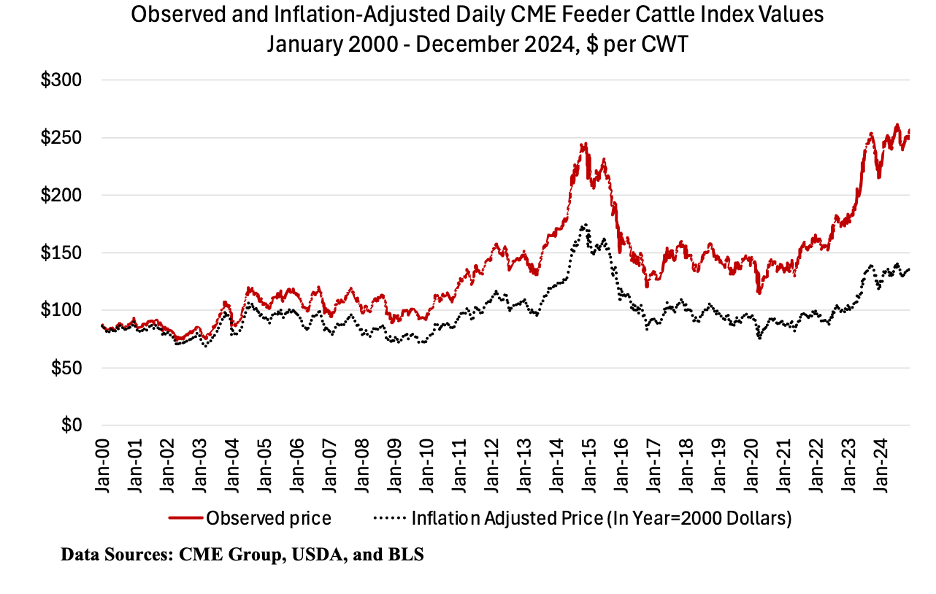

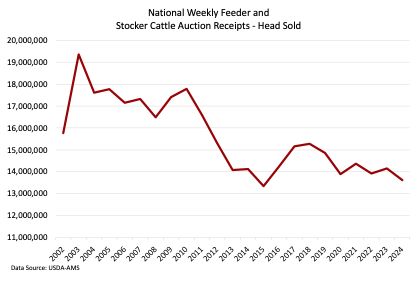

Tighter cow numbers over the past few years have led to smaller calf crops and fewer cattle to sell. According to data from the USDA-AMS National Feeder and Stocker Cattle Summary, the number of feeder and stocker cattle sold during the first 14 weeks of 2025 totaled 3.72 million head which was 9.5 percent below the number sold during the same period in 2024. Receipts so far in 2025 are down 9 percent year to date when compared to the 4-year average from 2020-2023.

2018 was the peak in sales for the current cattle cycle as shown in the chart above. The 2024 total was 11 percent below 2018 and 4 percent below 2023. It is still early in 2025, but the current trend, and general lower cattle supply, suggest that 2025 sales will be lower again. This dataset includes auction, direct, and video/internet sales reported to USDA. It is not a comprehensive dataset as it does not capture all feeder and stocker cattle transactions, and the report notes that “receipts vary depending on the number of auctions reported.” However, given the similar methodology over time, comparisons are useful in comparing market dynamics to previous years.

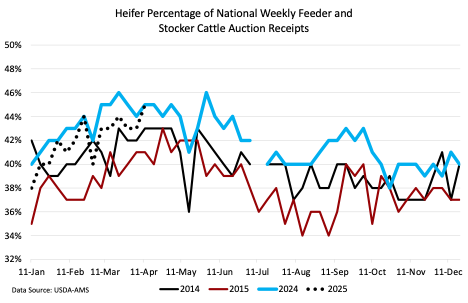

The report also gives information about the mix of steers and heifers. It is interesting to compare 2024-2025 to 2014-2015 in the context of heard expansion. As shown in the chart below, the percentage of heifers has been higher in 2024 and 2025 than it was in 2014 and 2015. When herd expansion begins, we’d expect the share of heifers in the feeder cattle mix to decline as producers begin to retain more heifers. This is another indicator that producers have not yet started retaining heifers in the same way that they were in 2014-2015 when that herd expansion period began.

Maples, Josh. “2025 National Feeder and Stocker Receipts and Heifer Percentage.” Southern Ag Today 5(16.2). April 15, 2025. Permalink