The Fall is often an interesting time to look at hog and pork markets because production typically increases seasonally, and prices decline. Holiday ham demand usually kicks in to partially offset supply driven lower prices. This year has some notable differences happening.

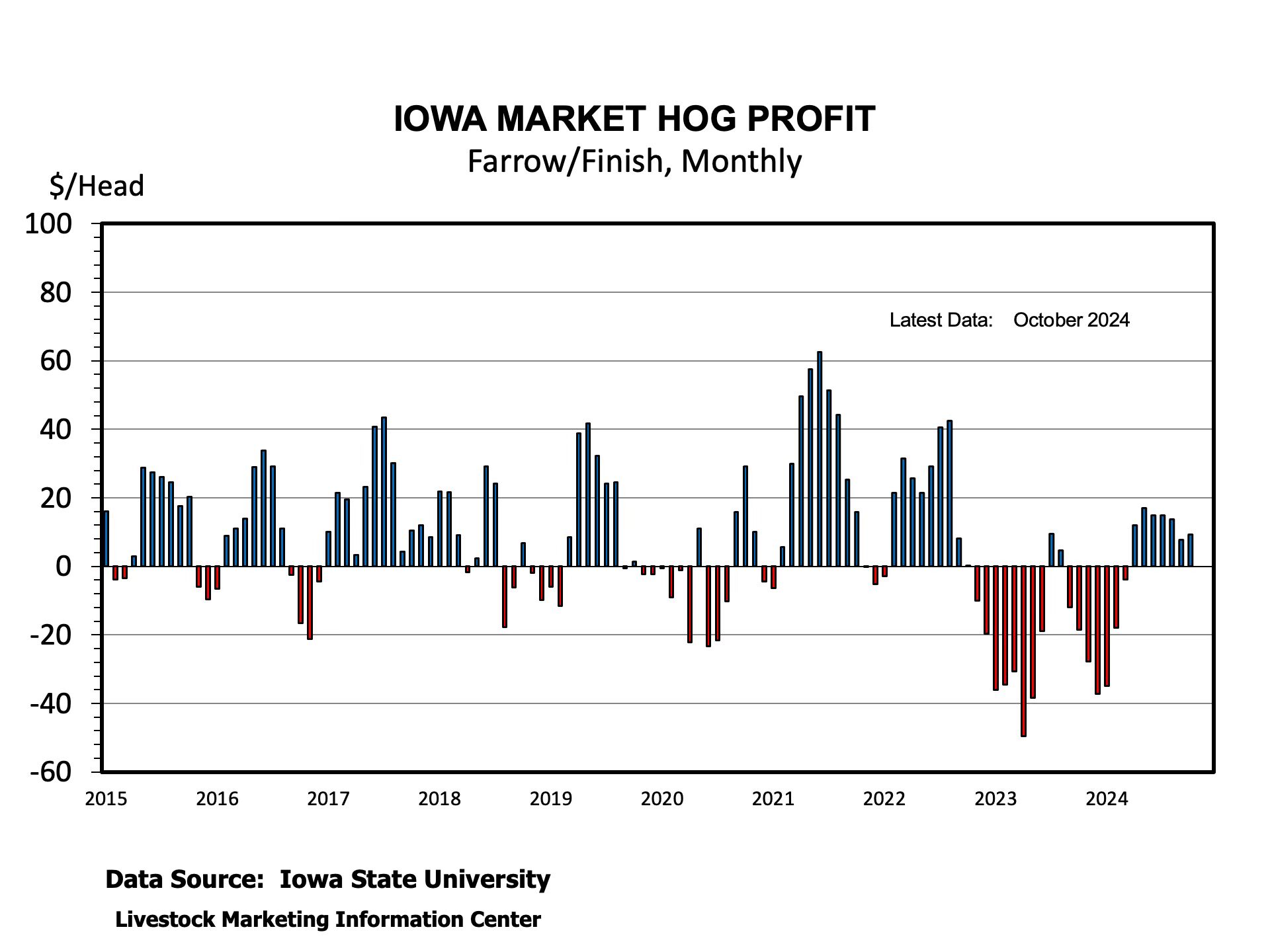

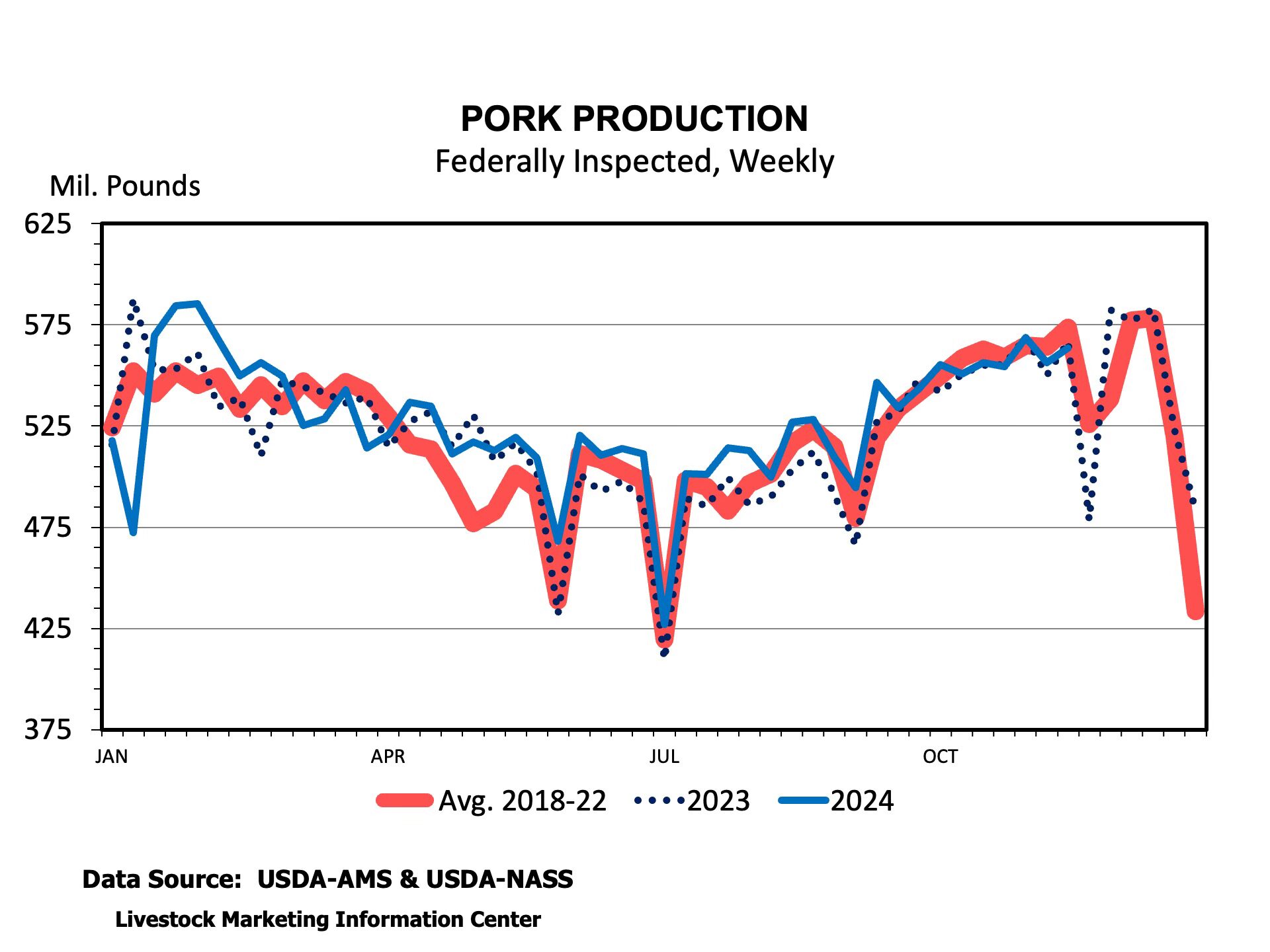

The hog industry has had a 7-month run of profits according to Iowa State University’s estimated farrow-to-finish returns. Profits have been generated by much lower feed costs in recent months. But, those profits are following huge financial losses in 15 of the preceding 17 months. Losses have led to a reduction in the breeding herd and in sows farrowing. USDA’s September 1 hogs and pigs report indicated the smallest breeding herd since 2016. About 18 percent of the nation’s breeding herd are in the South. June through August farrowings were estimated to be the smallest since 2013. Only increasing numbers of pigs per litter, hitting 11.72 in the third quarter of the year, supported slaughter numbers. Over the last month hog slaughter and pork production have been almost equal to a year ago.

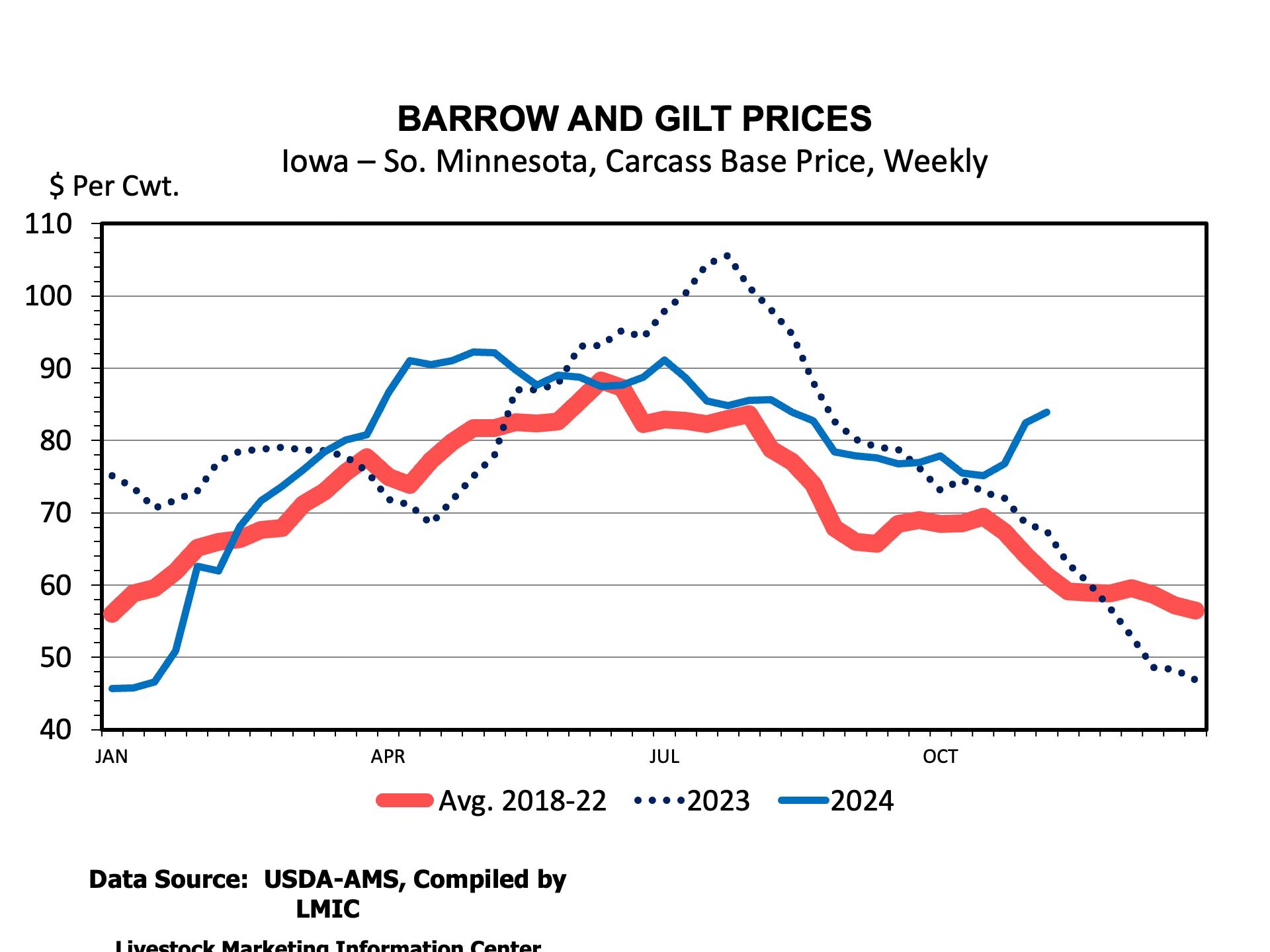

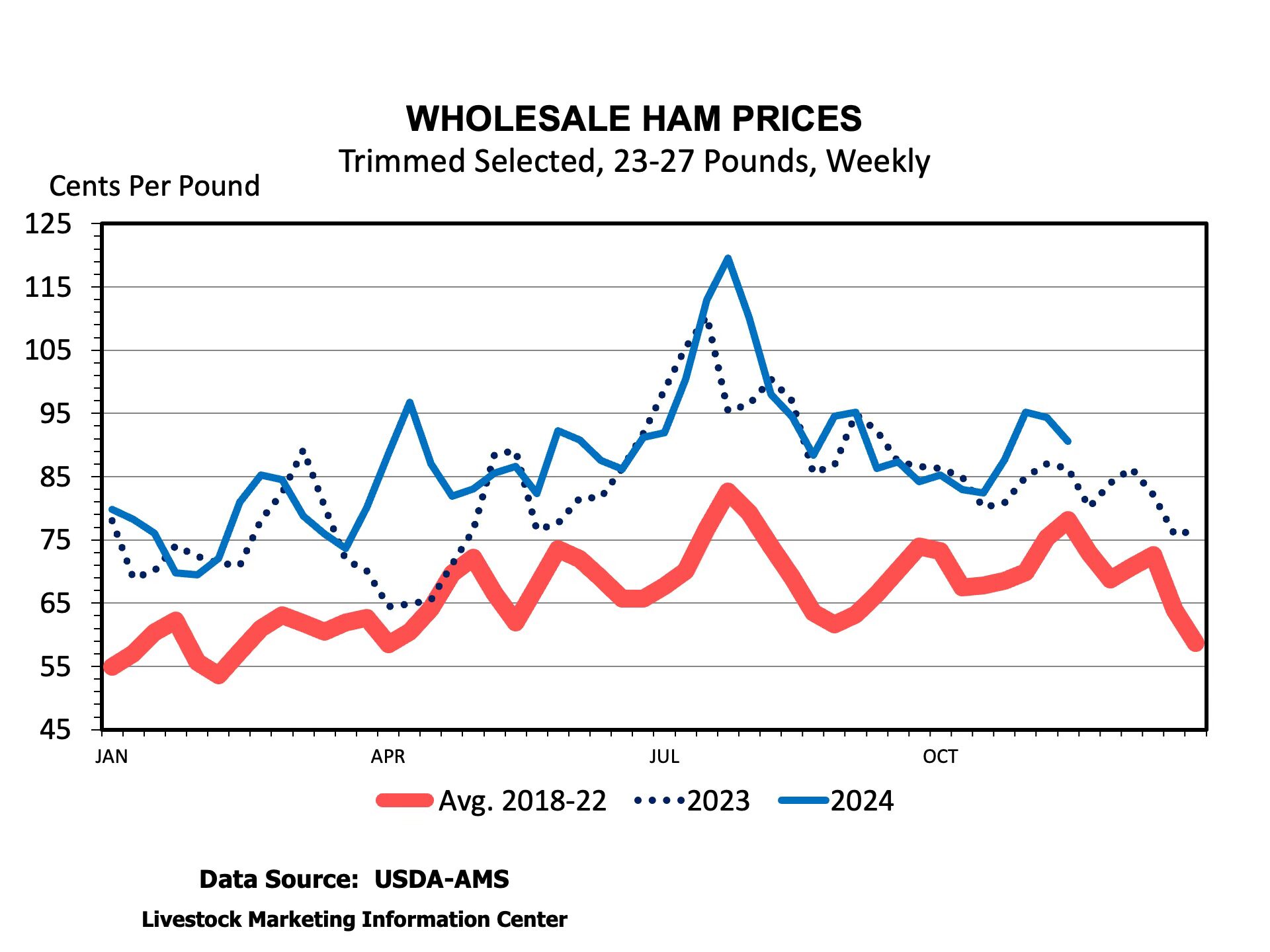

While pork production has increased seasonally this Fall, supplies appear to be tightening compared to a year ago. Hog prices are enjoying a counter-seasonal increase. Iowa-Southern Minnesota barrow and gilt carcass prices have increased from about $75 per cwt to $84 per cwt over the last month. The cutout is up about $7 per cwt over the same time. Wholesale prices are higher for pork bellies, trimmings, ribs, and hams. Bellies are up about $30 per cwt over the last month to $2.02 per pound. They were $1.24 per pound a year ago. Trimmed pork spareribs hit $1.75 per pound last week compared to $1.18 a year ago.

In the meantime, more retail pork features and specials are occurring compared to a year ago. Retail prices for boneless hams are a little higher than a year ago while bone-in hams are a little cheaper than a year ago in the week leading up to Thanksgiving according to USDA’s retail price report.

It’s going to take some sustained higher hog and pork prices to boost profitability enough to increase production in the coming year. It’s likely that higher pork prices are ahead for 2025.

Anderson, David. “A Look at the Hog Market.” Southern Ag Today 4(47.2). November 19, 2024. Permalink

Leave a Reply