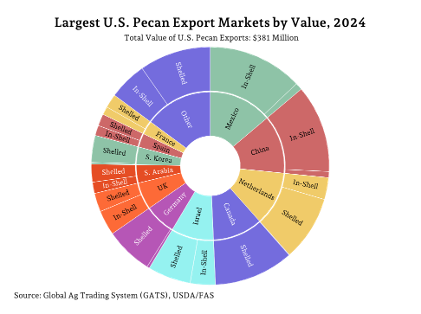

United States (U.S.) pecan production totaled 120 thousand metric tons (TMT) in 2024. Exports of pecans from the United States in 2024 totaled 53.7 TMT, worth a total of $381 million. In-shell pecans accounted for 32.2 TMT and $169.2 million; the remaining 21.5 TMT and $211.8 million of exports were shelled. In-shell exports to Mexico and China accounted for $94.5 million in 2024, representing 75.8 percent of the total volume of in-shell exports. The export market for shelled pecan exports is less consolidated.

Due to the ease of access to low-cost labor in Mexico, a significant portion of the in-shell pecans exported to Mexico will be shelled and then imported back to the United States, where they will be sold domestically or packaged for export elsewhere. This makes Mexico far and away the largest market for U.S. pecan imports. Mexico accounted for 99.7 and 99.5 percent of in-shell and shelled imports, respectively.

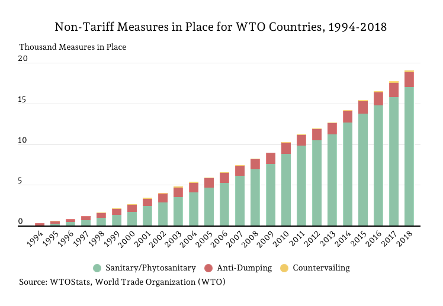

The North American Free Trade Agreement (NAFTA) worked to lower trade barriers and was renewed recently in 2020 as the United States-Mexico-Canada Agreement (USMCA). One such barrier addressed was tariffs on pecan trade between the United States and Mexico, which were set at zero percent. This does not account for non-tariff barriers to trade. Non-tariff measures (NTM) have a major impact on trade that is difficult to quantify. Since 2004, the NTMs for all WTO countries have nearly quadrupled from 5.3 thousand measures to 19 thousand. The largest NTM category is sanitary and phytosanitary (SPS) restrictions.

The pecan weevil quarantine is one such SPS issue that has arisen. Arizona, California, New Mexico (except for Otero County), and six counties near El Paso, Texas, are all that fall outside of the pecan weevil quarantine zone. While the Texas Department of Agriculture also has a quarantine on pecan weevils for many eastern states, once one of the four approved treatment options has been completed, the product is free to travel from a non-quarantine zone. That is not the case with exports to Mexico, which requires non-quarantined pecans to be treated and will not allow any pecans from quarantine areas.

In February, it was announced that a 25 percent tariff would be placed on both USMCA partner countries; this applies to all products, including agricultural imports. Thus, the tariff rate on imported pecans from Mexico, which is primarily shelled, would increase from zero percent to 25 percent. U.S. pecan imports coming from Mexico account for over 99.5 percent of the total for both shelled and in-shell; thus, other new import tariffs have little impact comparatively. It is very difficult to predict the actual impact of the 25 percent tariff, but somewhere along the supply chain, the extra cost will have to be paid, and oftentimes the lion’s share falls onto the consumer.

References

Foreign Agricultural Service (FAS). Global Agricultural Trade System (GATS). Online database. https://apps.fas.usda.gov/gats/default.aspx. Online public database accessed August 2025.

USDA Animal and Plant Health Inspection Service (APHIS). Phytosanitary Export Database (PExD) with Requirements by Country. https://pcit.aphis.usda.gov/PExD/faces/ViewPExD.jsf Online public database accessed May 2025.

USDA National Agricultural Statistics Service (NASS). Quick Stats. https://www.nass.usda.gov accessed May 2025.

World Trade Organization. WTO Stats. https://stats.wto.org/. Online public database. Accessed April 2025.

Young, Landyn, and Luis Ribera. “U.S. Pecan Trade and Tariff Outlook.” Southern Ag Today 5(24.4). June 12, 2025. Permalink

Leave a Reply