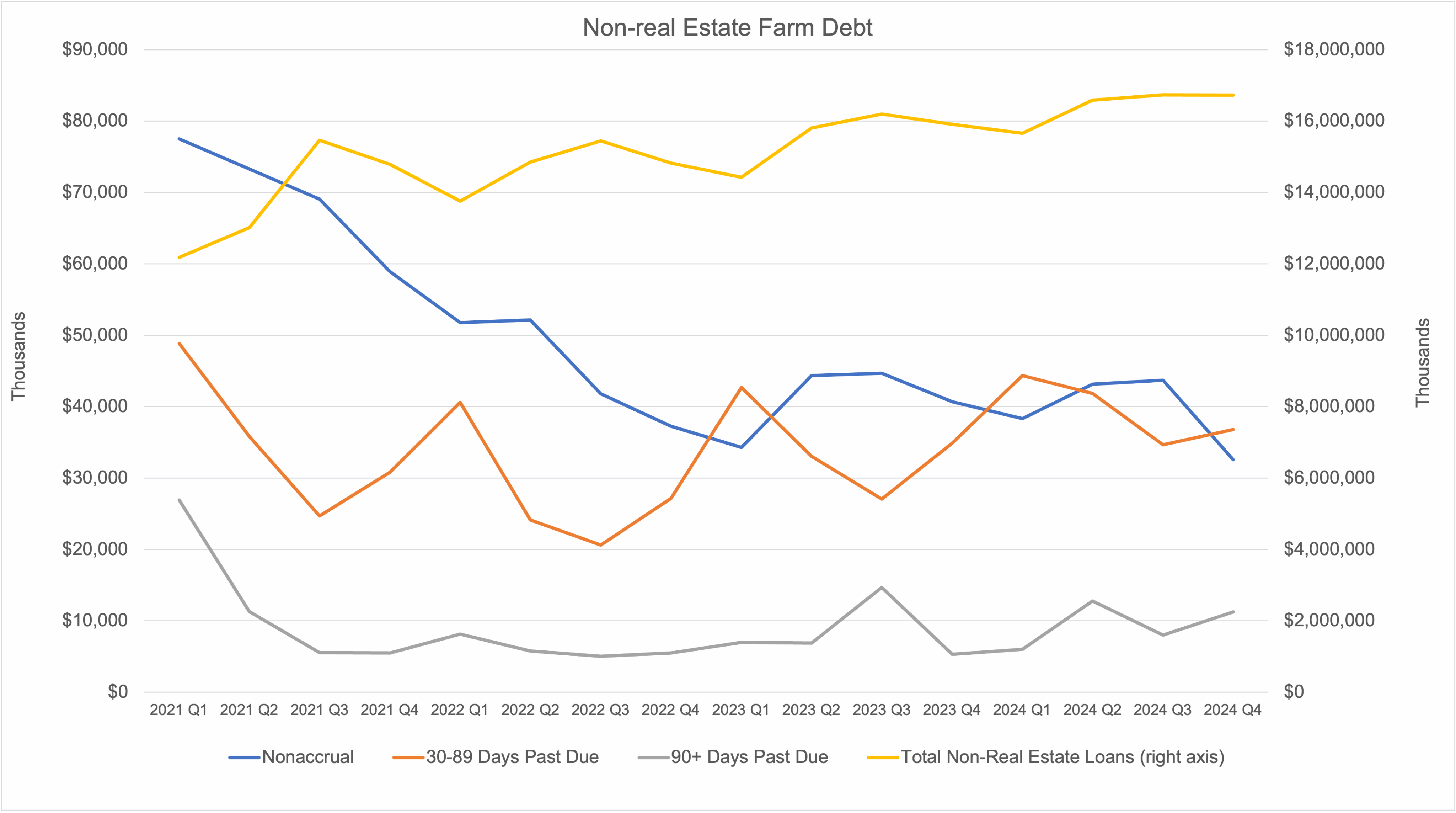

As mentioned in previous Southern Ag Today (SAT) articles (Martinez and Ferguson 2022, Martienz 2023), monitoring Non-Real Estate Farm Debt provides insight into debt health. Last year, there were periods of drought and increased input prices for producers. At the time of this article, planting is on everyone’s mind (completed or about to start), producers are bailing hay, and all prices in every supply chain are working their way through tariffs. The most recent reports offer insights through the end of 2024. As a refresher, every commercial bank in the U.S. submits their quarterly Reports of Condition and Income, which are known as call reports. Within these call reports are totals of agricultural loans and the status (on time or late) of the loans. Figure 1 displays the total loan volume (yellow line) and loan volume for three late categories (30-89 days late, 90+ days late, non-accrual) for the last 16 quarters (4 years). The totals are for all the Southern Ag Today States.

Through the end of 2024, non-accrual (blue line) loans continued to decrease, which is positive, and loans that are 90+ days late (grey line) remained relatively the same. Total loans (yellow line) are down from the previous quarter, which is expected due to seasonal trends. But, total loan debt is up 4.8% compared to 2023. The most concerning statistic is the loans that are 30-89 days late (orange line). At the end of 2024, debt that was 30-89 days late, was up 5.2% compared to the end of 2023 and the highest since Q1 of 2021. Q1 is seasonally the highest quarter for 30-89 days late loans, but given that it’s up from a year ago, the Q1 2025 reports will provide an indication of debt health in 2025 and moving forward.

From a sky high view, the call reports indicate that there are some possible caution signals for debt in the SAT states. Total non-current debt is approximately 1%, which is still relatively low. The next two quarters will provide answers if the signals are false alarms or true signals of concern. In the coming months, it is crucial that producers are mindful of their working capital and continue the positive production and risk management strategies they have implemented thus far.

Figure 1. Non-Real Estate Farm Debt from 2021 Q1- 2024 Q4

References

Martinez, Charley, and Haylee Ferguson . “Current Non-Real Estate Farm Debt“. Southern Ag Today 2(30.3). July 20, 2022. Permalink

Martinez, Charley, and Parker Wyatt. “Current Non-Real Estate Farm Debt.” Southern Ag Today 5(20.1). May 12, 2025. Permalink

Leave a Reply