With all the talk about the number of cows and cattle in the U.S., when herd rebuilding might begin, tariffs, and recent record high prices it seems like a good time to re-visit cattle numbers and beef production from a longer-term view.

Things We Know

The cattle industry remains a cyclical industry. The cattle cycle is driven by biology and economics with events like droughts interrupting the cycle. Beef production is cyclical also. It follows from the cow herd expansion or contraction, the number of calves, and the weights of those finished cattle.

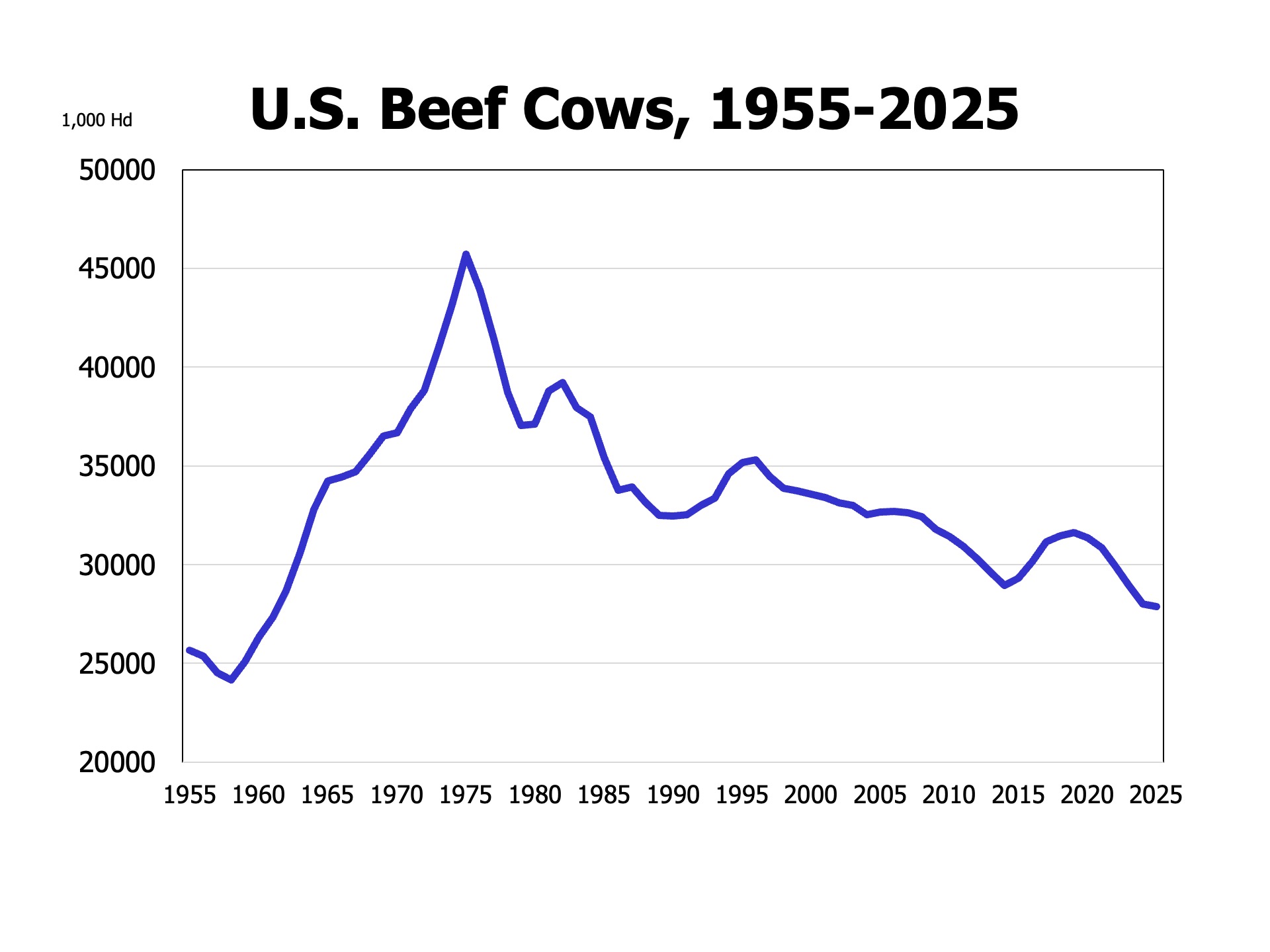

The beef cow inventory has declined since its peak in 1975 at 45.7 million head. Each peak in the number of cows has been smaller than the previous cyclical peak over that time. The cow herd declined, as part of the current cycle, to 27.9 million head in 2025, the fewest since 1961. While the herd has moved cyclically up and down every 10-12 years, the overall trend in beef cows is declining over time.

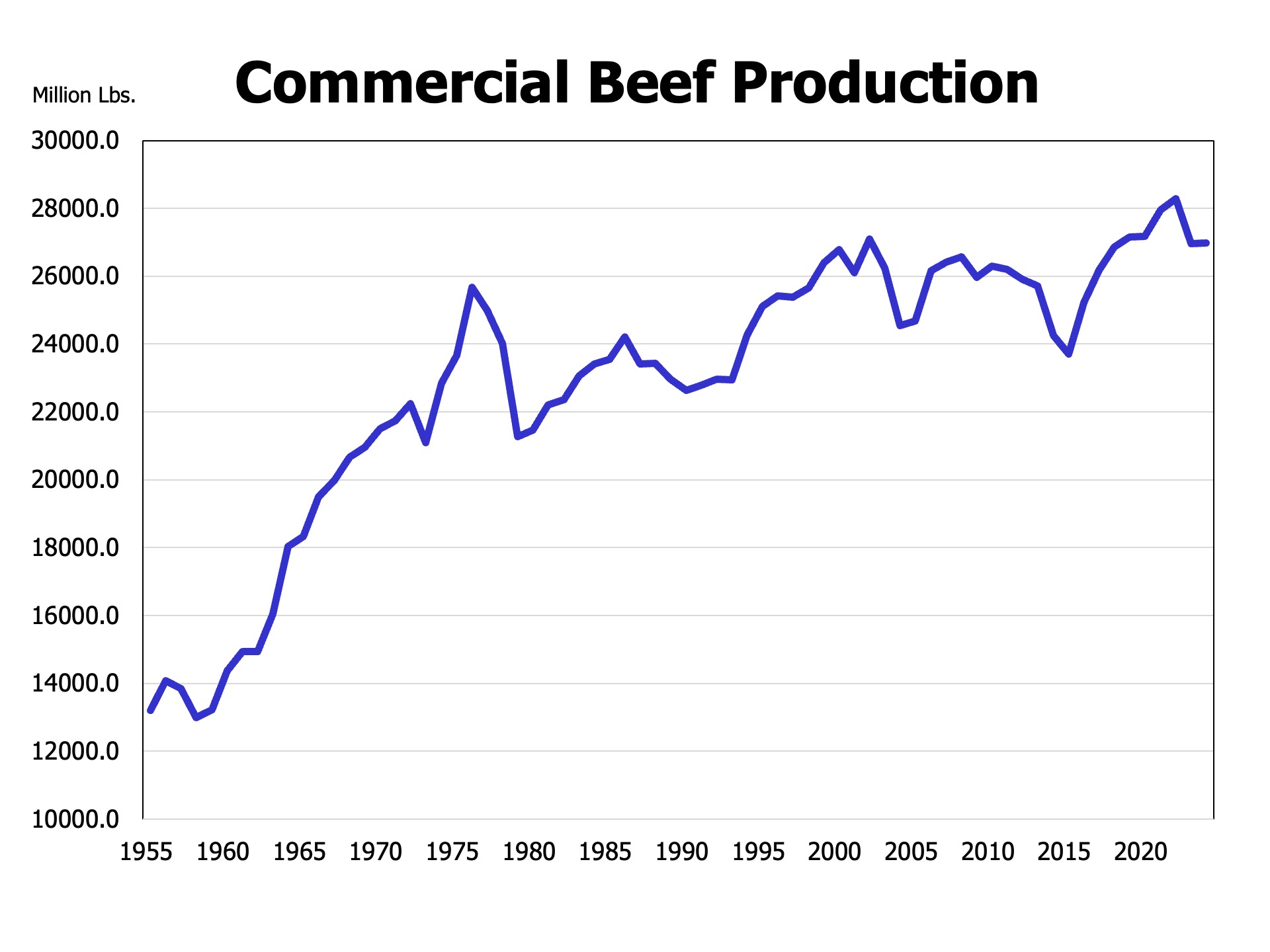

In contrast to cow numbers, beef production has been trending higher since 1975. Following the 1975 peak in cows, beef production peaked in 1976 at 25.7 billion pounds. This remained the high mark until 1999 when beef production hit 26.4 billion pounds. Production has since exceeded the 1974 level in all but 4 years, despite the lower cow numbers. Genetics and feeding improvements have led fed beef production to have an upward trend even with fewer head. The key is the trend in cattle weights. The U.S. has a long-term trend toward heavier weights driven by economics, genetics, technology, cattle size, feeding, and nutrition.

What Does This Suggest?

The industry has experienced tremendous growth through productivity gains that show up in animal weights. The cattle cycle shows up in beef production as it does in herd numbers. Declining cattle numbers reduces beef production, mitigated by heavier weights and cow culling, and supports higher prices leading to herd expansion. A growing cattle herd increases beef production by even more as weights increase.

This discussion leads to questions to consider. Can we get back to cattle numbers of the past? This would imply more ranchers, more feedlots, and more industry infrastructure? Or will the next cycle continue to the trend of a smaller peak than the most recent cyclical peak in 2019? Recent record high prices have not quite yet led to herd expansion – but when that expansion comes, can the herd eclipse the 2019 total of 31.6 million head and deliver profitable balance sheets to continue rebuilding?

Maples, Josh, and David Anderson. “Cattle Inventory and Beef Production.” Southern Ag Today 5(15.2). April 8, 2025. Permalink

Leave a Reply