The European Union (EU) and Mercosur (Brazil, Argentina, Uruguay, and Paraguay) signed a trade agreement on December 6, 2024, after more than 25 years of negotiations. The agreement, yet to be ratified, has the potential to become the most significant EU partnership, encompassing over 700 million people. It emerges amid the U.S. discussion of raising tariffs.

Highlights for Agriculture

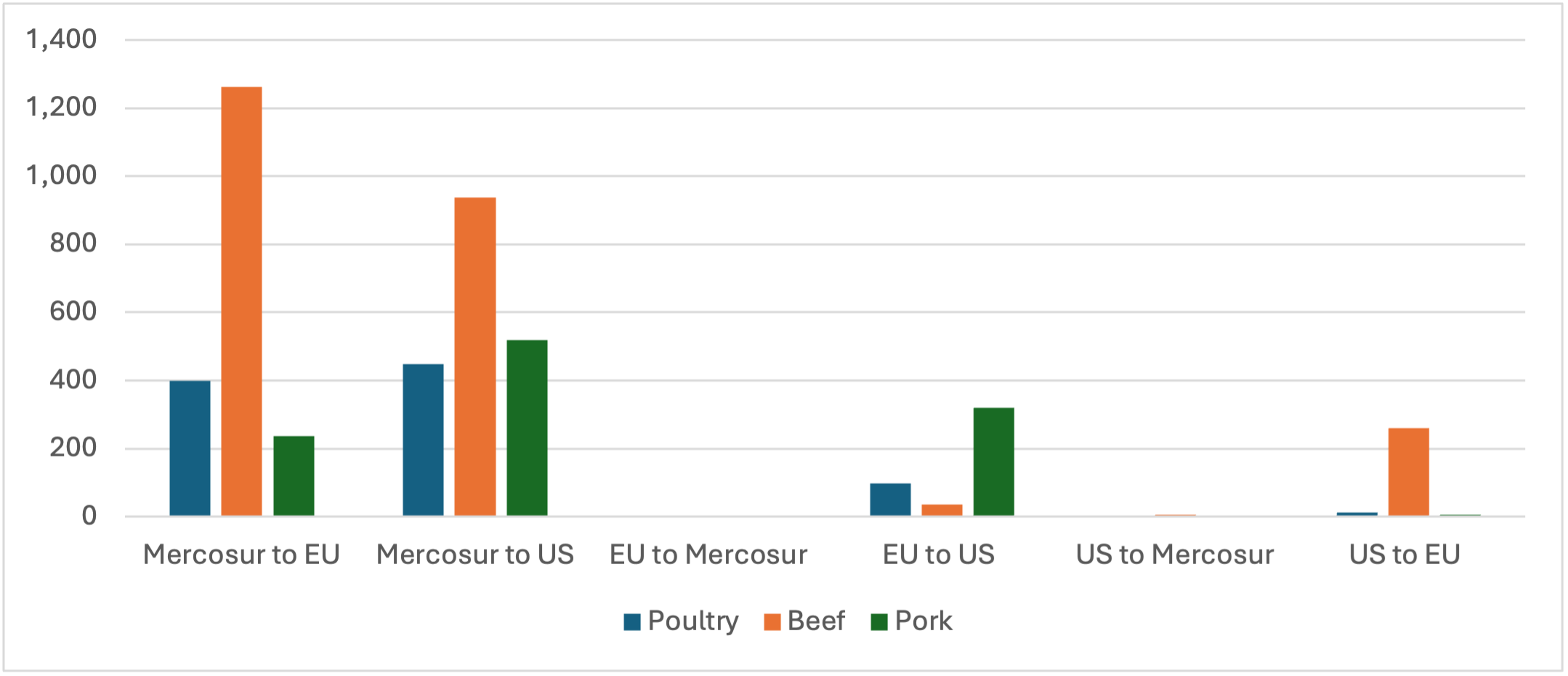

The flow of agricultural products is more significant from Mercosur to the EU, as illustrated in Figures 1, 2, and 3. The EU-Mercosur Trade Agreement introduces significant changes to agricultural trade by establishing quotas and reducing tariffs over a phased period[1], providing greater access to Mercosur countries. For beef, an additional quota of 99,000 metric tons (CWE) will be introduced over five years with a 7.5% tariff, while the existing Hilton Quota (10,000 metric tons) will become tariff-free upon the agreement’s implementation. Poultry exports will benefit from a 180,000 metric ton (CWE) quota, phased over five years, with zero tariffs, while pork will have a 25,000 metric ton quota with a fixed tariff of €83 per metric ton, implemented over five years.

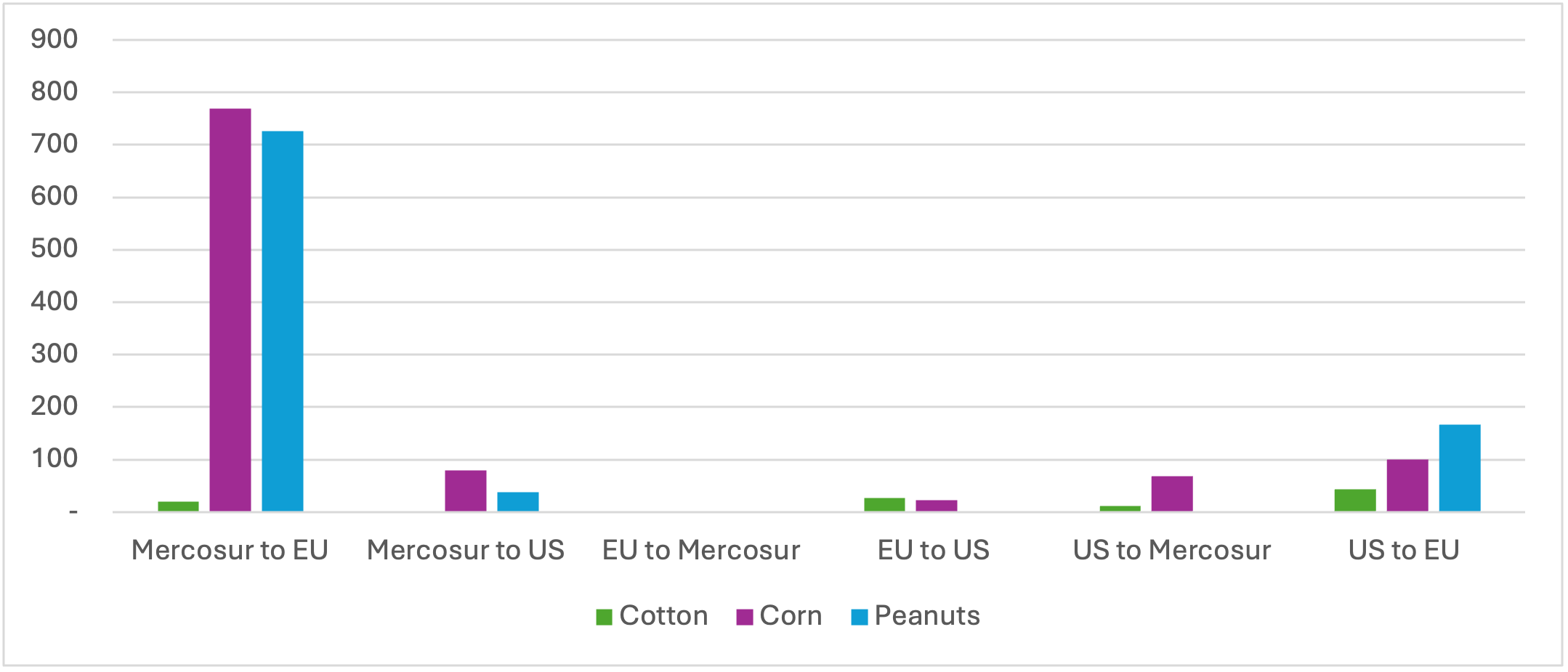

The agreement also includes quotas for sugar (180,000 metric tons with zero tariffs, including 10,000 metric tons reserved for Paraguay), ethanol (450,000 metric tons duty-free for industrial use), and corn (1 million metric tons at zero tariffs, increasing over five years). A 60,000 metric ton quota for rice will start at zero tariffs and gradually increase over five years. Additionally, orange juice tariffs will be eliminated over seven to ten years, with a 50% preferential margin during the transition. These provisions aim to expand market access for Mercosur’s agricultural exports while aligning with EU tariff structures.

Sustainability: Both blocs committed to following the Paris Agreement, combating deforestation, and reducing greenhouse gas emissions. The EU committed to using data from Mercosur authorities to assess Mercosur’s compliance with the requirements established by European bloc legislation.

Challenges Ahead

The signing of the EU-Mercosur trade agreement represents a significant milestone. However, the agreement may face political challenges in the future. The EU member states and the European Parliament must review and approve the final text. France and Poland are likely to express opposition to the agreement. Additionally, the Mercosur nations will need to ratify the agreement in their respective congresses.

Implications for the United States

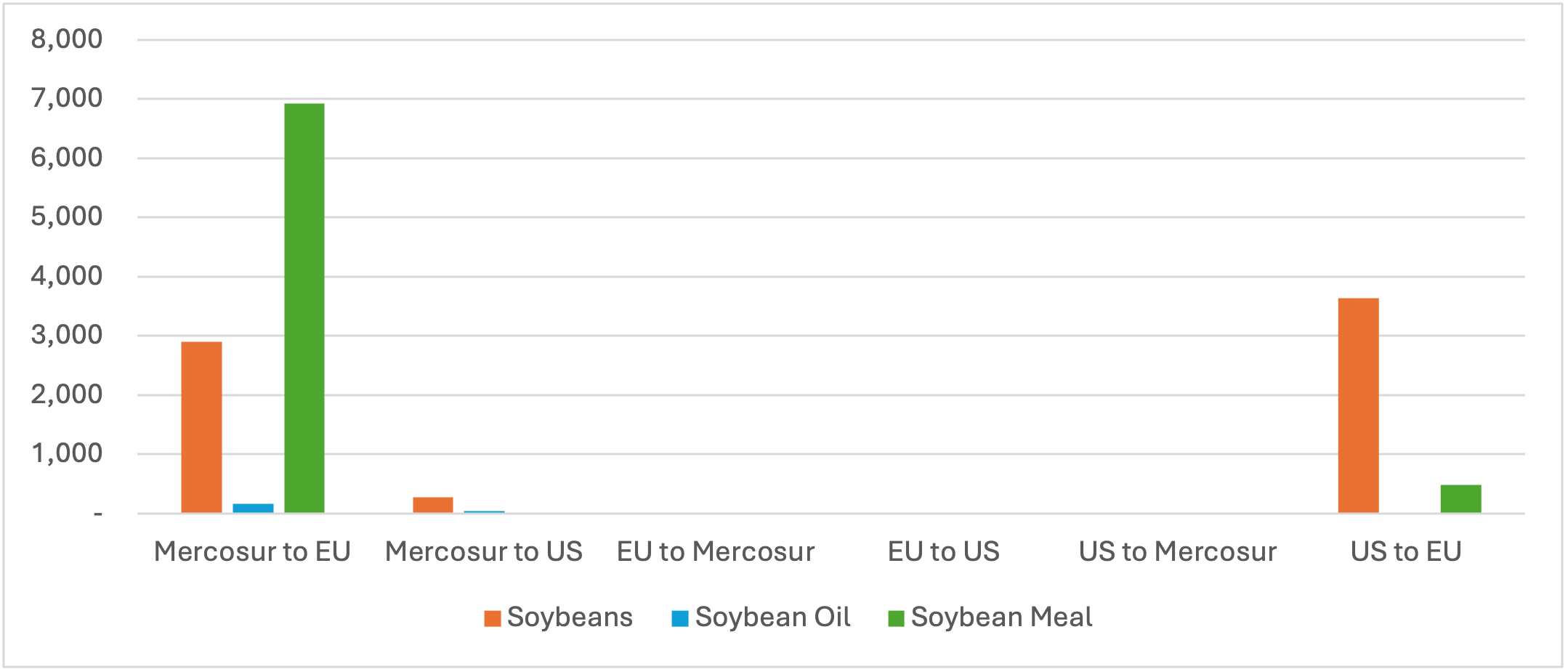

The EU-Mercosur trade agreement introduces competitive challenges for U.S. agricultural exporters by granting Mercosur countries preferential access to European markets and strengthening the EU’s position in Mercosur. Commodities such as beef (Fig. 1), corn/peanuts (Fig. 2), and soybeans (Fig 3) will face increased competition, with Mercosur benefiting from reduced tariffs and expanded quotas in the EU. At the same time, the agreement allows European goods to gain a stronger foothold in Mercosur countries, reducing U.S. export opportunities in high-value sectors like processed goods and dairy. The deal further challenges the U.S.’s ability to compete globally by setting a precedent for trade norms.

Figure 1 – 2023 Livestock Export Values by Product and Region (FOB, $ Millions)

Notes: Poultry, HS Code: 0207 (Meat and edible offal of poultry), 1602 (Prepared or preserved poultry); Beef, HS Code: 0201 (Fresh or chilled beef), 0202 (Frozen beef); Pork, HS Code: 0203 (Fresh or frozen pork), 1602 (Prepared or preserved pork).

Figure 2 – 2023 Crop Export Values by Product and Region (FOB, $ Millions)

Notes: Cotton, HS Code: 5201 (Raw cotton), 5205 (Cotton yarn), 5209 (Woven cotton fabrics); Corn, HS Code: 1005 (Corn/maize), 1102 (Corn flour); HS Code: 1202 (Raw peanuts), 1508 (Peanut oil).

Figure 3 – 2023 Soybeans Export Values by Product and Region (FOB, $Millions)

Notes: HS Code: 1201 (Soybeans), 1507 (Soybean oil), 2304 (Soybean meal)

[1] Sources: https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/countries-and-regions/mercosur/eu-mercosur-agreement/factsheets-and-guides_en

Calil, Yuri, and Pancho Abello. “EU-Mercosur Trade Agreement.” Southern Ag Today 4(52.4). December 26, 2024. Permalink

Leave a Reply