The latest USDA Cattle on Feed report was released Friday and showed placements of cattle into feedlots during August were 1.4 percent lower than during August 2023. Marketings of fed cattle out of feedlots were down about 3.5 percent from a year ago, partially due to one less business day in August 2024 than in August 2023. Both of these numbers were within pre-report expectations and will likely not be big market movers.

Most of the decline in placements from a year ago occurred in placements of cattle weighing less than 800 pounds. Placements of cattle in this weight range were 3.4 percent lower while placements of cattle weighing more than 800 pounds were 1.4 percent higher. Placements in both Kansas and Nebraska were down about 3 percent while placements in Texas were down nearly 6 percent as compared to a year ago. Placements in Colorado were the exception and were up nearly 30 percent.

Despite the lower placements, the total number of cattle in feedlots with more than 1,000 head capacity on September 1st was up 0.6 percent compared to a year ago. This continues the trend of cattle staying in feedlots longer. Total placements of cattle into feedlots during 2024 is down about 2 percent but longer feeding periods have reduced turnover and helped to keep inventory levels from fully reflecting the declining calf crop totals.

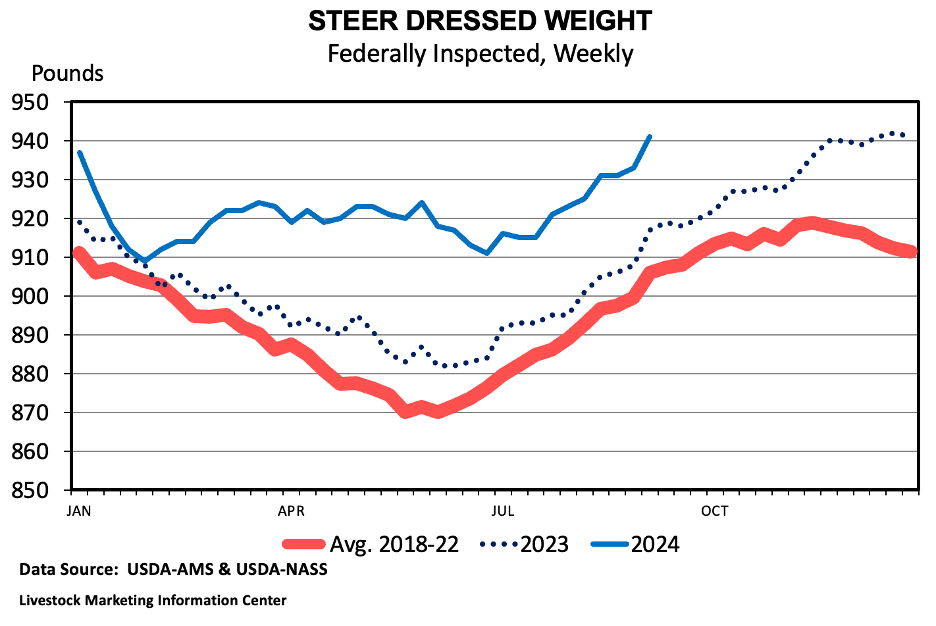

Longer feeding periods are leading to higher cattle weights. The average dressed weight for federally inspected steers during August 2024 was 930 pounds. Assuming a dressing percentage of 62.5 percent, this suggests an average live weight of 1,488 pounds. This is the highest August steer dressed weight average on record, easily surpassing the 911-pound average during August 2020. Heifer dressed weights also hit an August record at 840 pounds on average. The higher dressed weights are offsetting much of the impact of lower cattle numbers on beef production. Total beef production in 2024 is now expected to be very close to beef production in 2023 despite fewer head processed.

Maples, Josh. “Cattle on Feed and Record High August Fed Cattle Weights.” Southern Ag Today 4(39.2). September 24, 2024. Permalink