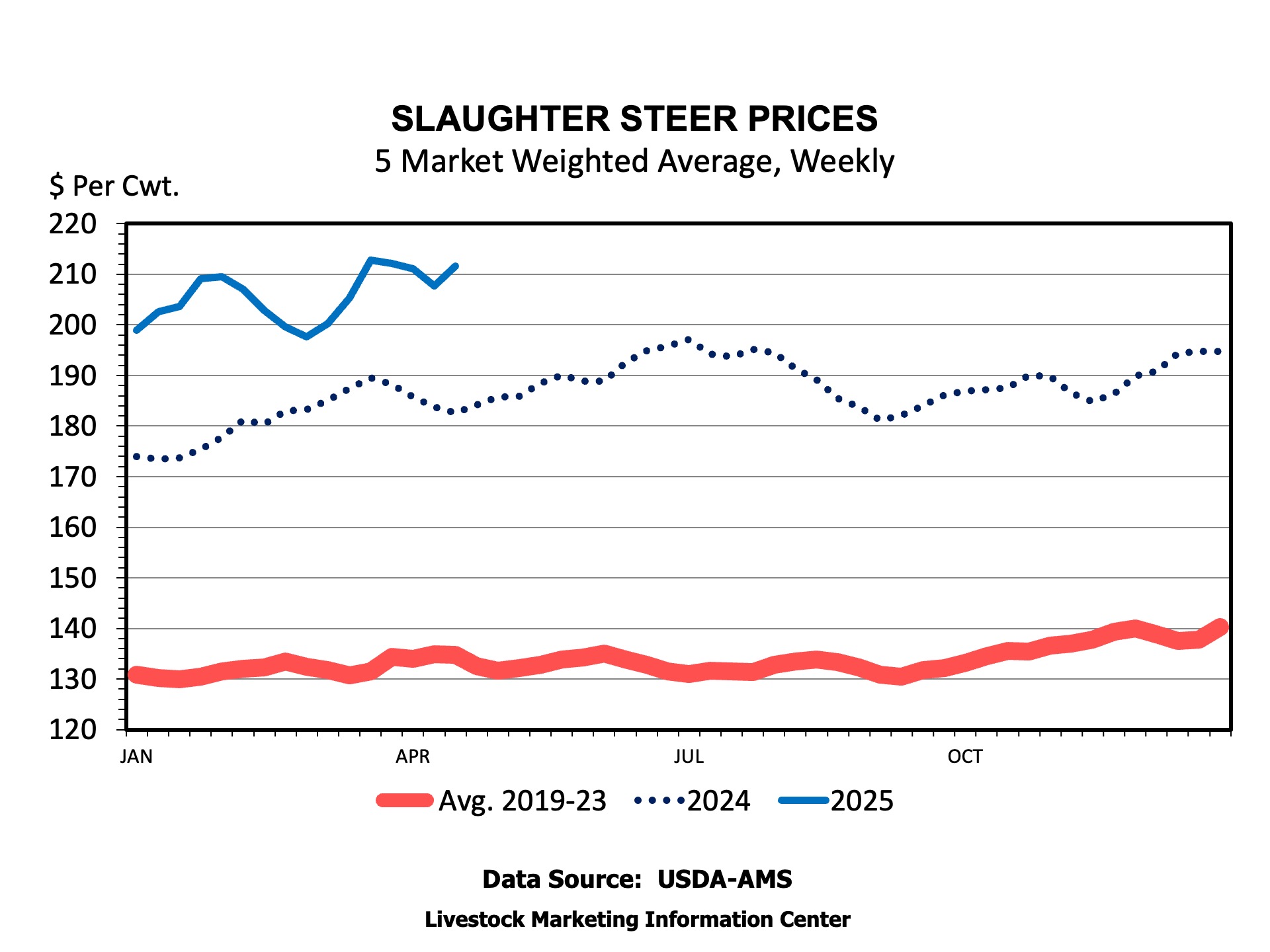

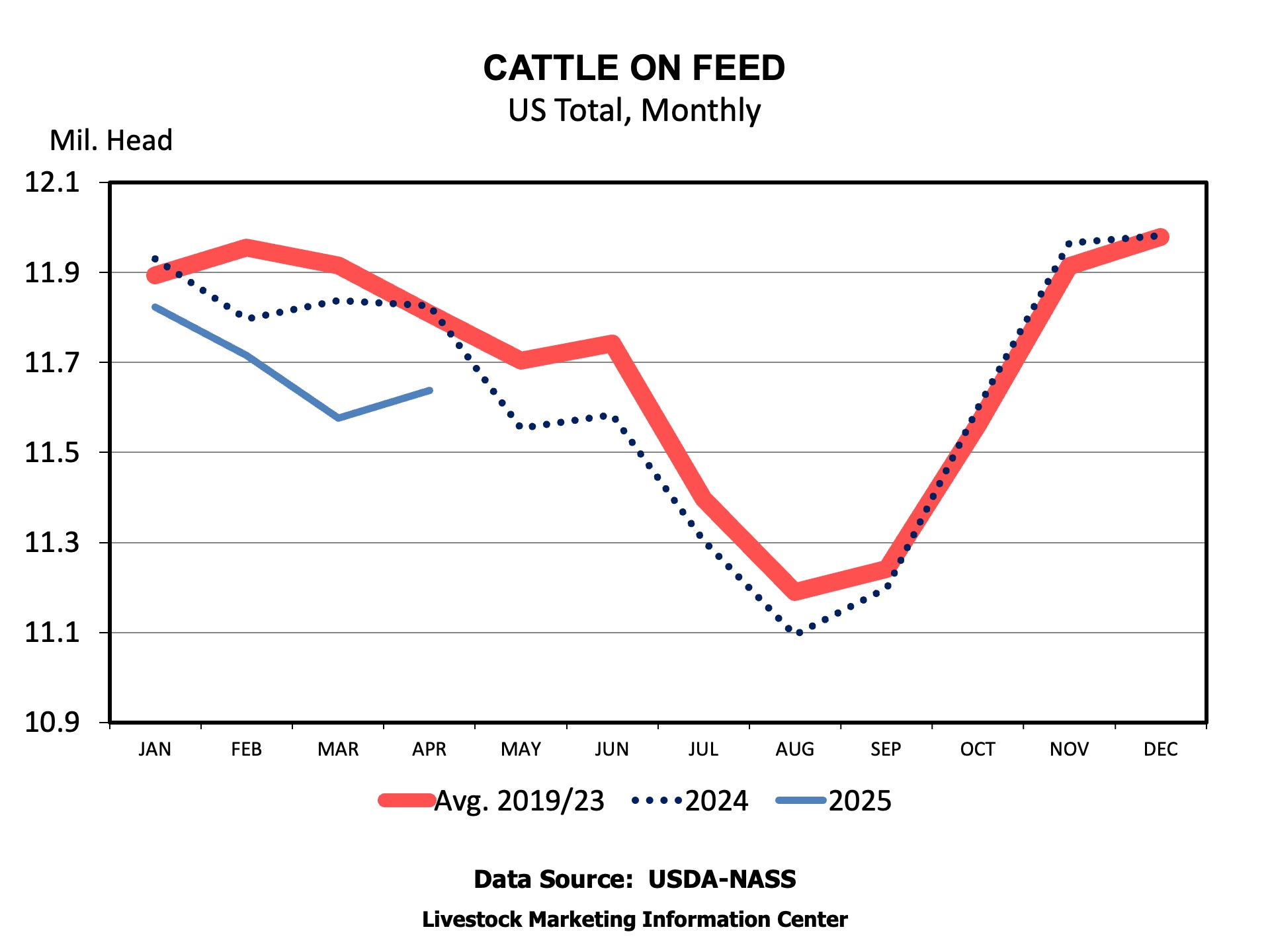

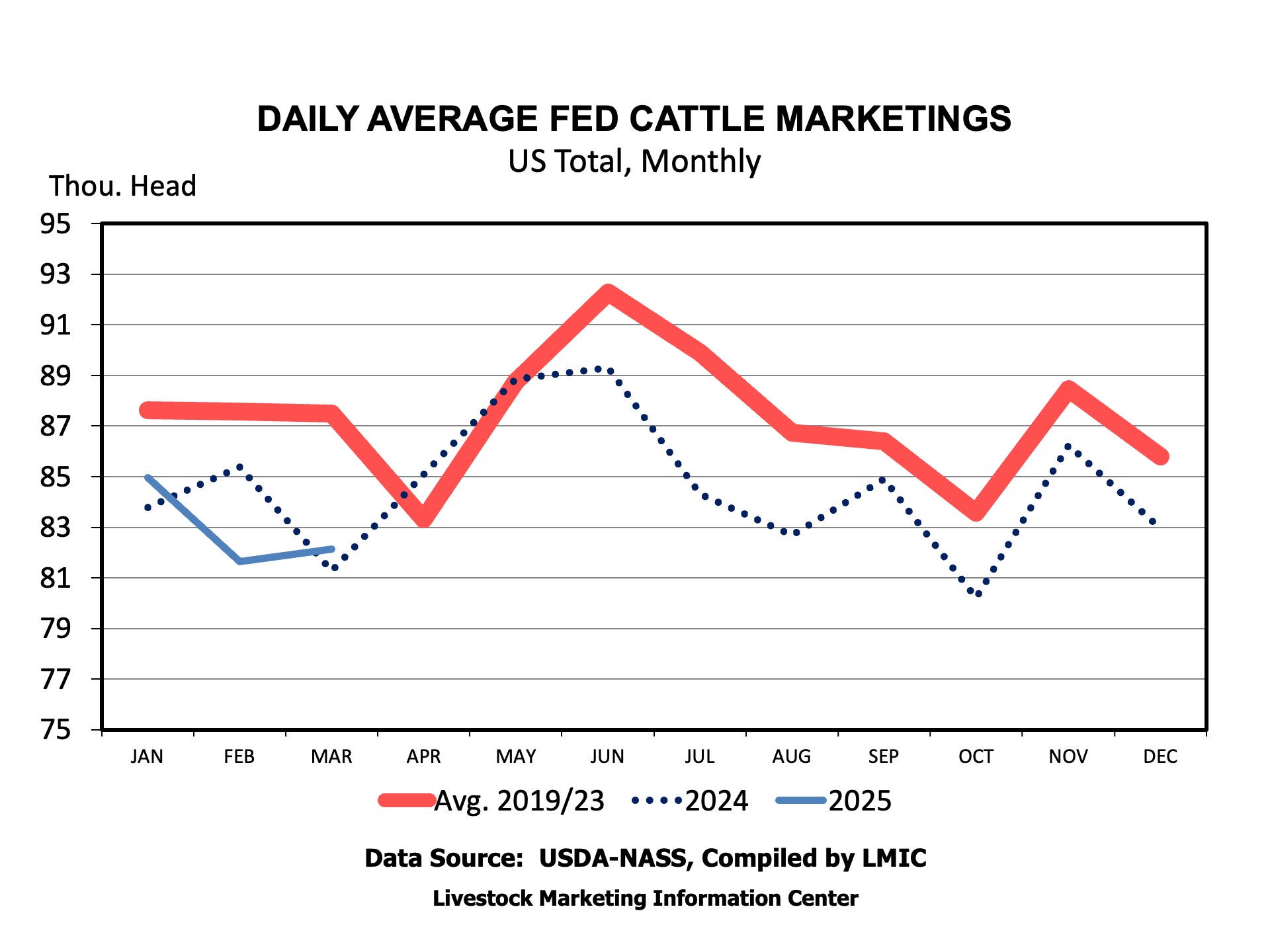

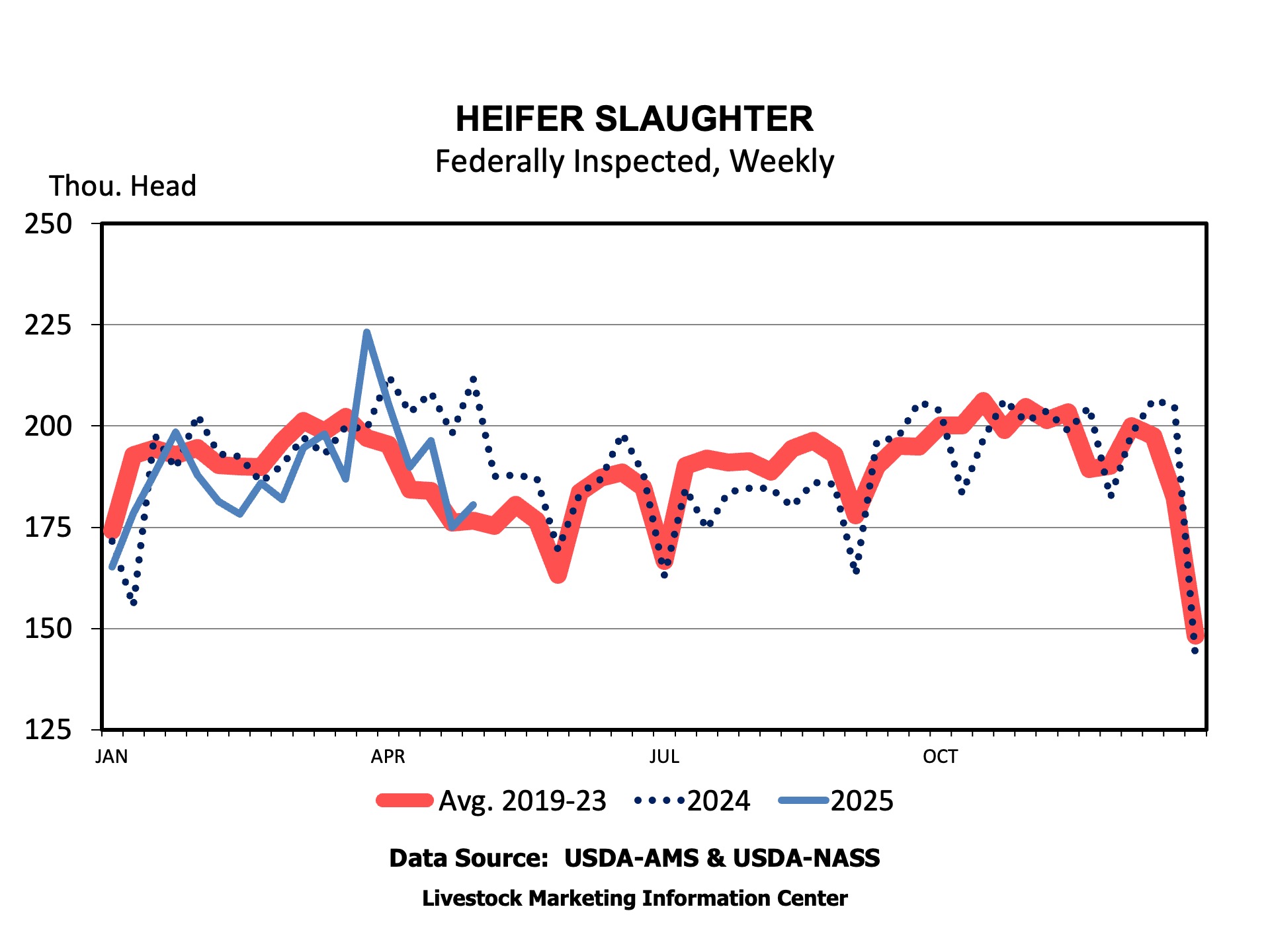

Friday, May 23rd, brings us the next USDA Cattle on Feed report. Most analysts anticipate April’s feedlot marketings to be more than 3 percent smaller than last year, with the same number of working days in April 2025 compared to April 2024. Fed steer and heifer slaughter has declined dramatically, more than 5 percent from year-ago levels, over the last six weeks.

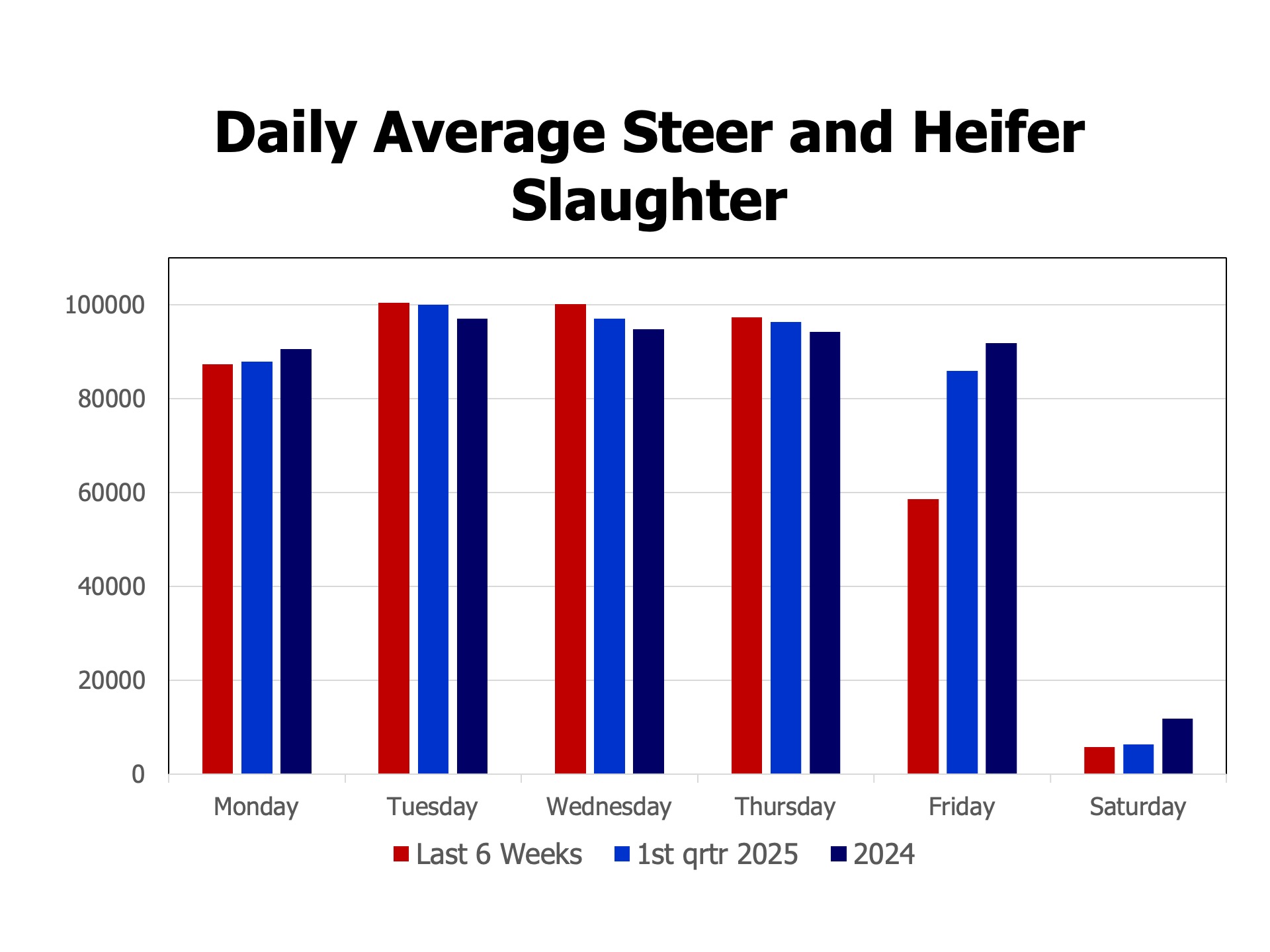

Saturday slaughter is often used as a measure of capacity utilization. Fewer animals processed on Saturdays indicates declining capacity utilization or over capacity. Declining cattle numbers mean that fewer may be processed on other days of the week. Daily slaughter should suggest some thoughts about the ability of current packing plants to remain open in future months as cattle numbers contract.

Over the last 6 weeks, steer and heifer slaughter has averaged 58,671 head on Fridays, down from 85,958 head during the first quarter of the year. Other days of the week have remained relatively close to the average during the first quarter of the year and compared to all of 2024. It appears that overall, packers are dealing with fewer cattle numbers by maintaining capacity on Monday through Thursday, even increasing head per day in the middle of the week, while sharply cutting back on Friday.

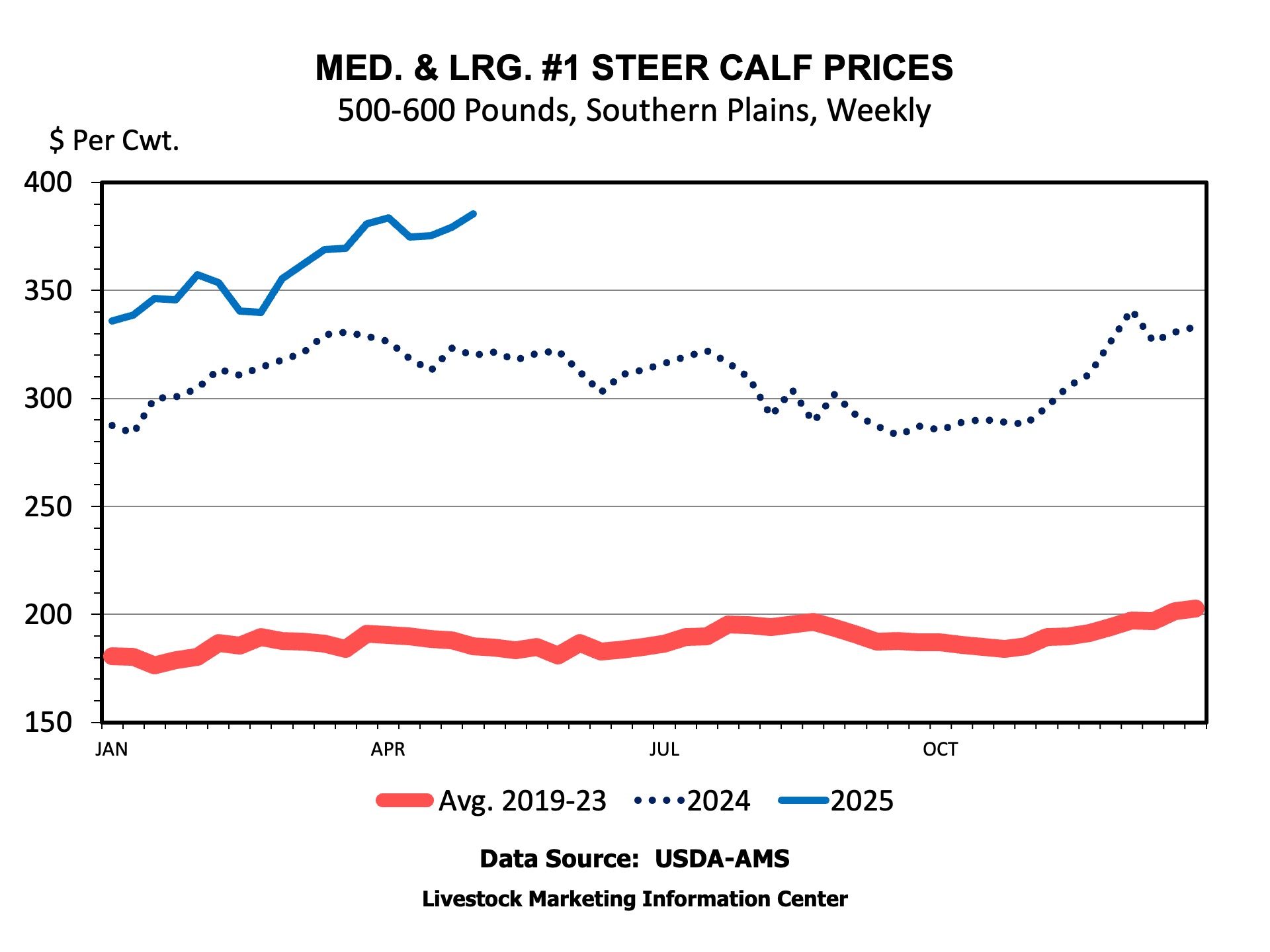

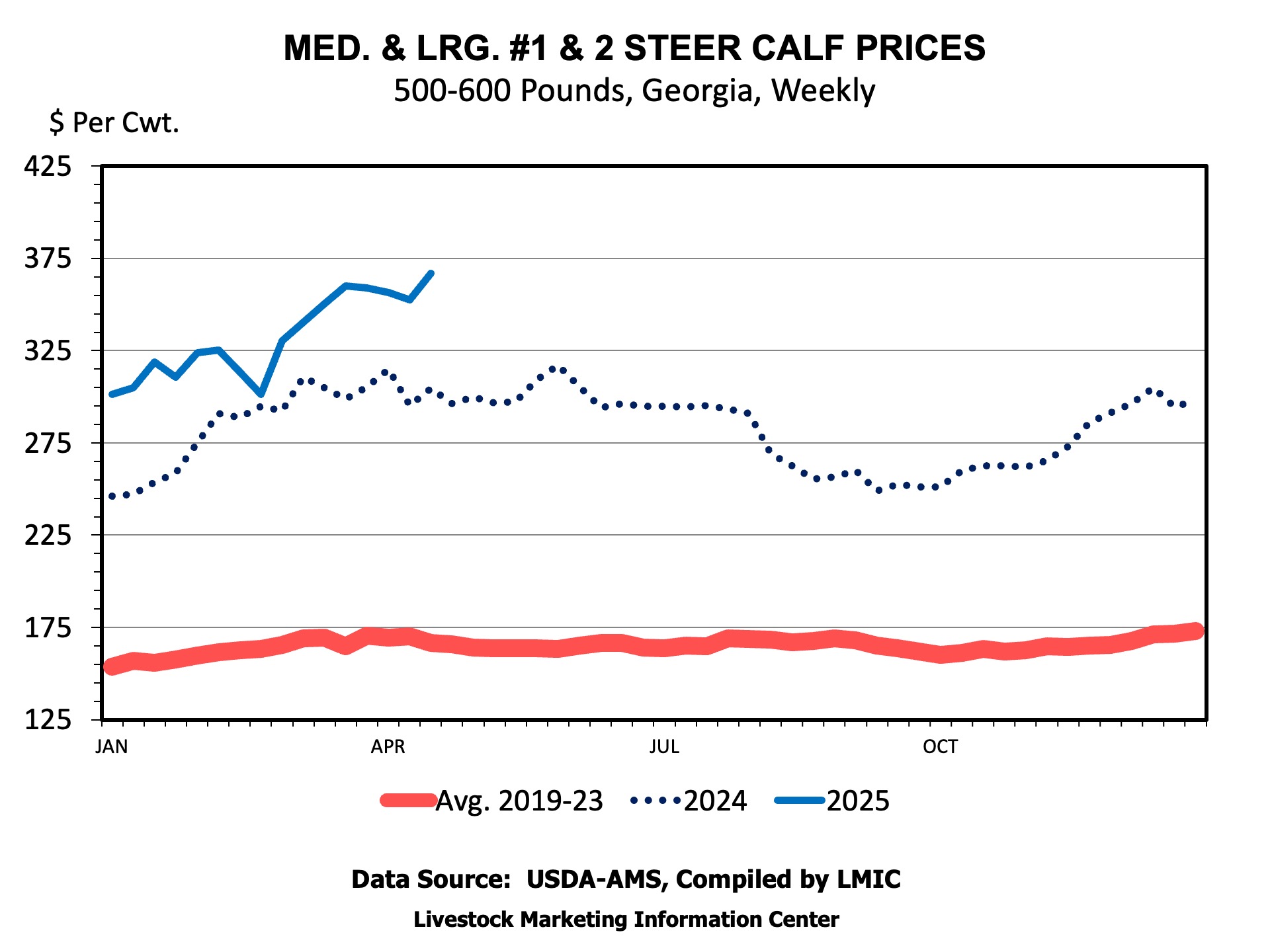

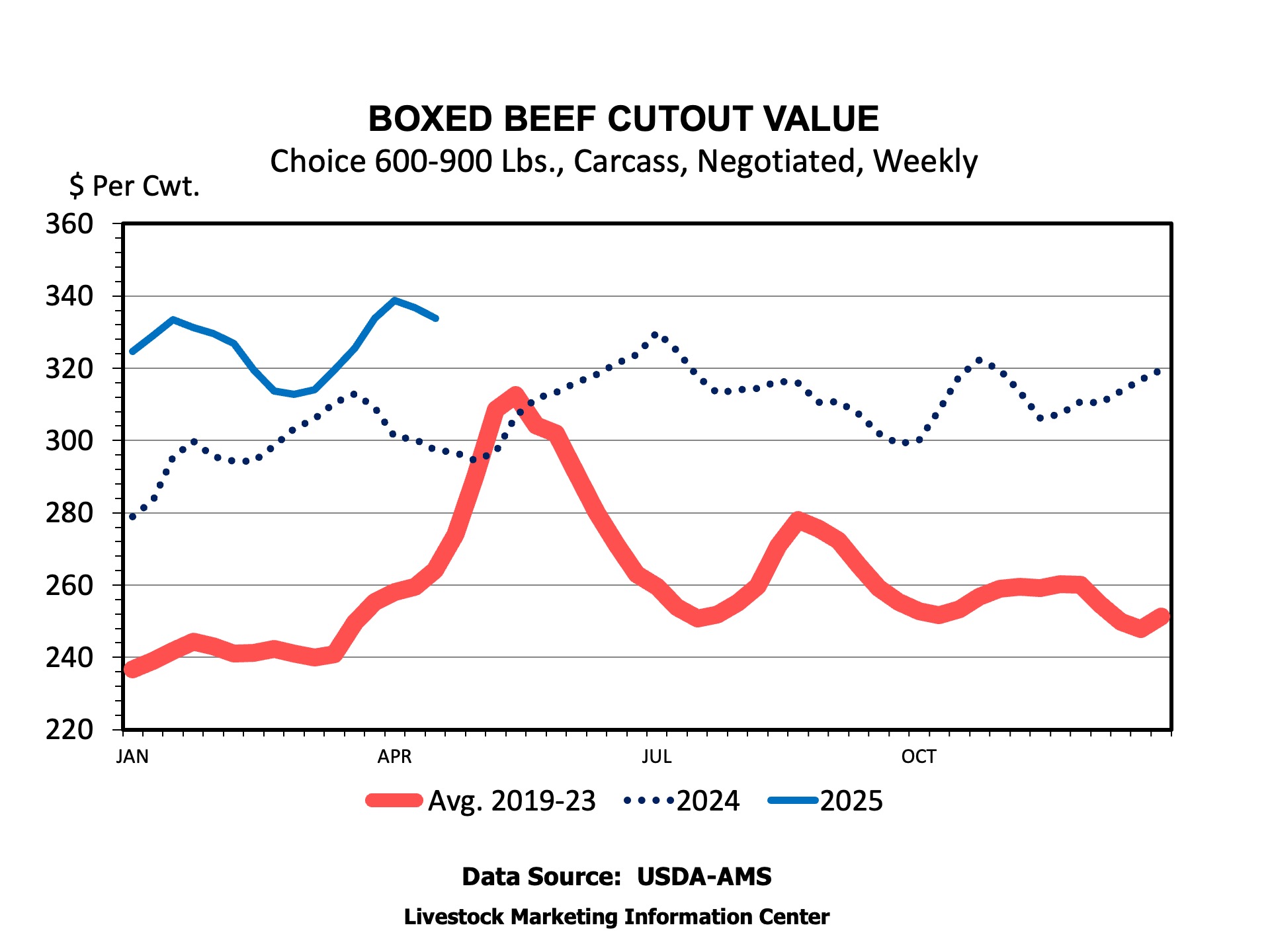

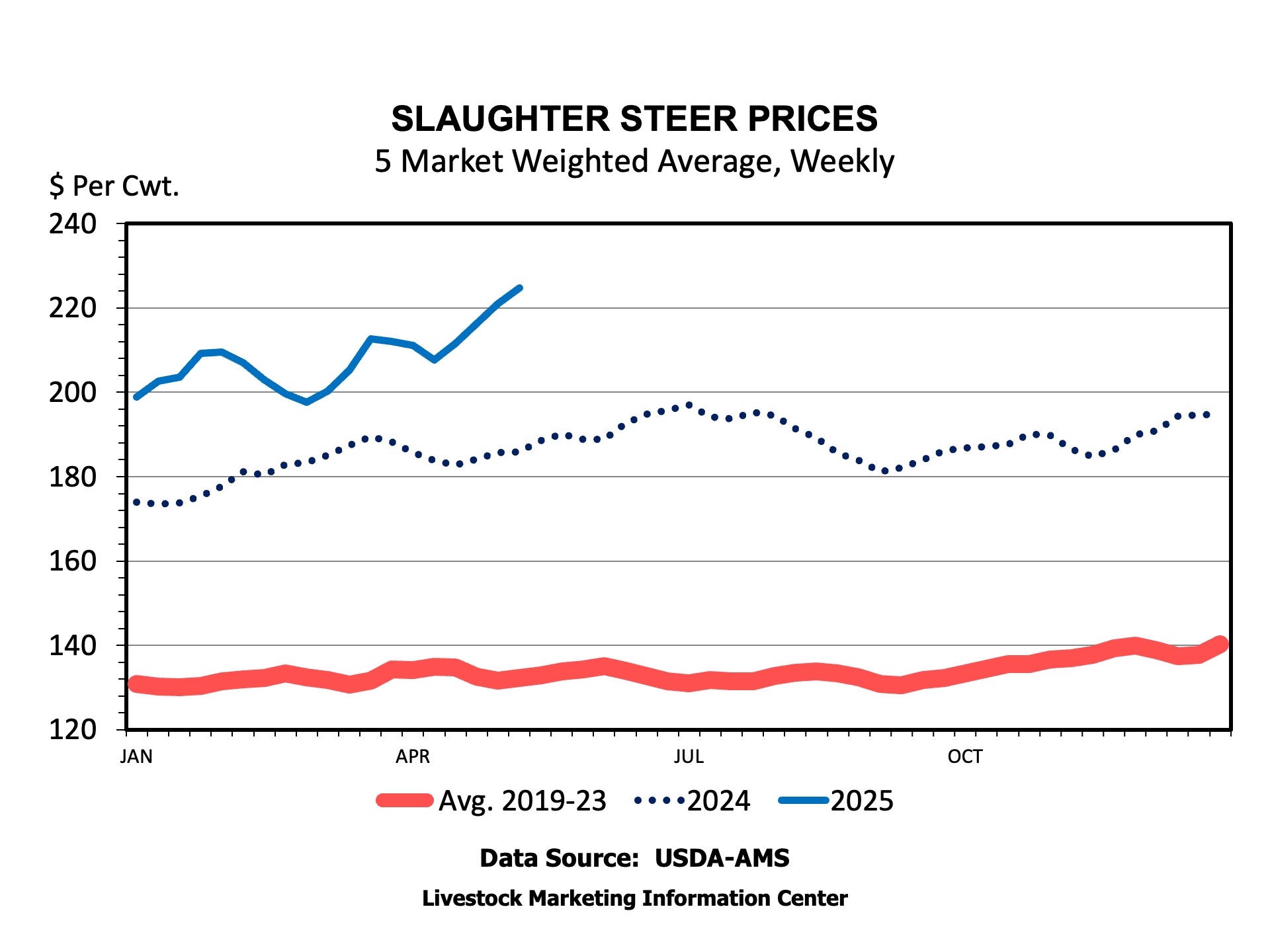

The decline in fed steer and heifer slaughter, even combined with historically heavy dressed weights, has certainly supported fed cattle prices to new record highs in recent weeks. Grilling season beef demand has pulled the market even higher. Feeder cattle and calf prices have gone along for the ride. The cattle on feed report will provide another indication of how tight fed cattle supplies will be in the next few months. Fewer cattle on feed will continue the trend of reduced Friday slaughter and may lead to reductions on other days, as well.

Anderson, David. “Working Less on Friday!” Southern Ag Today 5(21.2). May 20, 2025. Permalink