Agriculture is inherently risky, with producers facing a complex array of production, market, and financial risks. These risks can significantly impact farm profitability, necessitating robust risk management strategies. Risk management in agriculture has become a complex system of financial instruments and strategies, with crop insurance and forward contracting serving as two key components.

Forward contracting allows producers to mitigate price risk by securing a predetermined price and buyer for their grain. This approach can be especially attractive due to the potential weather risk premium embedded in forward contract grain prices. Buyers are often willing to pay higher prices to hedge against weather-related uncertainties affecting crop production, which allows farmers to lock in favorable prices and potentially increase their revenue. However, it’s crucial to note that while forward contracting addresses market risk, it does not directly mitigate production risk. Aggressive use of forward contracting can expose farmers to unexpected yield risk as farmers may be unable to meet contracted quantities, leading to non-delivery penalties imposed by elevators and potentially substantial financial losses.

Farmers can also purchase crop insurance as a complementary risk management tool to address the production risk associated with forward contracting. The federal crop insurance program offers various products, with yield (YP) and revenue protection (RP) accounting for 71% of the $158.6 billion of liability in 2024 (USDA-RMA, 2024). YP provides production risk management using a farm-specific Actual Production History (APH), while RP additionally provides price risk management using futures prices. Pairing forward contracting with either insurance product could potentially help offset non-delivery penalties and reduce the financial burden on farmers who experience yield shortfalls. The combination of forward contracting and insurance protection allows farmers to confidently engage in more aggressive marketing strategies. By protecting against both price and yield risks with RP and yield risk with YP, this integrated approach could potentially lead to a more stable farm income and improved overall risk management.

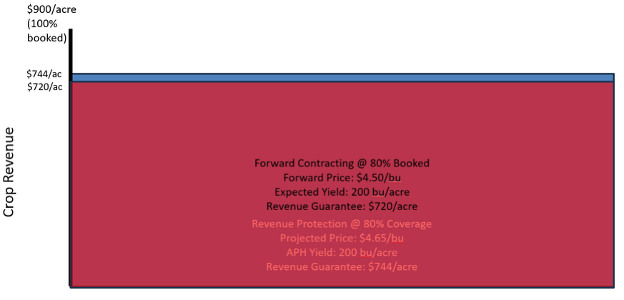

We provide a visual example of how these two risk management tools can work together in Figure 1 below. The red bar is the potential revenue generated from corn production by locking in a price of $4.50/bushel via a forward contract at a farm yield expectation of 200 bushels/acre. If a farmer booked 80% of expected production, the expected revenue from forward contracting would be $720.00/acre. The blue bar behind the red bar shows an RP crop insurance policy at 80% coverage that is layered underneath the expected revenue from forward contracting which guarantees $744.00/acre.

Figure 1. Layers of Protection Provided by Simultaneously Using Revenue Protection (RP) Crop Insurance and Forward Contracting in the Local Cash Market

NOTE: The purpose of this figure is to show two different “layers” of revenue coming from two different revenue risk management tools: forward contracting and RP crop insurance. The forward contracted revenue is in red while the crop insurance revenue guarantee is in blue behind the forward contracted revenue.

To illustrate the importance of this “layering” strategy, consider when a yield shortfall occurs leaving only 150 bushels/acre to sell at the forward price of $4.50/bushel rather than the 160 bushels/acre promised for delivery. This leaves a 10 bushel/acre shortfall. The local grain elevator is offering a cash delivery price of $4.00/bushel with a $0.05/bushel non-delivery penalty resulting in a non-delivery price of $4.05/bushel, and therefore, a total penalty of $40.50/acre. The resulting harvest revenue is about $635.00/acre (see table 1). Despite the penalty, the RP policy – which is in blue underneath the forward priced grain – provides an indemnity of $121.00/acre at a producer-paid premium of $56.00/acre. This results in a final cash revenue of about $700.00/acre rather than $635.00/acre, showing how the RP policy was able to pull crop revenue almost completely back to the expected amount of $720.00/acre despite the inability to fully deliver the promised amount (see table 2). This finding highlights the benefit of locking in prices during spring time as part of a pre-harvest marketing plan.

Table 1. Calculating Crop Revenue Using a Forward Price and Non-Delivery Penalty

| Expected Yield (a) | 200 bpa |

| Booked Yield (b = 80% x a) | 160 bpa |

| Realized Yield (c) | 150 bpa |

| Yield Shortfall (d = b – c) | 10 bpa |

| Forward Price (e) | $4.50/bushel |

| Harvest Price (f) | $4.00/bushel |

| Non-Delivery Fee (g) | $0.05/bushel |

| Non-Delivery Price (h = f + g) | $4.05/bushel |

| Forward -Priced Revenue (i= c x e) | $675.00/acre |

| Non-Delivery Penalty (w = d x h) | $40.50/acre |

| Revenue with Penalty (i– w) | $634.50/acre |

Table 2. Including Crop Insurance in the Crop Revenue Using a Forward Price and Non-Delivery Penalty

| Revenue with Penalty (a) | $634.50/acre |

| Crop Insurance Indemnity (b) | $121.00/acre |

| Revenue + Indemnity (c = a + b) | $755.50/acre |

| Producer Premium (w/subsidy) (d) | $56.00/acre |

| Revenue + Indemnity – Premium (c – d) | $699.50/acre |

Biram, Hunter, Andrew M. McKenzie, and Chanda Bhattrai. “How can crop marketing and crop insurance go together?” Southern Ag Today 5(24.3). June 11, 2025. Permalink

Leave a Reply