Growing demand for renewable fuel is reshaping crop decisions across the Southern United States, where farmers are rapidly expanding winter canola production. Traditionally grown in the U.S. Northern Plains, canola is now gaining traction in Southern double-crop rotations—driven largely by a strategic partnership between Bunge, Chevron, and Corteva Agriscience. Interest in winter canola production has been focused on the potential for winter oilseeds to contribute to the U.S Sustainable Aviation Fuel (SAF) Grand Challenge goal of 3 billion gallons of SAF by 2030 and 35 billion gallons by 2050.

The partnership combines Bunge’s grain origination and processing, Chevron’s fuel distribution, and Corteva’s proprietary genetics to position winter canola as a leading feedstock for renewable fuel. Central to this strategy is a new oilseed processing facility in Destrehan, Louisiana, which is slated to begin processing canola by 2026.

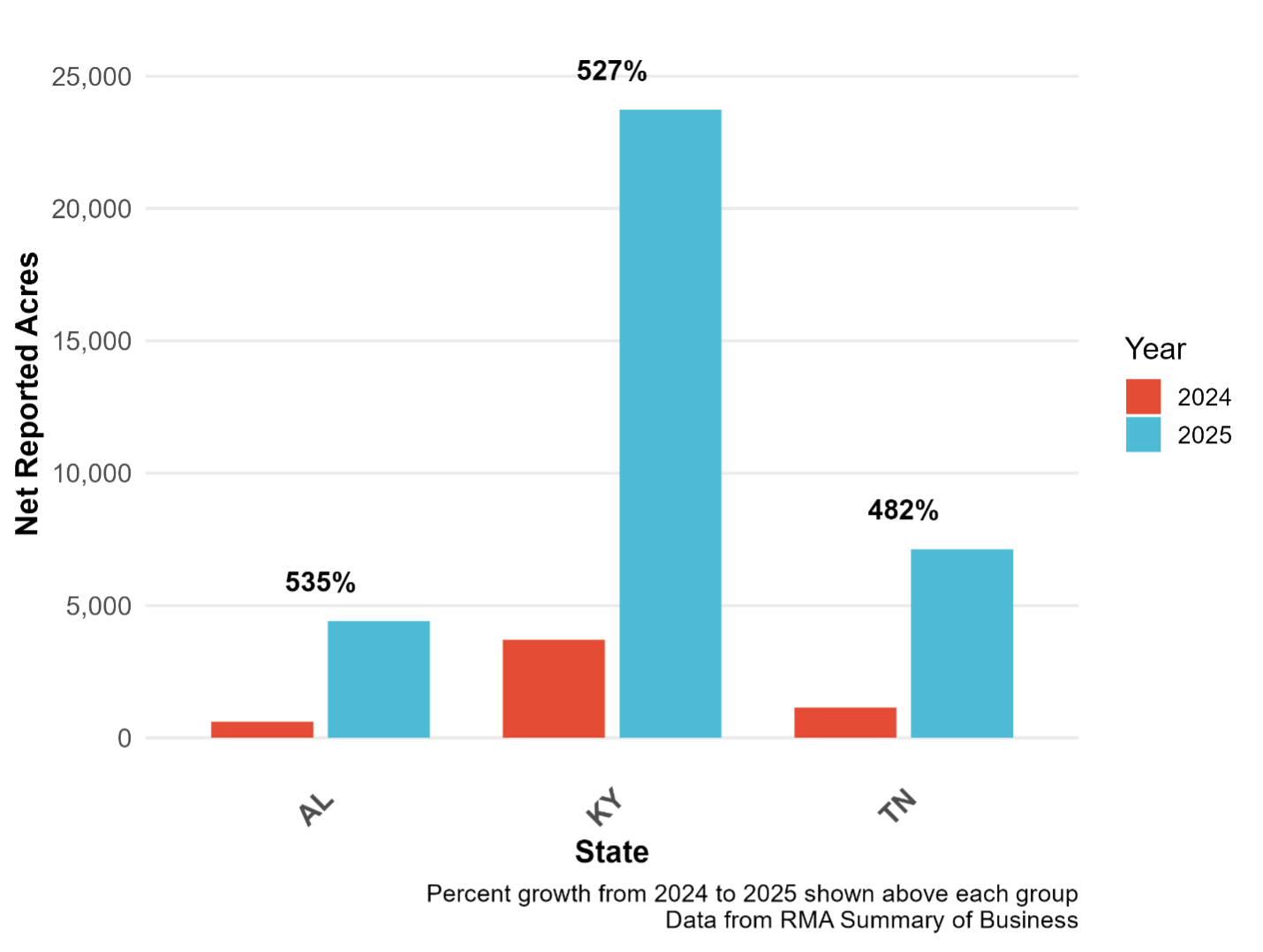

To meet projected demand by 2026, the strategic partnership launched a pilot program in the 2023–24 marketing year, contracting 5,000 acres across western Kentucky and Tennessee. By 2024–25, the initiative expanded to over 35,000 acres spanning Kentucky, Tennessee, Mississippi, Arkansas, Alabama, and Missouri (Pioneer, 2024). Reported insured acres from USDA’s Risk Management Agency (RMA) confirm this growth (Figure 1), with average increases of nearly 500% across Alabama, Kentucky, and Tennessee—highlighted by 7,500 acres in Tennessee and 25,000 in Kentucky.

Based on the anticipated crush capacity at the Destrehan, LA facility, near-term canola demand could reach 100,000 to 150,000 acres across the Southern United States. Over the longer term, the partnering companies project demand could rise to nearly 1 million acres as infrastructure and markets scale (Heslip, 2024).

Early reports from Kentucky and Tennessee suggest winter canola average yields of 40–65 bushels per acre. Contract prices for 2024 (2025 crop year) hovered around $12.00 per bushel, depending on contract timing, acres contracted, and freight costs. Gross revenue of $480-$780 per acre provides many mid-south farmers with a viable financial alternative to traditional soft red winter wheat production (Gross revenue of $420-$468; University of Kentucky and University of Tennessee 2025 Crop Budgets). Many growers report lower input costs compared to winter wheat, contributing to higher profit margins at current price levels. Currently, acreage contracts are being offered to producers for fall planting. Acreage contracts provide producers with a defined number of acres at a specified price. Production is not specified in the contract; the contract writer takes all production for the contracted acres at the set price. Before entering a production contract, producers need to fully understand the terms and conditions, including production practices, delivery, and quality specifications.

Figure 1: Canola Acres Insured (Net Reported) by State and Year

Sources:

Pioneer. 2024. “Corteva-Bunge-Chevron Winter Canola Program in the Mid-South Achieves Successful Harvest.” Accessed July 8, 2025. https://www.pioneer.com/us/news-and-events/news/media-release/corteva-bunge-chevron-winter-canola-successful-harvest.html.

Heslip, Nicole. 2024. “Winter Canola Pilot Expanding in Mid-South.” Brownfield Ag News (blog). Accessed July 8, 2025. https://www.brownfieldagnews.com/news/winter-canola-pilot-expanding-in-mid-south/.

Gardner, Grant, and Aaron Smith. “Winter Canola Expansion in the Southern U.S: A Renewable Fuel Opportunity.” Southern Ag Today 5(29.3). July 16, 2025. Permalink

Leave a Reply