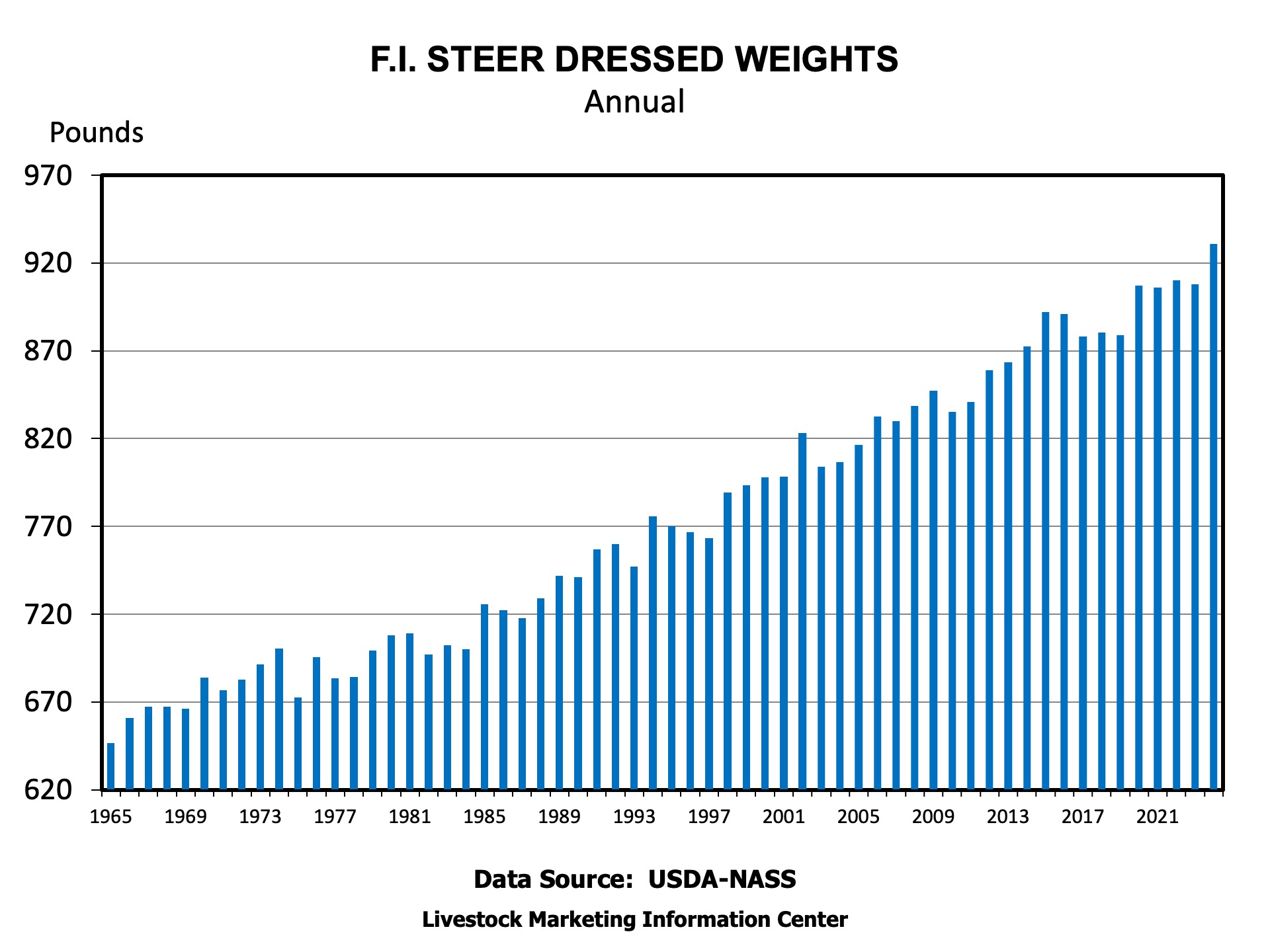

Recent SAT articles on the cattle market have mentioned the surge in fed cattle dressed weights as an important factor in boosting fed beef production in 2024. This article puts 2024’s dressed weights into some historical context and looks at some factors that will influence dressed weights this year. Since 1964, federally inspected steer dressed weights have increased from 662 pounds to 931 pounds in 2024. That is a 41 percent increase over that time period. A simple average of percentage change per year equals 0.68 percent, or 4.75 pounds per year increase in steer dressed weights.

The chart of steer dressed weights illustrates this trend in increasing weights. It also illustrates that this growth is not a straight line of increasing weights every year. There are many examples of year-to-year declining steer weights. Many of these years with large weight changes correspond to years with interesting challenges. For example, steer dressed weights declined 28 pounds from 1974 to 1975 and rebounded 23 pounds from 1975 to 1976. Other examples might be 2001-2003 or 2014-2016. The 23 pound increase in annual average dressed weight from 2023 to 2024 is significant, but is not the largest year-over-year increase. Even larger annual increases were recorded in 1985, 1994, 1998, 2002, and 2020.

Large annual increases are often followed by declining weights. Could weights decline in 2025? There are several factors that could lead to a decline in weights including winter storms that pull down weights. As cattle numbers further tighten, the need to run packing plants at efficient levels could pull cattle out of feedlots faster and lighter. However, good beef demand will create an incentive to try to produce more beef per head pushing weights higher to offset fewer cattle. Continued lower corn prices lowers the cost of gain which is an incentive to feed to heavier weights.

We might consider the effect of increasing weights and the implied increase in production per cow on beef cow inventory in the future. Heavier weights implies fewer beef cows are needed to maintain level beef production. The 23-pound increase in dressed weight multiplied by the approximately 15.1 million head of federally inspected steers slaughtered in 2024 is the equivalent of about 371 thousand steers. Put another way, increased dressed weights offset the need for 371,000 steers suggesting the need for fewer cows. This is a rough example that could use some refinement, but the point remains that increased weights likely impact the cow herd expansion.

This article used only steer dressed weights. Heifer dressed weights have increased at an even faster rate and cow weights have increased, too. Heavier weights are not limited to cattle as hog and poultry weights have increased over time but, those weights are for another article. There is little reason to expect weights to stop their long-term growth. But the data shows it’s a bumpy ride to heavier weights with fits and starts along the way.

Anderson, David, and Josh Maples. “Fed Cattle Weights and Herd Expansion.” Southern Ag Today 5(3.2). January 14, 2025. Permalink