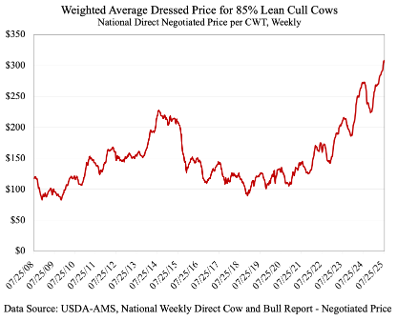

Tight supplies and strong demand are driving all types of cattle to record price levels, including cull cows. The national direct dressed price for 85 percent lean (boner cows) cull cows topped $300 per CWT last week for the first time in history. At local auctions across the southeast, cull cow prices are topping $160, $170, $180, and occasionally even $190 per cwt, depending on type. Ground beef demand has been strong and is the product most closely associated with lean trim from cull cows. Average U.S. retail ground beef prices topped $6 per pound in June for the first time ever, according to data from the Bureau of Labor Statistics.

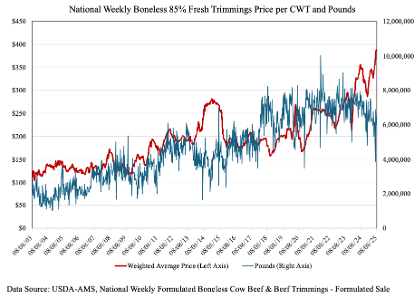

The chart below displays the price of 85 percent fresh trimmings and the pounds sold over time. This series is not comprehensive of all trims since it is just looking at formula sales for 85 percent trim and not any other percentages or sales type. However, the chart is interesting in that it highlights the inverse relationship between price and quantity. The declining availability of 85 percent trim over the past year has corresponded with sharp increases in price. This is driving the sharply higher dressed cow prices and local auction prices for cull cows.

Imports are a key piece of this puzzle. Beef imports are up sharply this year amid the high U.S. domestic prices. The majority of imports are lean trim that will be mixed with the fattier trim produced by domestic fed steers and heifers to make ground beef. Recent changes in tariffs will have impacts on lean trim. Brazil was the top import source for the first half of 2025, but the tariff on beef from Brazil jumped to 76 percent last week, which is sure to lead to significant reductions for as long as the tariff is in place. Meanwhile, the percentage of those imports that were lean trim will need to be filled by other import sources or domestic lean trim (i.e., cows and bulls). This is a good example of how tariffs and trade flows can impact domestic prices and supplies.

This all leads to an important discussion about cow herd expansion. Producers making culling decisions ahead of winter will be tasked with navigating the value of the cow as a cull cow vs their expected value in producing a calf next year. As the value of domestic lean trim increases, cull cow prices also increase. There will be some producers who would not have culled cows at $150 per CWT, but will cull cows if they are able to get $200 per CWT, if their expected value of calves in 2026 is unchanged. These decisions are all interconnected. In the absence of much heifer retention, it is possible that surging cull cow values could slow expansion efforts further.

Maples, Will. “Ground Beef Now or Calves in 2026?” Southern Ag Today 5(33.2). August 12, 2025. Permalink

Leave a Reply