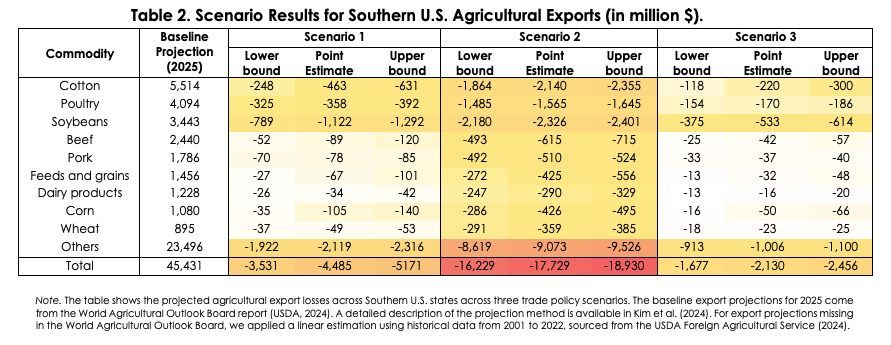

In our previous analysis, we explored the overall impact of potential trade policy shifts on Southern U.S. agriculture, highlighting significant risks to critical commodities. However, these impacts will vary widely across different states. This analysis focuses on the state-level effects, examining how the worst-case trade policy scenario (Scenario 2 in our previous study) could affect agriculture across individual states within the Southern U.S.

Our analysis focuses on the most extreme trade policy scenario following the 2024 U.S. presidential election. In this worst-case scenario, the U.S. imposes a 60% tariff on Chinese goods and a 10% tariff on imports from other countries. This could provoke severe retaliatory measures from China, including a 60% tariff on U.S. agricultural exports and additional tariffs from other trading partners. These disruptions could significantly impact Southern agriculture, a region heavily dependent on foreign markets. The impact would vary by state, depending on each state’s reliance on specific export markets. By focusing on this worst-case scenario, our analysis highlights the localized risks each Southern state might face.

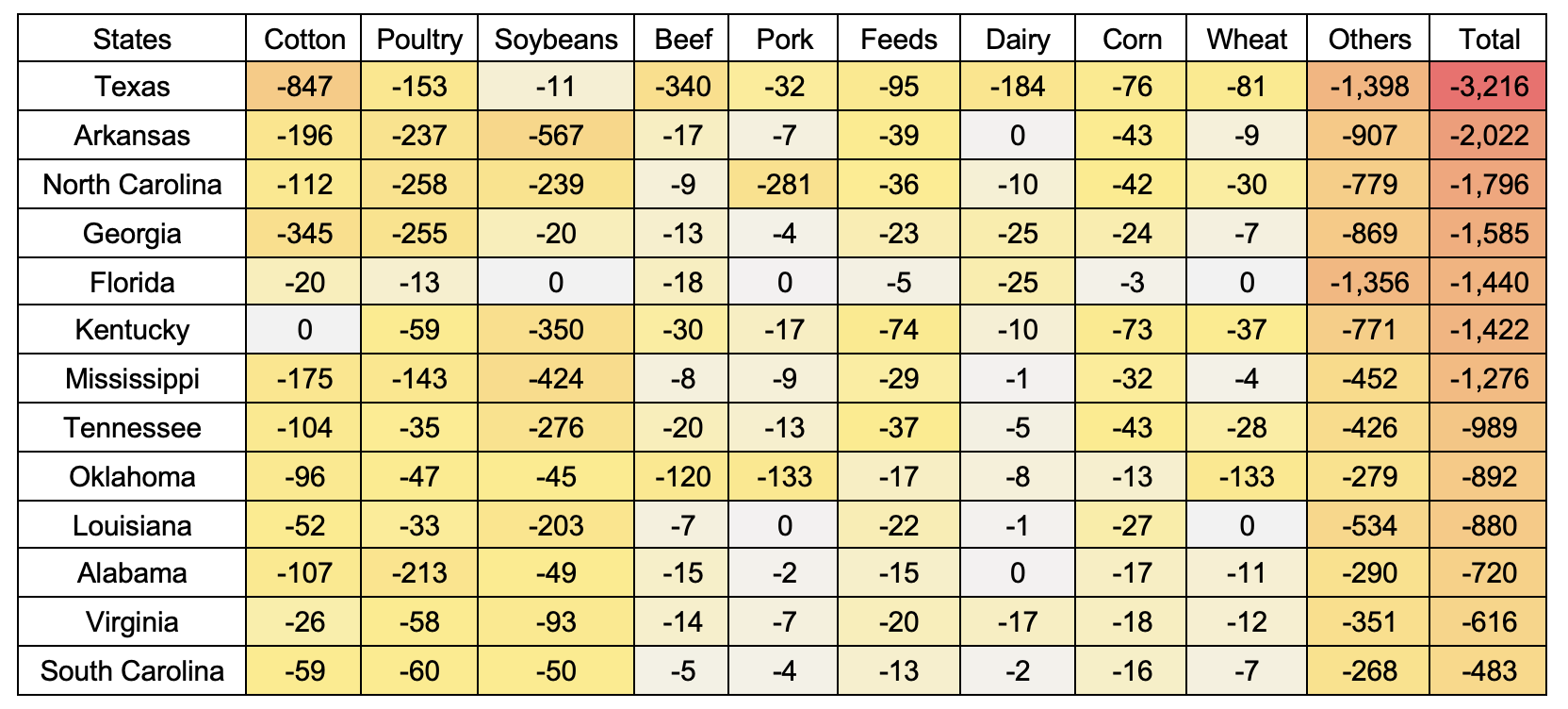

Our analysis reveals significant economic vulnerabilities at the state level, particularly in critical agricultural commodities. As shown in Figure 1, Texas emerges as the most impacted state, with a projected total trade loss of $3.2 billion. The cotton industry could see an export decline of $847 million, while the beef and dairy sectors are expected to lose $340 million and $184 million, respectively. These figures underscore Texas’s heavy reliance on these major agricultural products, making it highly susceptible to trade disruptions that could severely affect its economy.

Arkansas and North Carolina also face substantial economic challenges as well, with total projected losses of $2.0 billion and $1.8 billion, respectively. As shown in Table 1, Arkansas’s soybean industry could see a decline of $567 million in export value. The poultry and pork sectors in North Carolina are particularly vulnerable, with expected losses of $258 million and $281 million, respectively. These sectors are critical to the state’s agricultural output, and such large-scale impacts could have far-reaching consequences for producers and the broader regional economy.

Other Southern states are similarly at risk, with significant commodity-specific losses under the worst-case scenario. For example, Georgia’s cotton and poultry industries could see combined losses exceeding $600 million, with cotton alone projected to decline by $345 million, as detailed in Table 1. Alabama’s poultry sector is expected to suffer a $213 million loss, a significant blow to the state’s agricultural revenue. Kentucky’s soybean exports could also drop by $350 million, while Oklahoma’s wheat and livestock sectors face a combined projected loss of $386 million. These projected trade impacts emphasize the profound impact trade policy shifts could have on critical agricultural commodities across the region.

Our analysis highlights the severe economic impact that potential trade policy shifts could have on Southern U.S. agriculture under the worst-case trade policy scenario. Texas could face losses of $3.2 billion, with significant hits to its cotton, beef, and dairy industries. Arkansas and North Carolina also stand to lose billions, especially in soybeans, poultry, and pork. These figures underscore the urgent need for targeted, state-specific strategies to mitigate these risks and support the most affected sectors. Policymakers must address these vulnerabilities to safeguard the region’s agricultural economy.

Figure 1. 2025 State-Level Export Loss Projections for the Worst-case Scenario.

Table 1. Projected 2025 Export Losses by Commodity and State for the Worst-case Scenario (million $).

Learn More

Kim, D., Steinbach, S., Yildirim, Y., & Zurita, C. (2024). Understanding Trade Strategy Impacts on Soybean Exports and Farm Income in North Dakota. CAPTS White Paper 2024-01. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4920301.

Goyal, Raghav, Sandro Steinbach, Yasin Yildirim, and Carlos Zurita. “Trade Policy Scenarios after the U.S. Presidential Election and What They Could Mean for Southern U.S. Agriculture.” Southern Ag Today 4(44.4). October 31, 2024. https://southernagtoday.org/2024/10/31/trade-policy-scenarios-after-the-u-s-presidential-election-and-what-they-could-mean-for-southern-u-s-agriculture/

Goyal, Raghav, Sandro Steinbach, Yasin Yildirim, and Carlos Zurita. “State-Level Effects of Potential Trade Policy Shifts on Southern U.S. Agriculture.” Southern Ag Today 4(50.4). December 12, 2024. Permalink