The Tomato Suspension Agreement (TSA) between the U.S. and Mexico, first established in 1996, was designed to regulate the importation of Mexican tomatoes. This agreement emerged from an antidumping investigation aimed at determining whether imports of fresh tomatoes from Mexico were being sold at less than fair market value. Under the TSA, Mexican tomato producers agreed to sell fresh tomatoes in the U.S. market at set reference prices, and in return, the U.S. suspended the antidumping duty investigation. The first suspension agreement became effective in November 1996. Over the years, the U.S. Department of Commerce and Mexican signatories have entered into revised suspension agreements in 2002, 2008, and 2013, with the most recent becoming effective in September 2019 (Federal Register, 2019).

On April 14, 2025, the U.S. Department of Commerce announced its intent to withdraw from the 2019 Agreement, citing its failure to protect U.S. producers from “unfairly” priced Mexican tomatoes. Upon termination—effective in 90 days—antidumping duties of around 21% will be imposed on most Mexican tomatoes (Spiegelman, 2025). This decision could have a significant impact on imports, benefiting domestic producers. However, these duties (i.e., tariffs) could also reduce the economic activity associated with tomato supply chains and increase consumer prices.

The basic premise of an antidumping investigation is to determine whether imported goods are being sold in the U.S. market at less than fair value, often referred to as “dumping.” This practice can harm domestic producers by depressing local prices and causing financial distress. Concerns about imports of Mexican tomatoes have been driven by a significant surge in imports over the last two decades. Since 1995, imports from Mexico have grown by nearly 700% in value, from $406 million in 1995 to $3.1 billion in 2024. In terms of quantity, imports from Mexico have increased by around 220% (USDA-FAS, 2025).

What is even more concerning is that this growth occurred even as U.S. production declined, and per capita availability increased. In 1995, the year prior to the agreement, domestic tomatoes accounted for over 70% of the total U.S. supply. This situation has now completely reversed, with imported tomatoes accounting for 70% of the total U.S. supply in 2025 (USDA-ERS, 2025a). Almost all imports come from Mexico, which accounted for around 90% of U.S. tomato imports in 2024 (USDA-FAS, 2025). Despite the surge in imports, is there evidence to suggest that domestic prices have been depressed, impacting U.S. tomato growers?

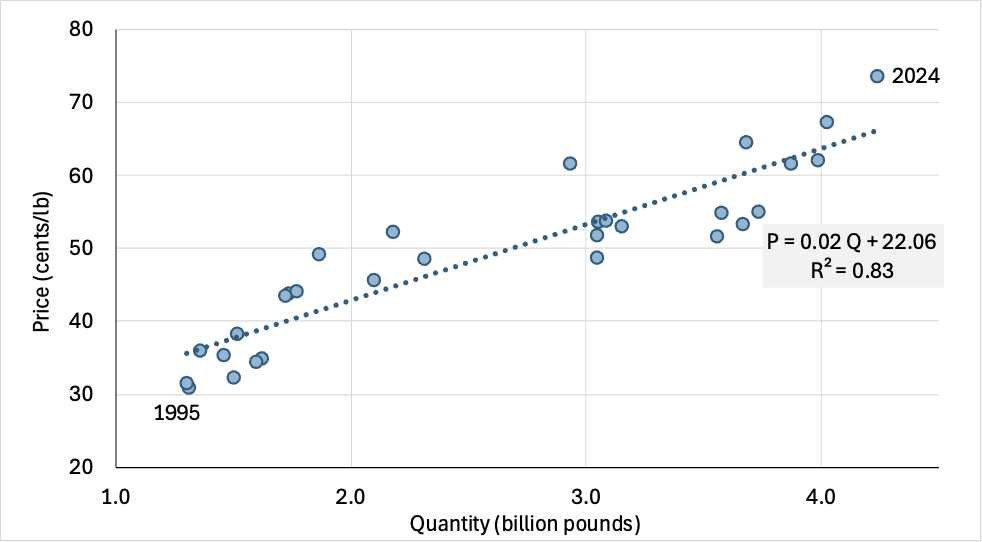

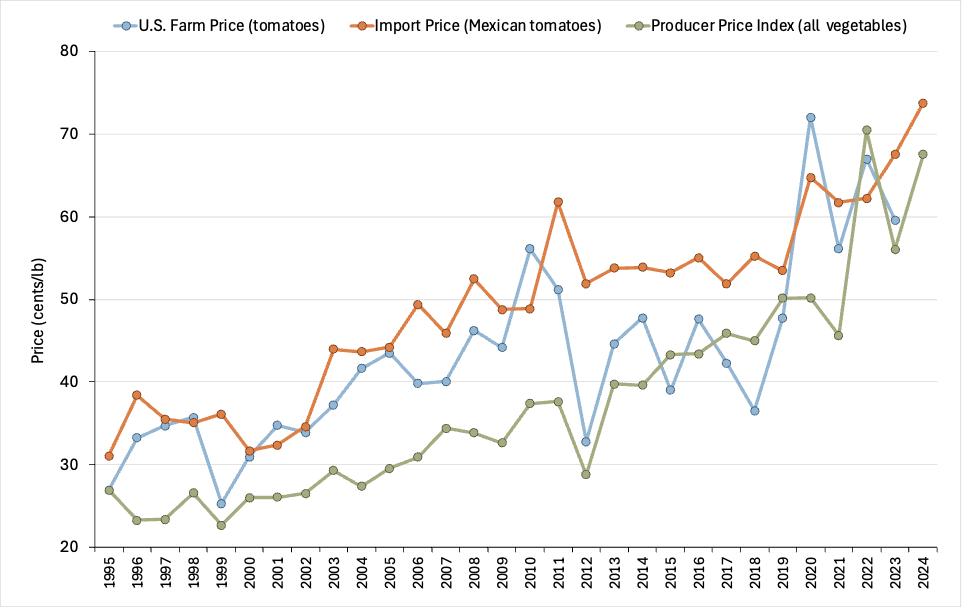

From 1995 to 2024, the U.S. saw a significant rise in the importation of Mexican tomatoes (Figure 1). The quantity of tomatoes imported from Mexico surged from approximately 1.3 billion pounds in 1995 to over 4.4 billion pounds in 2024. Alongside this rise in quantity, import prices also increased, starting at about 31 cents per pound in 1995 and reaching nearly 74 cents per pound in 2024. This upward trend in prices could be the result of the suspension agreements where Mexican signatories agreed to sell at increasingly higher prices. However, various factors, such as increased demand, changes in production costs, and market dynamics, likely contributed to this high correlation. Comparing Mexican tomato import prices to U.S. tomato farm prices and the U.S. Producer Price Index for all fresh vegetables shows little evidence of domestic price depression from imports (Figure 2). There is a positive correlation between import prices and U.S. farm prices, with a consistent upward trend. While it could be argued that prices would have grown at a faster rate without the surge in imports, overall vegetable prices suggest that this is not the case. In fact, import prices often exceeded both U.S. farm prices and overall vegetables prices.

In closing, while increased barriers on Mexican tomatoes might benefit U.S. tomato producers, there are other factors to consider. In 2024, the U.S. imported almost 2.0 million metric tons (over 4.0 billion pounds) of fresh tomatoes from Mexico, valued at more than $3.0 billion. According to a recent study by Texas A&M University, these imports generated an estimated $8.3 billion in total economic impact, including $3.6 billion in direct effects and $4.7 billion in indirect and induced effects, supporting approximately 47,000 U.S. jobs (Ribera et al., 2025). This suggest that there is more at stake if the U.S. eliminates the suspension agreement.

Figure 1. Import price and quantity of Mexican tomatoes: 1995–2024

Figure 2. Comparison of import and domestic prices: 1995–2024

References

Bureau of Labor Statistics (BLS) (2025). Inflation and Prices, Prices – Producer, Commodity Data. https://www.bls.gov/data/

Federal Register (2019). Fresh Tomatoes From Mexico: Suspension of Antidumping Duty Investigation. https://www.federalregister.gov/documents/2019/09/24/2019-20813/fresh-tomatoes-from-mexico-suspension-of-antidumping-duty-investigation

Ribera, L.A., L. Young, S. Zapata, D. Hanselka, and D. McCorckle (2025). Economic Impact Analysis of Fresh Mexican Tomatoes Imported by the United States. Center for North American Studies, Texas A&M University System. https://agecoext.tamu.edu/wp-content/uploads/2025/04/2025.02.Update-Estimated-Impact-Analysis-of-Mexican-Tomatoes-Imported-by-the-United-States.pdf

Spiegelman, M. (2025). “Commerce moves to end tomato deal with Mexico, reimpose duties” Inside U.S. Trade (April 15). https://insidetrade.com/daily-news/commerce-moves-end-tomato-deal-mexico-reimpose-duties

U.S. Department of Agriculture, Economic Research Service (USDA-ERS) (2025a). Vegetables and Pulses Yearbook Tables. https://ers.usda.gov/data-products/vegetables-and-pulses-data/vegetables-and-pulses-yearbook-tables

U.S. Department of Agriculture, Economic Research Service (USDA-ERS) (2025b). Price Spreads from Farm to Consumer https://www.ers.usda.gov/data-products/price-spreads-from-farm-to-consumer

U.S. Department of Agriculture, Foreign Agricultural Service (USDA-FAS) (2025). Global Agricultural Trade System. https://apps.fas.usda.gov/gats/default.aspx

Muhammad, Andrew, and Luis A. Ribera. “Tomato Trade Wars: How the Suspension Agreement with Mexico Shapes the U.S. Market.” Southern Ag Today 5(18.4). May 1, 2025. Permalink

Leave a Reply