A “triple threat” of low commodity prices, high input costs, and high interest rates creates a challenging financial environment for many producers. This is especially true for producers with little working capital and who rely on operating loans to finance their business activities. The good news is that one part of this “triple threat” may soon begin to ease.

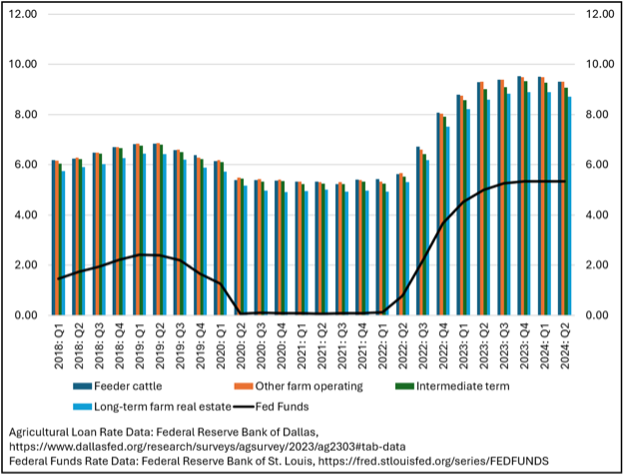

The Federal Reserve began raising the federal funds rate in the first quarter of 2022 in response to rising inflation (see Figure 1). This started a series of rate increases that ended in August 2023. Since, then, the federal funds rate has held steady at 5.33%. As the federal funds rate increased, interest rates charged on agricultural loans went up from about 5% to around 9% (Figure 1).

However, in a speech on August 23, 2024, Federal Reserve Chair Jerome Powell indicated that the Federal Open Market Committee (FOMC) would begin to lower the federal funds rate, perhaps as early as their September meeting. As the FOMC lowers the federal funds rate, other interest rates will begin to fall as well. This will be a welcome reprieve for producers as the cost of borrowing to finance operations decreases. It also provides producers with opportunities to manage the debt they have incurred over the last few years at high interest rates. Two strategies that producers might use as interest rates fall are debt refinancing and debt consolidation.

When debt is refinanced, an existing loan is replaced by a new loan with different terms and conditions for repayment. The new loan pays off the remaining principal plus any accrued interest that is still owed on the old loan. The amount that is paid off becomes the principal owed on the new loan. Payments are then made on this new loan, ideally with lower periodic payments. Debt consolidation is a form of refinancing in which multiple debts are combined into a single loan. The new loan pays off the remaining principal and any accrued interest on all the old loans, and the amount that is paid off becomes the principal owed on the new loan.

The primary benefit of refinancing or consolidating debt is smaller monthly or periodic payments, which occurs for two reasons. First, refinancing or consolidating debt often involves extending the debt’s repayment period. The amount owed is paid back over a longer period than the original loan(s) terms allowed for, so payments in each month are less. Second, refinancing or consolidating debt as interest rates decrease means the new loan should charge less in interest monthly than was charged on the old loan(s). The potential results of this benefit include improved monthly cash flow and an easier time making regular payments on debt.

Before a producer considers either of these strategies to help manage their debt, it is important to consider the potential pitfalls of refinancing or consolidation. First, extending the loan payment period may incur higher total interest costs. Although the amount owed in any single period is less, the fact that the loan principal is paid back over a longer time means interest accrues for longer as well. Therefore, there may be a tradeoff between lower periodic payments and higher overall costs for the loan. A second pitfall to consider is the closing costs and fees the producer must pay to initiate the new loan. Producers should consider whether they can pay these costs, and whether incurring these costs are worth any benefits of refinancing or consolidation, before initiating either process with their lender. Ultimately, producers will need to consult with their lenders to determine what refinancing or consolidations options are available to them and whether these options will be beneficial in the long run.

Figure 1. Changes in the Inflation rate, the Federal Funds Rate, and the Unemployment Rate, January 2018-February 2024

References

Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FEDFUNDS, April 1, 2024.

Board of Governors of the Federal Reserve System (US), Agricultural Survey, retrieved from the Federal Reserve Bank of Dallas; https://www.dallasfed.org/research/surveys/agsurvey/2024/ag2401#tab-report.

Wright, Andrew. “Lower Interest Rates Create Opportunities for Managing Debt on the Farm.” Southern Ag Today 4(37.3). September 11, 2024. Permalink

Leave a Reply