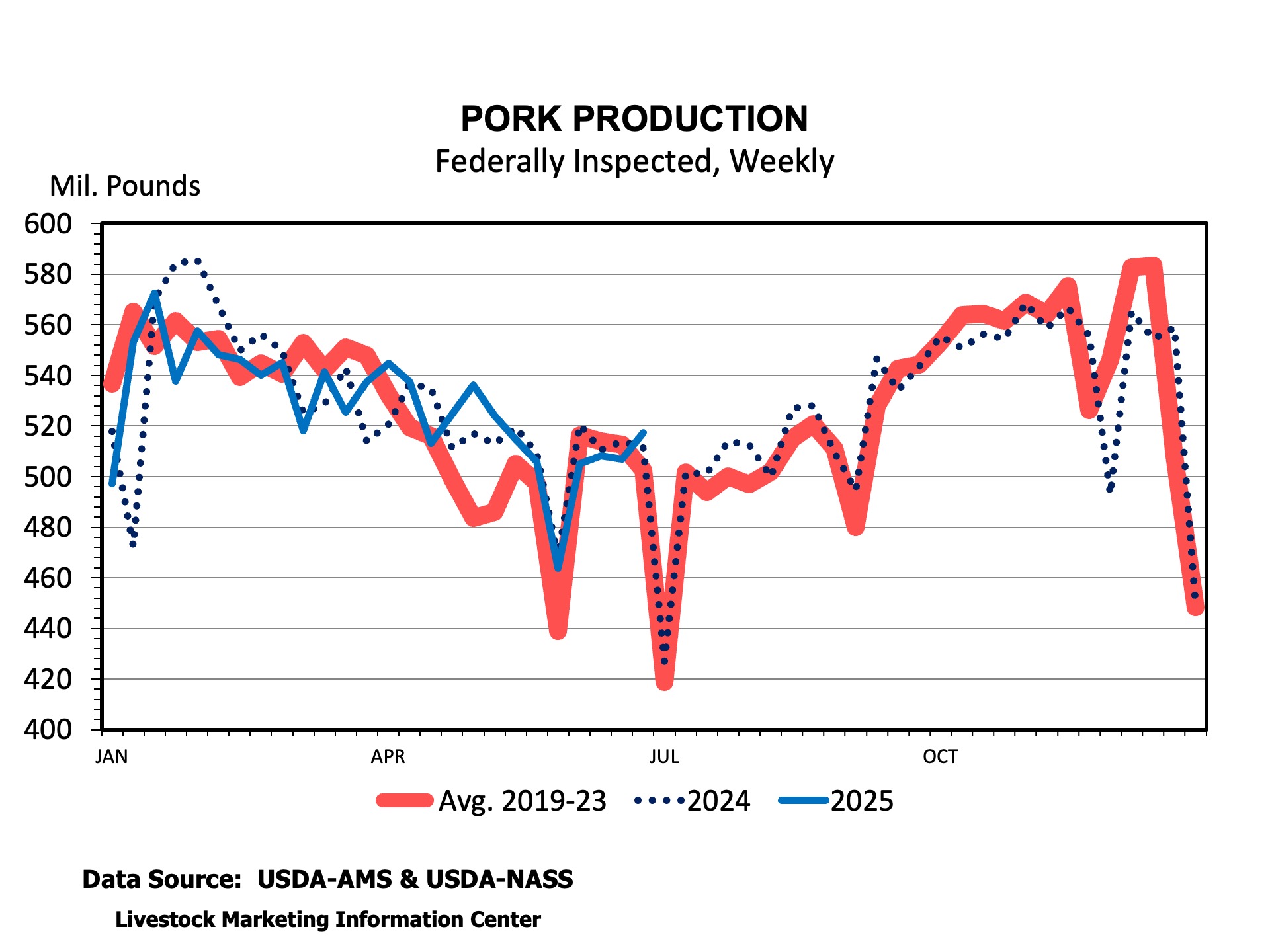

Hog and pork prices tend to increase seasonally during the Summer due to reduced production during summer months. Over the last 8 weeks, barrow and gilt slaughter is about 2 percent less than last year. Total pork production is down 0.7 percent over the last 8 weeks compared to last year. To get an idea of the seasonal decline in pork production this year, weekly production averaged 507.5 million pounds in June compared to 555.3 million pounds per week in January. That seasonal decline is not unusual compared to past years.

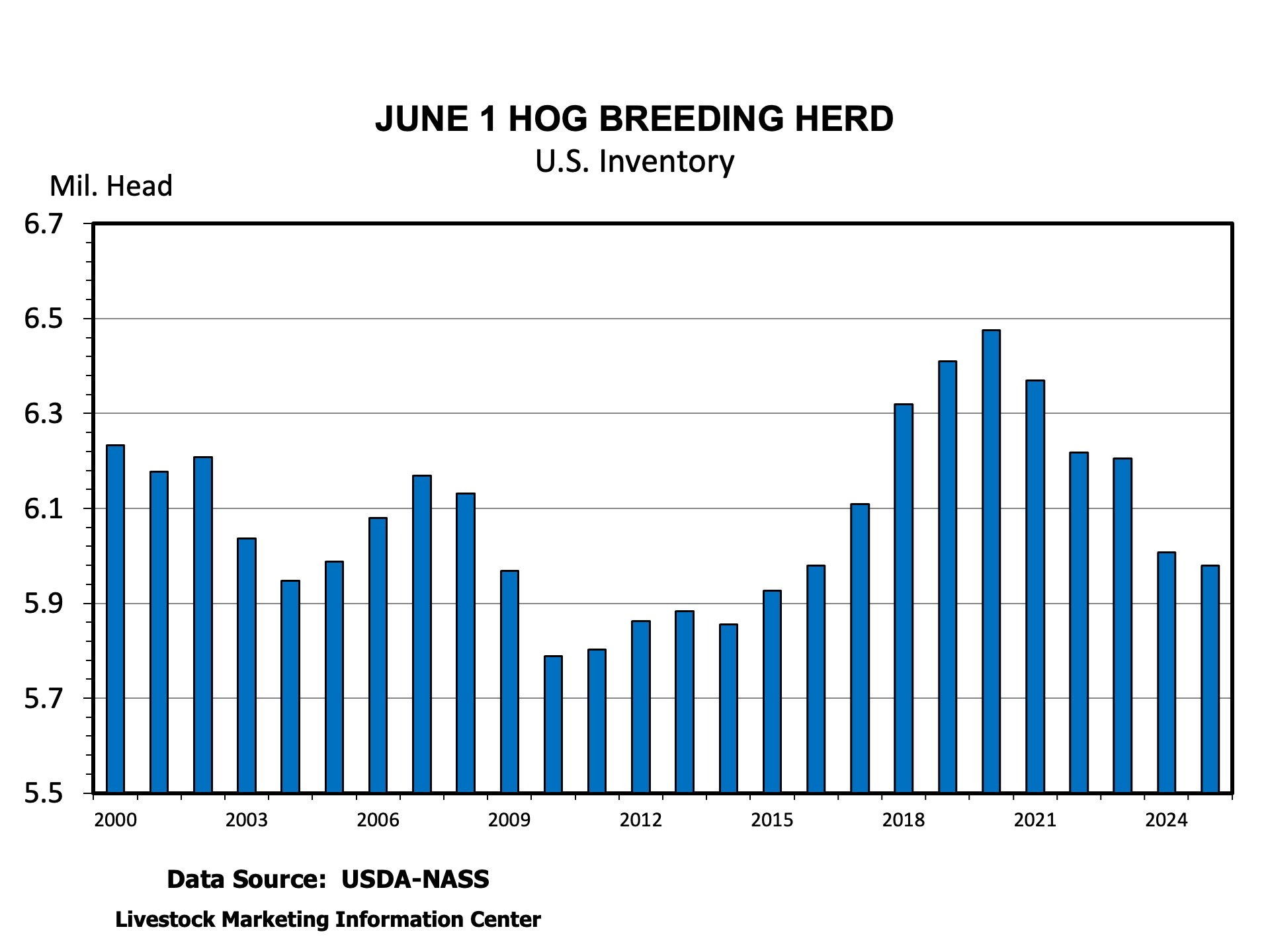

The price increase, especially when combined with lower feed costs, has brought some much needed profits to the production side of the industry. The industry has been largely treading water over the last year following large financial losses from 2022 into early 2024. Small profits have kept the sow herd declining in number, down to 5.979 million sows on June 1, 2025, the fewest since 2016. While the sow herd has been declining, the number of pigs saved per litter has continued to climb, hitting a record 11.7 pigs per litter over the last 6 months.

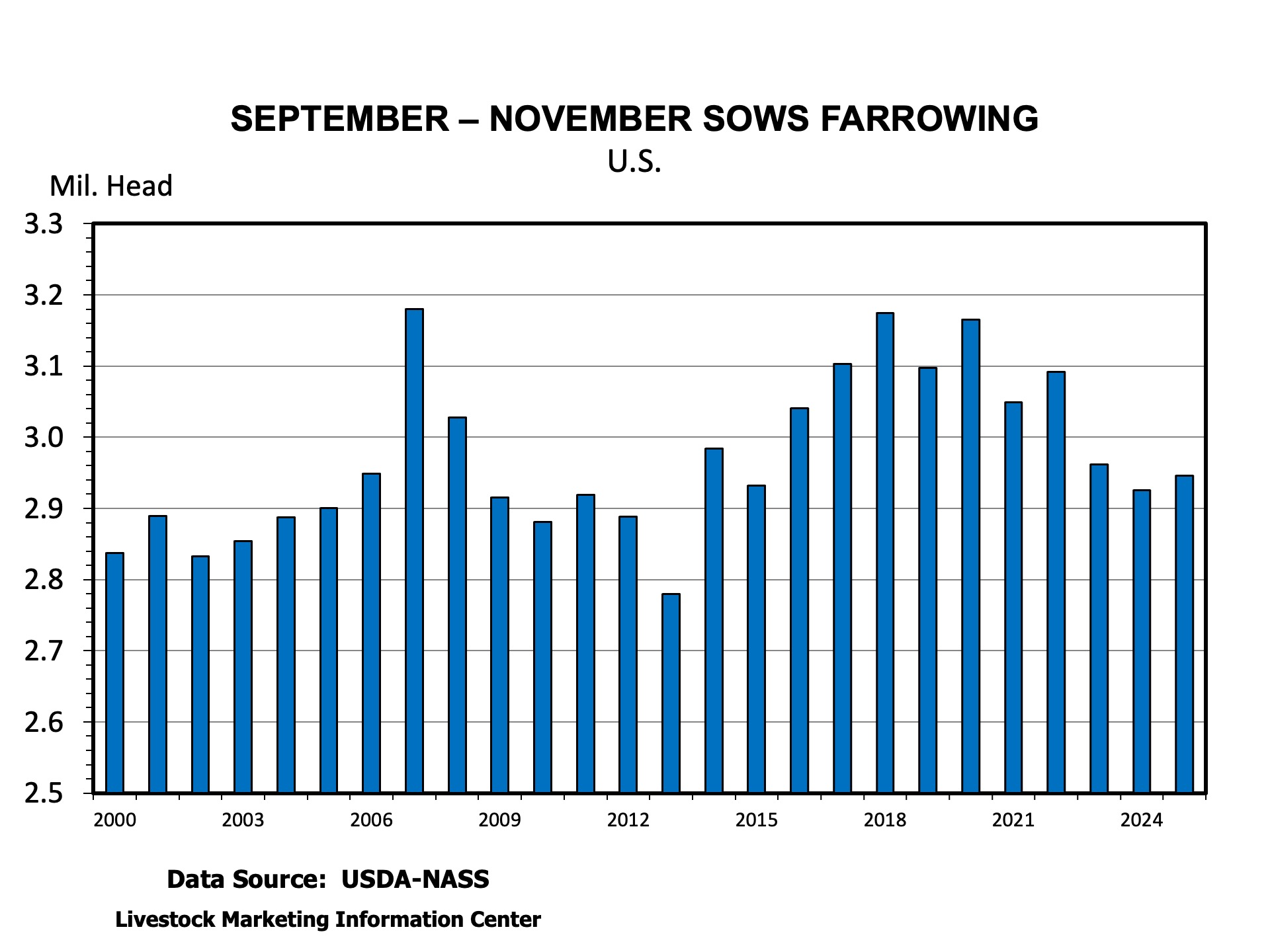

It appears that higher prices and profits will work their magic to spur a production increase in 2026. Hog producers reported in the USDA’s June Hogs and Pigs report to increase their intended number of sows farrowing in the last quarter of 2025. Increased sows farrowing combined with more pigs per litter should boost production in the first half of 2026.

Anderson, David. “Hog Prices Hit 3-Year Highs.” Southern Ag Today 5(28.2). July 8, 2025. Permalink