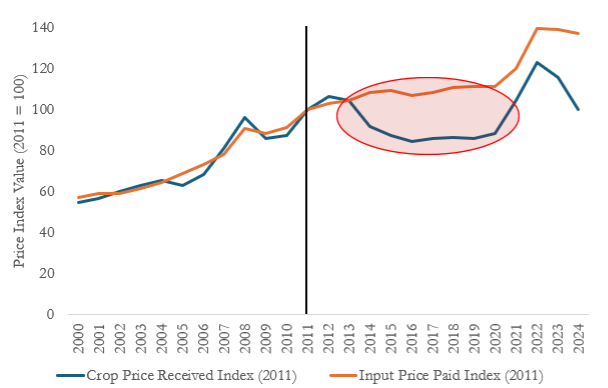

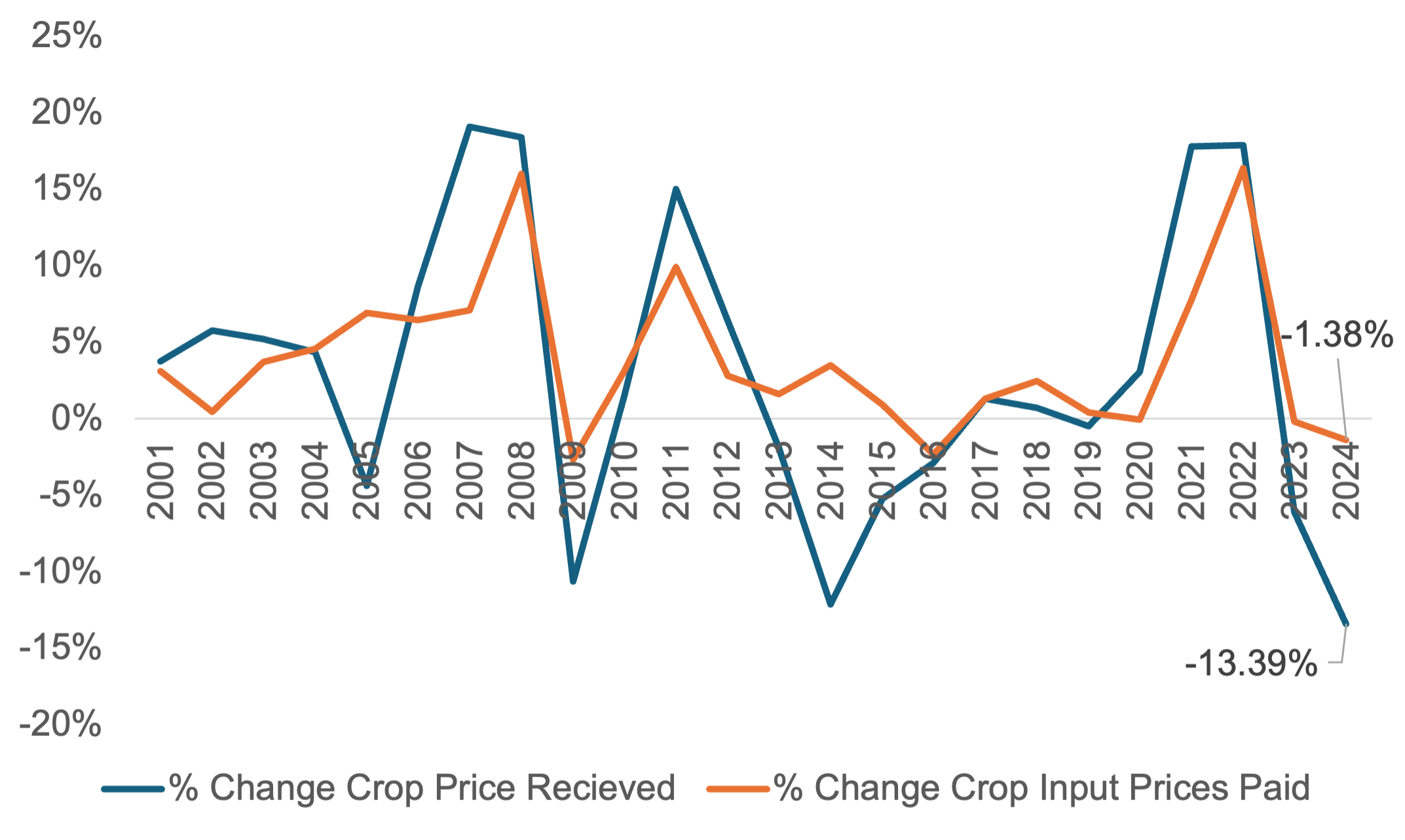

Historically, low commodity prices, high input costs, and expensive financing have been some of the most significant issues farmers have faced in the last few years. Luckily, some financial relief may come in the form of lower interest rates from the Fed reducing COVID-era rate increases (Wright, 2024). The Fed aggressively moved in September to cut 50 basis points, bringing the target Federal Funds rate to 4.75 – 5%, with indications for at least another 50 basis points before the end of 2024 (Fannie Mae, 2024). This article explores a hypothetical situation of a producer leveraging lower interest rates to consolidate debt to improve short-term liquidity.

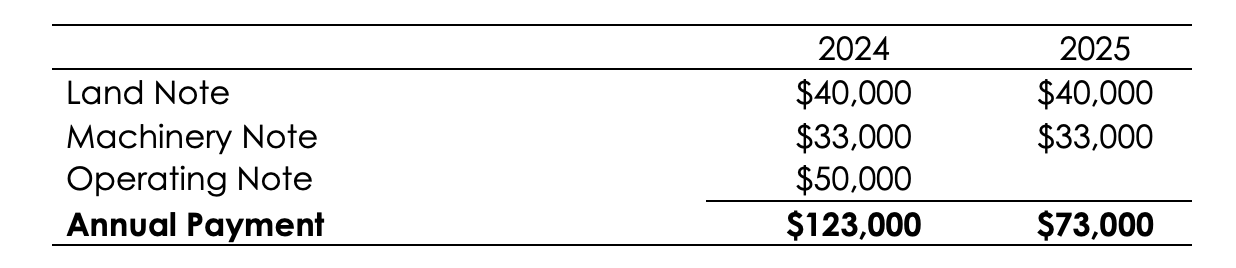

Consider a farmer’s debt obligation for 2024 (Table 1). In this scenario, the farmer holds a land loan with an original principal balance of $450,000 at a fixed interest rate over 20 years. As of 2024, the remaining principal stands at $330,000, with 12 years left in the repayment period. Additionally, the farmer has a machinery loan with an original principal balance of $180,000, structured over a 7-year term. The outstanding balance on this loan is currently $110,000, with 4 years left until maturity.

The farmer also faces a $50,000 operating loan, due at the end of this year. Unfortunately, this year has not been profitable, and he cannot cashflow all his debt obligations.

Table 1. Current Debt Obligations – Before Consolidation

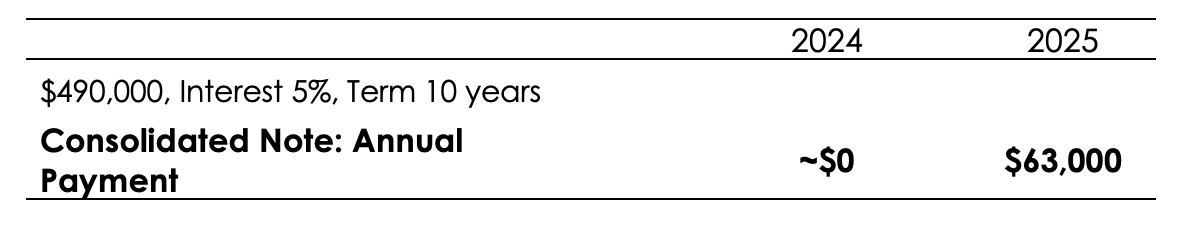

The farmer’s total current debt obligation amounts to $123,000 for the year (Table 2). To address this financial strain, the producer meets with their lender to explore options for restructuring their debt. They discuss the possibility of consolidating existing debt into a longer-term, more favorable interest rate structure. The lender agrees to consolidate the remaining principal balances on all three loans ($330,000 + $110,000 + $50,000) into a new 10-year note totaling $490,000 (Table 3). The lender agrees to secure this loan using the equity in the farmer’s financed land as collateral.

Table 2. Debt Financing Structure Before Consolidation

Table 3. Consolidated Debt Structure

Under this new debt structure, the farmer not only relieves the burden of the current year payments, but also reduces the ongoing obligation from $73,000/year to $63,000/year. While debt consolidation offers advantages, it’s also important to consider potential drawbacks. For example, under the original debt structure, the annual debt service obligation would have dropped to $40,000/year, after the machinery loan was paid off in 4 years. Under the consolidated note, the producer is committed to $63,000/year for a full 10 years. Longer-term debt obligations also potentially lead to paying higher total interest expenses, even with an interest rate lower than their original loan(s) due to the extended accrual period. Additionally, creating a new loan comes with closing costs and fees that could offset the immediate financial benefits. Every situation is unique, and the pros/cons are not always clear. Those looking to consolidate existing debt should meet with their lenders and determine the best strategy for their farm’s short-term viability and long-term sustainability.

References

Wright, Andrew. “Lower Interest Rates Create Opportunities for Managing Debt on the Farm.” Southern Ag Today 4(37.3). September 11, 2024.

Fannie Mae. (2024). Fed Cuts Interest Rates Amid Sluggish Existing Sales but a Rebound in Starts Activity. Retrieved November 5, 2024, from https://www.fanniemae.com/research-and-insights/forecast/fed-cuts-interest-rates-amid-sluggish-existing-sales-rebound-starts-activity#:~:text=The%20Federal%20Open%20Market%20Committee,rate%20of%202.75%2D3%20percent.