Payment limitations are not a novel policy tool. Modern day limits have been imposed since the 1970 Farm Bill, with multiple changes to the payment limit in subsequent farm bills (Congressional Research Service, 2020; Ferrell, Fischer, Lashmet, 2024). We provide an example of what incentivizes a producer to create a new entity to receive potentially forgone commodity program payments and how it could be completed in practice when appropriate. It should be note that there are rules in place that prohibit farmers from restructuring just to avoid payment limits.

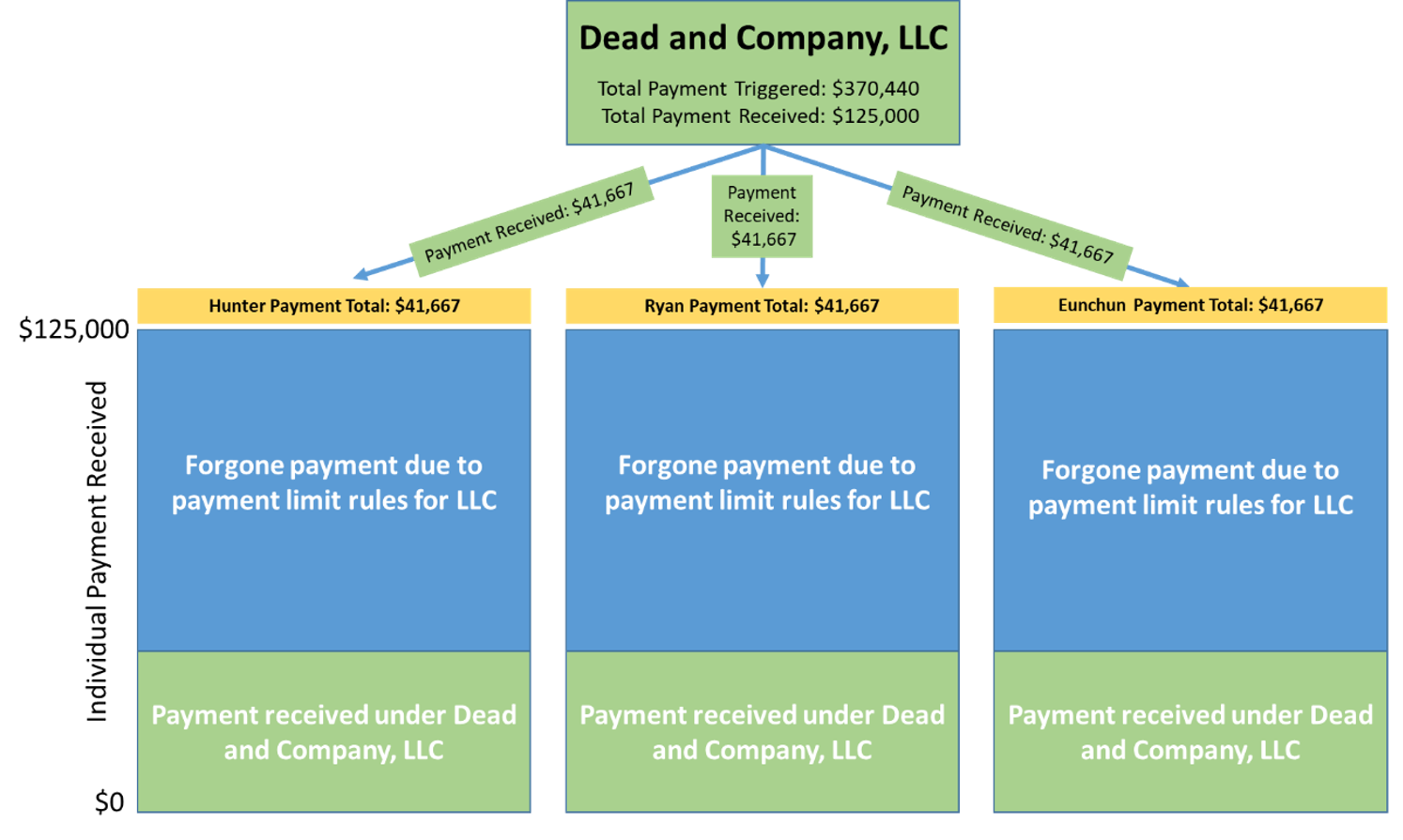

Suppose a producer is one of three members (with equal ownership shares) of Dead and Company, LLC, located in Lawrence County, Arkansas. The entity has 2,800 acres of long grain rice base; the county average Price Loss Coverage (PLC) payment yield is 63 cwt/ac[1], and the payment rate is $2.10/cwt. This would result in a total PLC payment for Dead and Company, LLC of $370,440[2]. However, under current rules, Dead and Company, LLC is subject to a $125,000 payment, and each member is also subject to a personal payment limit of $125,000, however, based on their one-third share they are limited to $41,667. In this example, Dead and Company, LLC receives the full $125,000 payment limit, effectively forgoing $245,440 ($81,813 per member) of the total payment. A visual example is provided in Figure 1 below.

Figure 1. Example of Payment Limit Distribution and Forgone Payment under an LLC

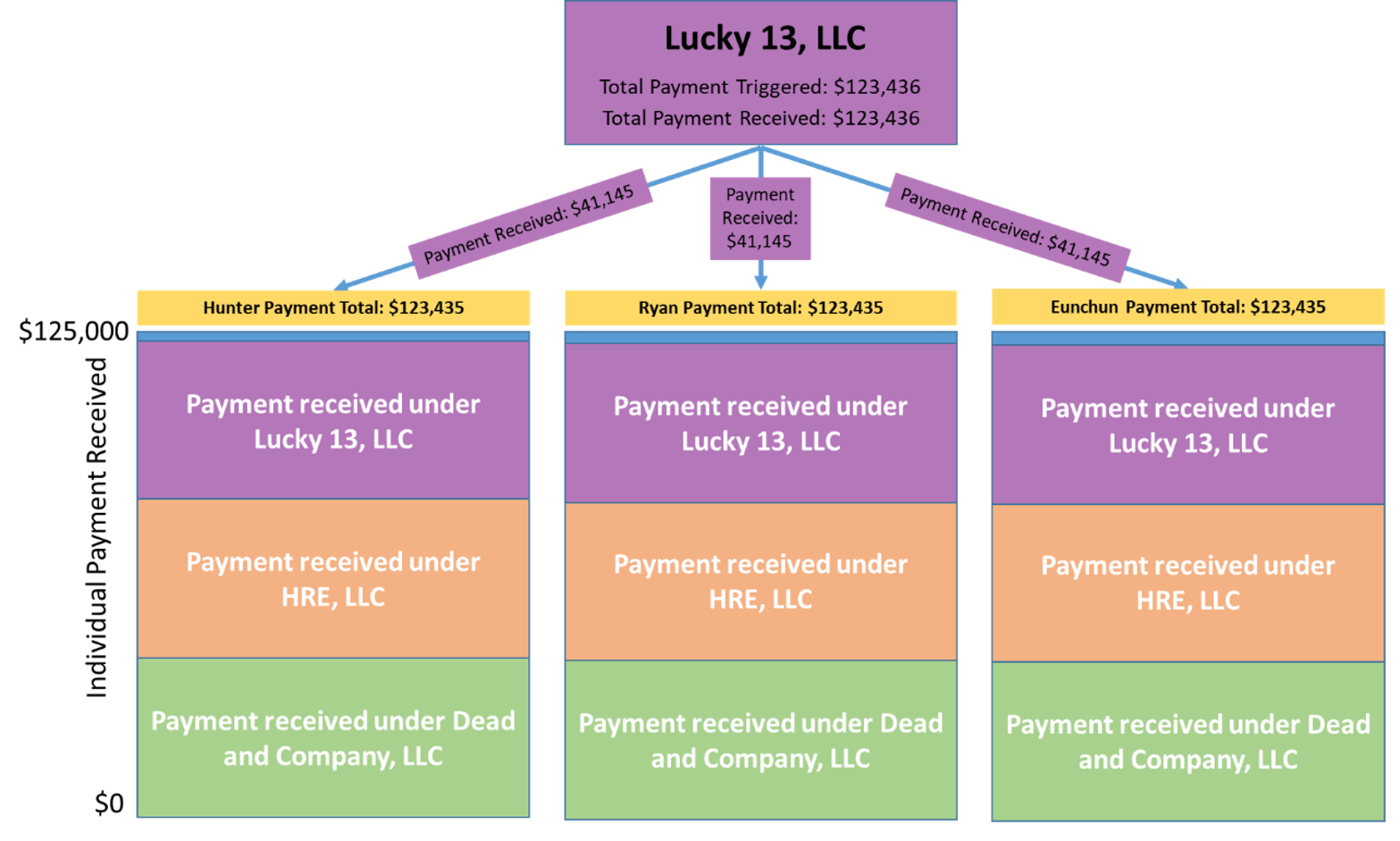

If it makes sense within the operation of the business, the three members of Dead and Company, LLC could choose to reallocate the 2,800 base acres to different entities to increase their individual payment received and stay within the $125,000 individual payment limit. This could be done by creating two new entities, HRE, LLC and Lucky 13, LLC, which have the same three members as Dead and Company, LLC. The three individuals are now members of three different LLCs, each containing 933 acres, or an even share of the 2,800 base acres, resulting in a total payment per entity of $123,436, below the $125,000 payment limit per LLC. While there are three entities that have separate payment limits, one should note that the three entities have to maintain separate sets of books. In other words, while setting up additional entities is relatively easy with the help of a lawyer, the additional time associated with the requirement to maintain separate records for each farm also needs to be taken into consideration. In addition, while the math on this exercise is fairly easy, there are significant rules and procedures that have to be followed when reorganizing to avoid the appearance of reorganizing to take advantage of payment limit rules. Figure 2 shows how the forgone payment due to current payment limit rules increases per individual as each person receives an additional payment from a different entity. In short, each individual receives $41,145 in three PLC payments under Dead and Company, LLC, HRE, LLC, and Lucky 13, LLC.

Figure 2. Payments to each member under base reallocation from Dead and Company, LLC to Lucky 13, LLC and HRE, LLC

The 2014 farm bill provides a unique setting for studying the impact of payment limits on entity creation. First, producers had to make a one-time decision in 2014 for the commodity program to place their base acres in (i.e., ARC or PLC), which would not change for the life of the 2014 farm bill. Second, for a given crop year, all entities would receive a PLC payment if a payment was triggered for a crop in which base acres were enrolled. Third, historical plantings directly tied to the land determine the number of base acres, and enrolled entities are free to dissolve and be created. Therefore, while these conditions do not allow for reallocation to a new program election (i.e., switching from PLC to ARC), they can allow for base acreage reallocation to different entities.

While considering the individual payment limit itself is important in discussions that include higher statutory reference prices, it is also important to consider the number of entities allowed to receive payments. This is because of rules such as the “3-entity-rule” which existed prior to the 2008 farm bill, which repealed this rule. Understanding why a producer would create a new farm entity and how this can be done in practice is important as increasing farm size could limit the whole farm protection provided by commodity program payments and threaten farm income stability.

References

Congressional Research Service, 2020, U.S. Farm Programs: Eligibility and Payment Limits, https://crsreports.congress.gov/product/pdf/R/R46248. Accessed 22 May 2024.

Ferrell, Shannon L., Tiffany Dowell Lashmet, and Bart L. Fischer. “Paved with Good Intentions: Unintended Impacts of Farm Bill Payment Limitations.” Southern Ag Today 4(19.4). May 9, 2024. Permalink

[1] This value was taken from USDA-FSA data files and could be converted to bu/ac using a conversion factor of 2.22. In this case, this same yield in bu/ac is 140 bu/ac.

[2] This value is found by multiplying the total base acreage, the payment yield, and the payment rate.

Biram, Hunter, Ryan Loy, and Eunchun Park . “Commodity Program Payment Limits, Farm Entity Creation, and Implications for the Next Farm Bill.” Southern Ag Today 4(32.3). August 7, 2024. Permalink

Leave a Reply