While some of us might be tired of reading (and writing) about eggs, there is some new data out that sheds some more light on the pace of production recovery. USDA released its Chickens and Eggs report on Friday, March 21st. For eggs, two of the most important numbers in the report are: the number of table egg layers and the number of pullets on March 1st. These numbers tell us where we are currently in short term supplies and where we are headed in flock rebuilding.

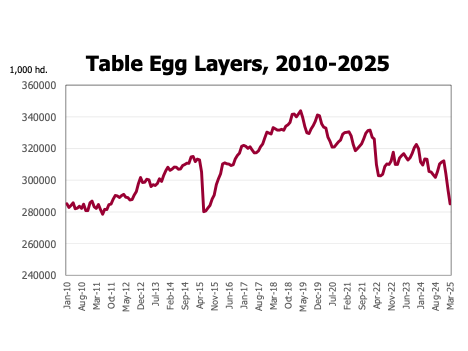

The report indicated that there were 285.1 million table egg layers on March 1. That was down 8.7 million from February 1 and down 28.3 million from last March. It was the fewest table egg layers for any month since October 2015 and the fewest for March 1 since 2011. HPAI continued in full swing during February, far outstripping the ability to replace lost birds.

The number of pullets, young hens heading to egg production, of all types was up 6.8 million or 5.5 percent over March of 2024. About 500,000 more were available than in February. While pullet production facilities have not been immune from HPAI occurrences, their numbers are growing as the industry responds to high prices and short supplies. Beyond the increased number of pullets, more eggs in incubators and eggs per 100 layers running ahead of a year ago indicate some more growing supplies.

On the price side of eggs, many have noted in the last couple of weeks falling wholesale egg prices. For the week of March 22nd USDA-AMS reported egg prices delivered to warehouses of $3.96 per dozen. That is down from the peak of $8.51 per dozen for the first week of March. Egg prices tend to be highly volatile and this data highlights that. Based on data from the chickens and eggs report, it does not appear that growing supplies are driving lower prices. The most likely factor is demand economics. For almost all goods, people buy fewer quantities of an item when its price goes up. It appears that consumers are reacting to record high prices by purchasing fewer eggs which results in lower prices.

The bottom line is that while there are fewer table egg layers currently, increased egg production appears to the on the way. While egg prices are volatile, increased supplies, given a respite from HPAI caused chicken losses, will keep prices trending lower.

Anderson, David. “Chickens Before Eggs.” Southern Ag Today 5(13.2). March 25, 2025. Permalink