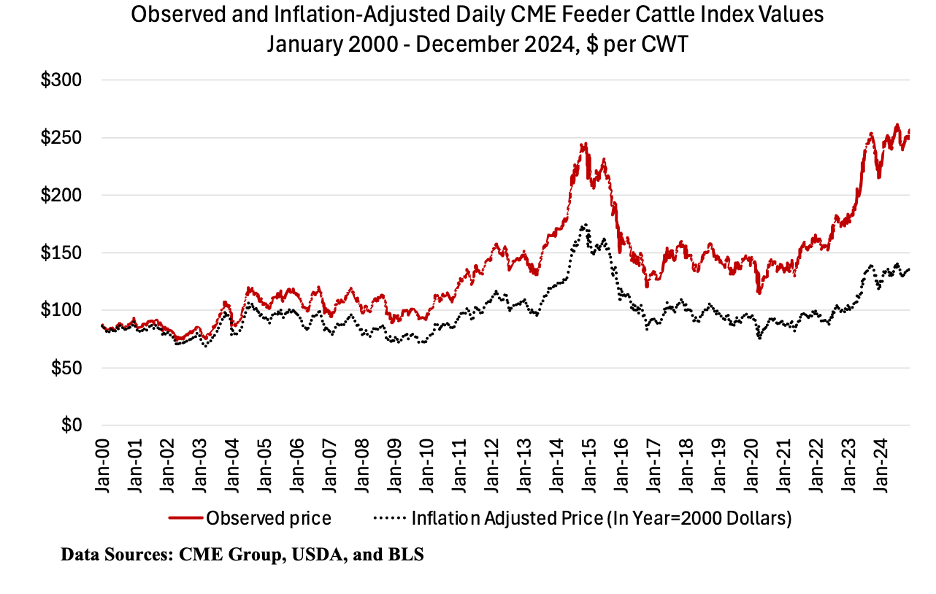

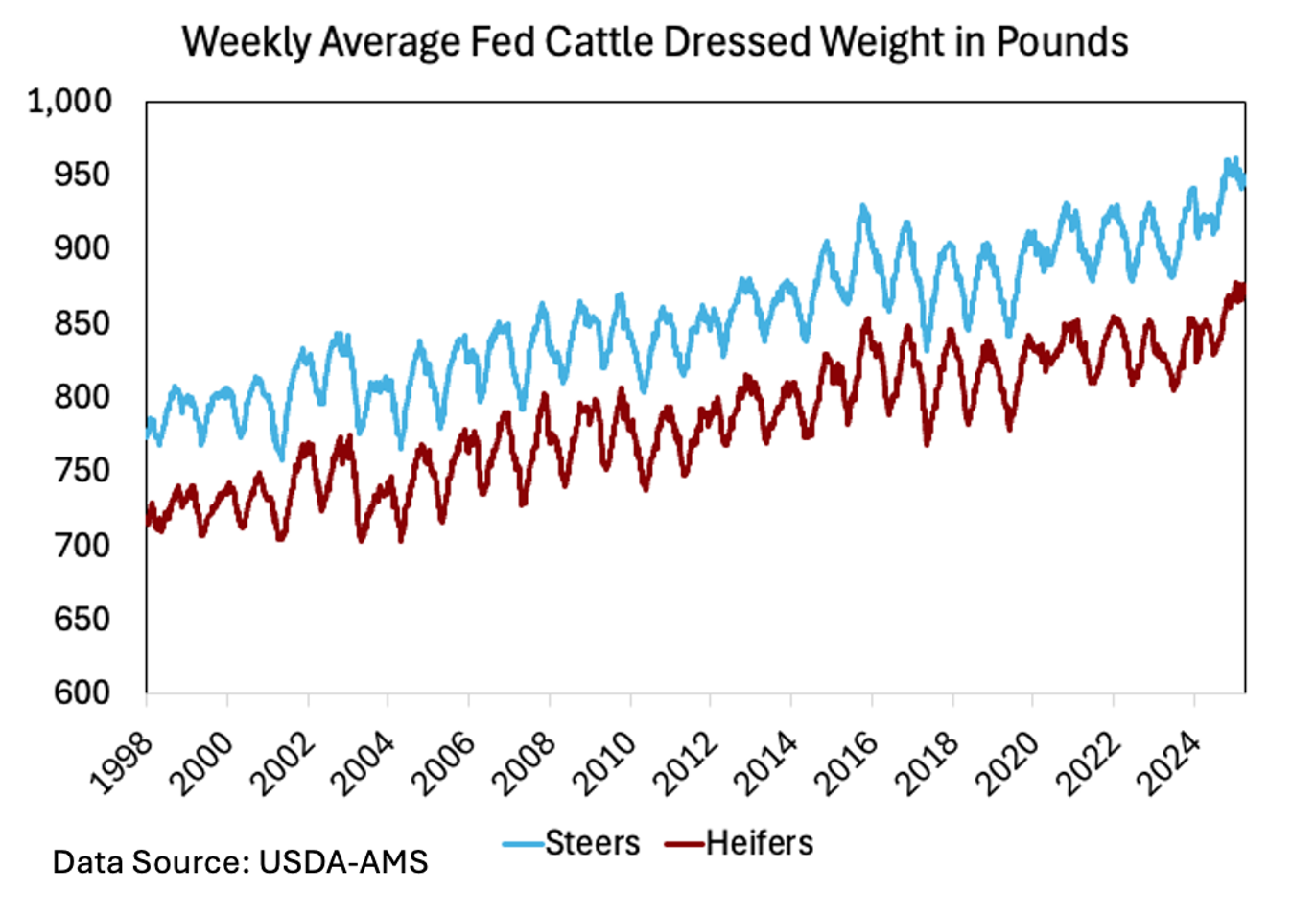

Last week, the 5-area market weighted average fed steer price topped $220 per cwt for the first time on record. This was a $35 increase from a year ago and up $20 per cwt since the start of the year. The CME June Live Cattle futures contract closed above $213 per cwt on Monday – also a record high for that contract. Looking across a longer time frame, the trends of fed cattle weights and beef quality grades over time are interesting. As shown on the dressed weight chart, fed cattle dressed weights have increased over time. Technological advances in raising cattle have allowed the sector to produce more beef per head. The chart shows a few years of declining weights and seasonal patterns within years, but the general trend is increasing fed steer weights over time. Assuming a 62.5 percent average dressing percentage, a 950-pound dressed weight would equal a 1,520-pound live weight. Larger weights in 2024 boosted beef supplies to offset fewer head processed.

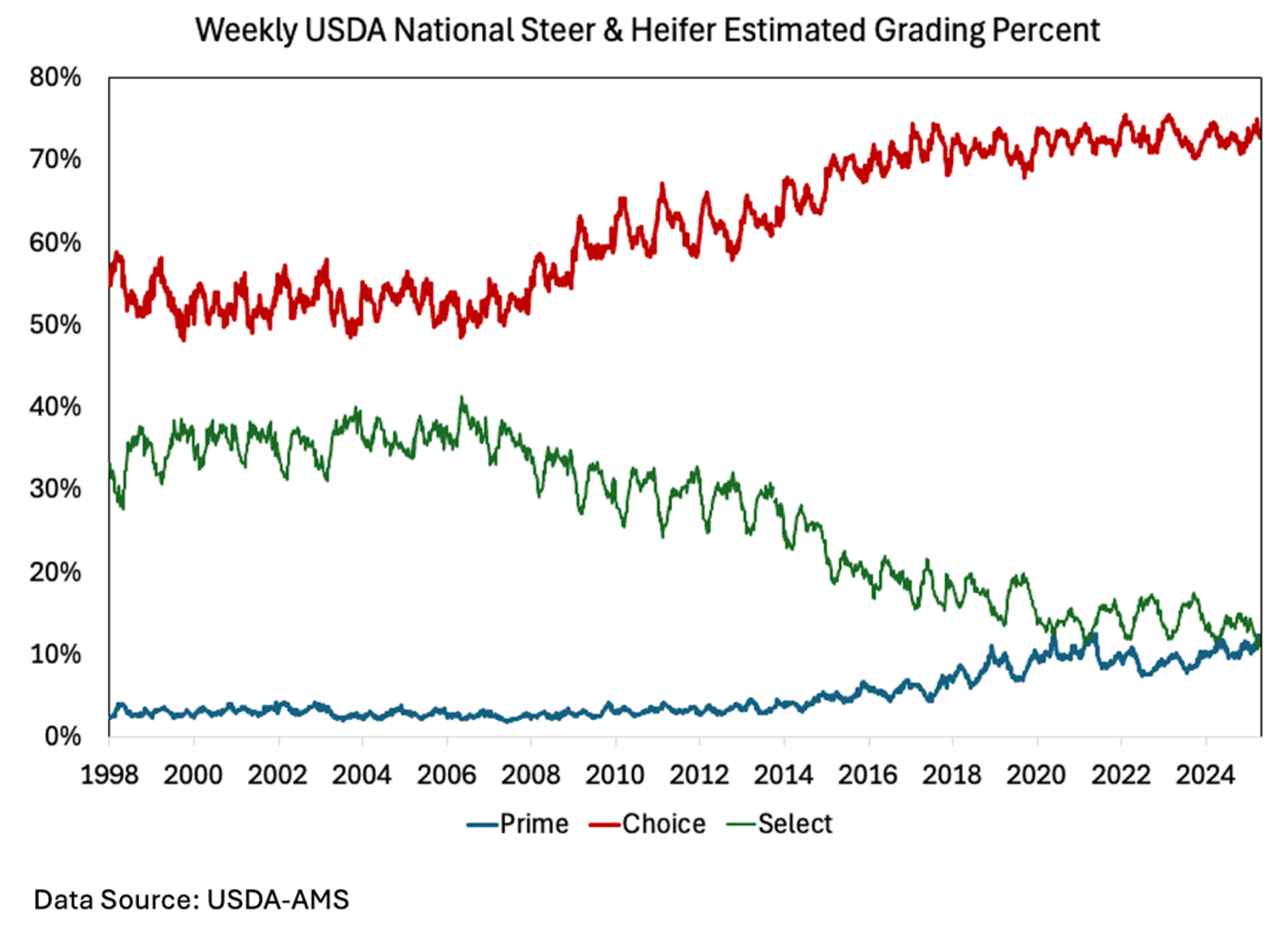

Another interesting (and related) trend is that of quality grades over time. The grading percent chart shows the percentages of fed cattle grading Prime, Choice, and Select weekly since 1998. Choice carcasses represented about 50-55 percent of the cattle in the 2000s but have more recently been hovering in the 75 percent range. Meanwhile, the percentage of cattle grading select has declined from roughly 35 percent in the early 2000s to less than 15 percent in recent years. Genetic improvements, cow-calf and stocker management practices, and feedlot technologies have played roles in this increase. It is also worth noting the more recent increase in carcasses grading prime. For the past few weeks, more cattle have graded prime than select. About 3-4 percent of cattle graded prime in the 2000s compared to 10-12 percent in recent years.

Maples, Josh. “Cattle Prices Hit New Highs and Carcass Grading Trends Over Time.” Southern Ag Today 5(19.2). May 6, 2025. Permalink