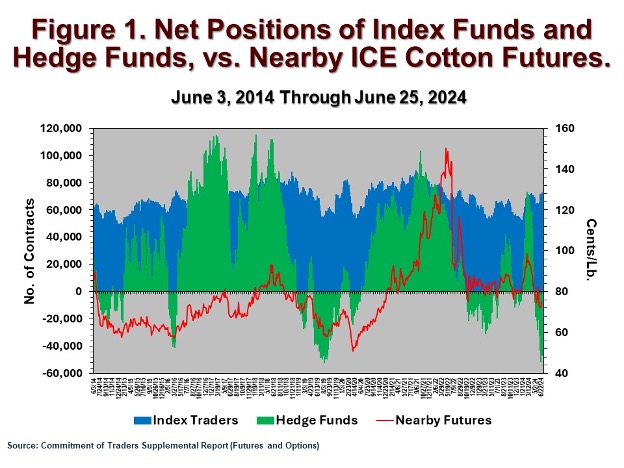

Hedge funds or “managed money” refers to financial client money that is invested in commodity futures, stocks, bonds, and other investments. Figure 1 shows varying levels of hedge fund investment in ICE cotton futures over the last ten years, either positioned as bullish net longs (i.e., upward pointing green areas) or bearish net shorts (i.e., downward pointing green areas). In contrast, the blue colored graphed area of Figure 1 reflects the more stable, long-only positioning of index funds. The latter tend to buy and hold nearby futures contracts, and then roll forward as those contracts mature.

Statistically, net long/short positioning of hedge funds is directly associated with higher/lower ICE cotton futures. Past statistical modeling indicates that a 1.9-cent decline in the most active cotton futures price was expected for every 10,000-contract decrease (or increase) in the hedge fund net long (net short) position (https://www.farmprogress.com/cotton/cotton-spin-hedge-funds-revisited ). Looking at the most recent price decline, the hedge fund net long position peaked at 73,230 contracts on February 27, 2024, when nearby ICE cotton futures settled at 98.80 cents per pound. This net long position changed to a 51,442 net short position, a total change of 124,672 contracts and associated with a 72.76-cent settlement on June 18 in nearby ICE cotton futures. The previous statistical relationship implies that 23.56 cents of the total 26.04 cent decline in nearby ICE cotton futures is associated with bearish hedge fund adjustment, all other things being equal.

How long will the current net short position last? Figure 1 highlights that net short positioning is less frequent than net long positioning. Over the ten years graphed in Figure 1, only 156 weekly observations involved net short positioning while 370 weekly observations involved net long positioning. Practically speaking, speculating on the size of an establishing, growing crop during the summer is a bit of a risky gamble. This dynamic may encourage caution on the part of short speculators during the growing season. Such behavior could also be the basis of a short covering rally in the event of reduced acreage expectations, bad weather, or negative production scenarios. Short covering is where hedge fund managers buy back their outright short speculative positions as a result of changing (i.e., more bullish) expectations and/or pre-set buy stop orders. The liquidation of a large net short position can thus lead to a cascade of buying, referred to as a short covering rally.

Robinson, John. “The Net Short Hedge Fund Position in ICE Cotton Futures.” Southern Ag Today 4(29.1). July 15, 2024. Permalink