The 2025 trade war between the U.S. and China has been an evolving phenomenon. The U.S. implemented tariffs on Chinese imports effective February 4, which were then increased March 4. China responded with a variety of tariffs, including 15% additional tariffs on U.S. raw cotton, effective March 10.

The above situation continued to change, with the U.S. and China effectively embargoing their mutual trade in April with extreme tariff levels and then adjusting these extreme levels lower in May. As of May 12, and for 90 days, the Chinese tariff rate on U.S. cotton is 10%.

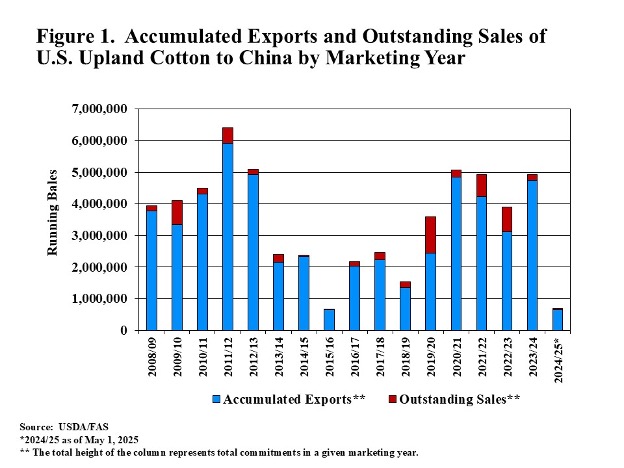

With all the policy variation, the direct impact on U.S. cotton has probably been lower in the current 24/25 marketing year than it would have been in previous years. The reason is that 2024/25 has seen an historically low level of U.S. export commitments to China of upland cotton (Figure 1). Thus, there is relatively little volume of U.S. cotton to be directly impacted by the initial, extreme, or current levels of Chinese tariffs.

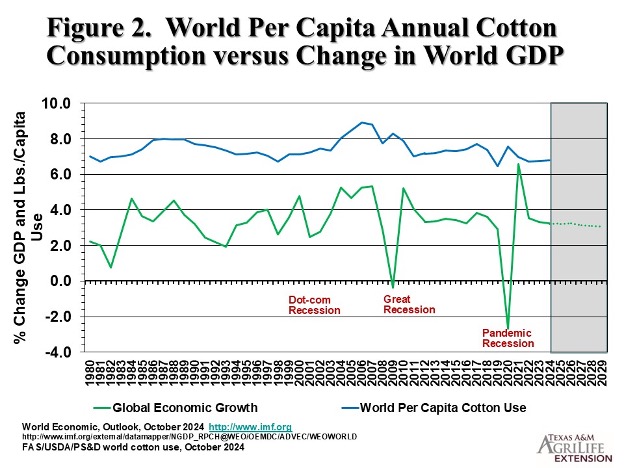

The remaining tariff risk to cotton demand is more likely an indirect influence. To the extent that tariffs imposed by the U.S. and its trading partners depress GDP, it follows that demand for semi-durable discretionary textile products could be reduced. This possibility is suggested in Figure 2, where the percentage change in world GDP appears to move directly with annual per capita cotton consumption.

Robinson, John. “Scope of Chinese Retaliatory Tariffs on U.S. Cotton Exports.” Southern Ag Today 5(21.3). May 21, 2025. Permalink

Leave a Reply