We’ll take a break from the cattle and beef market news of the last week to take a look at dairy markets. However, there is one important interaction between beef and dairy markets that intersects with recent news.

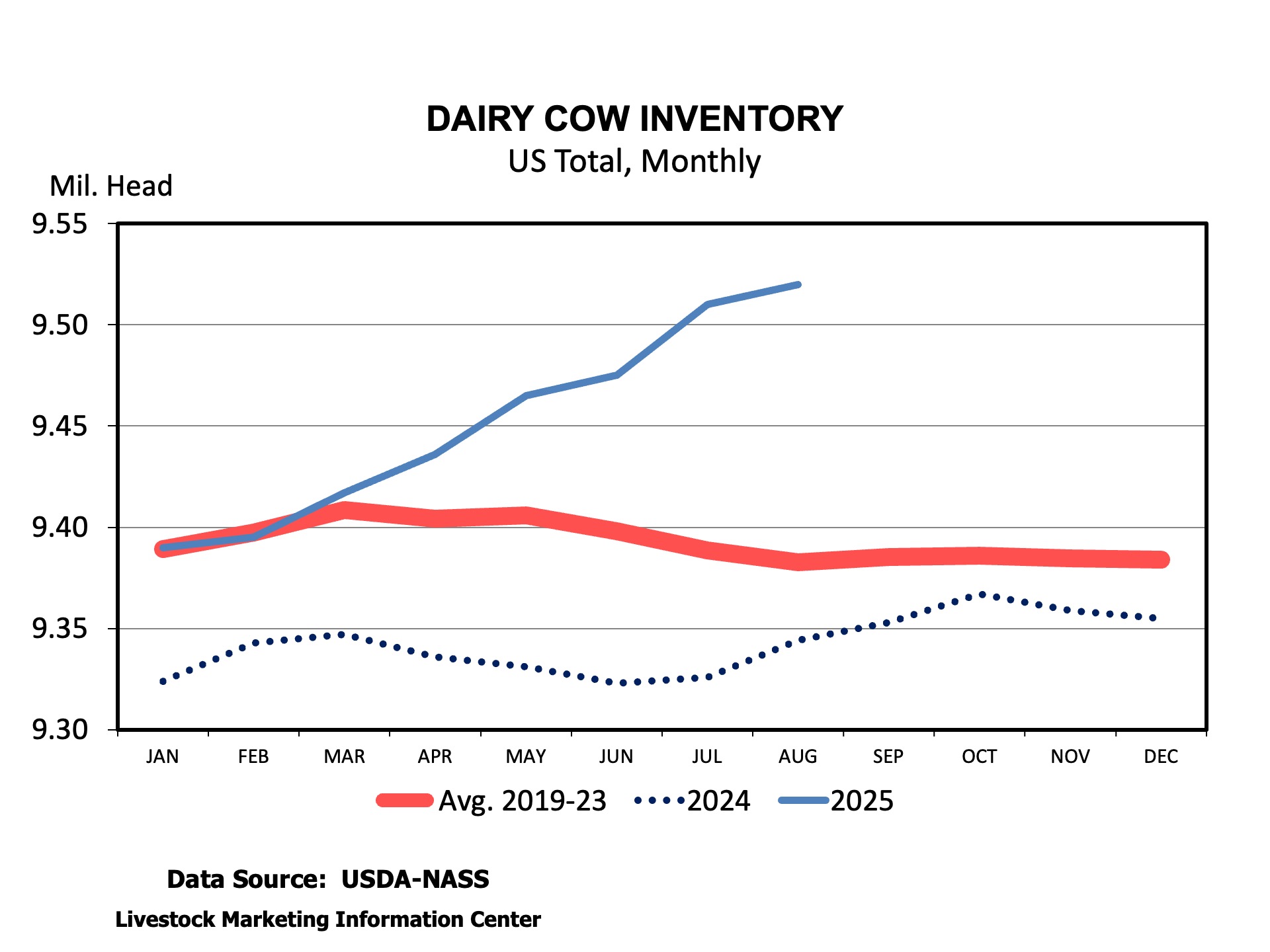

Profitable milk prices and falling feed costs in 2024 have led to a surge in the number of dairy cows since the first of the year. USDA’s August Milk Production report indicated 9.52 million dairy cows in the U.S. That is the highest number of dairy cows since 1993. The number of dairy cows in the U.S. has typically fluctuated between 9.3 and 9.4 million over the last decade. Cow numbers are particularly higher in the Plains. Dairy cows in Texas hit 699,000 head; this is the most dairy cows in the state since 1958! Milk processing capacity is growing hand in hand with cow numbers.

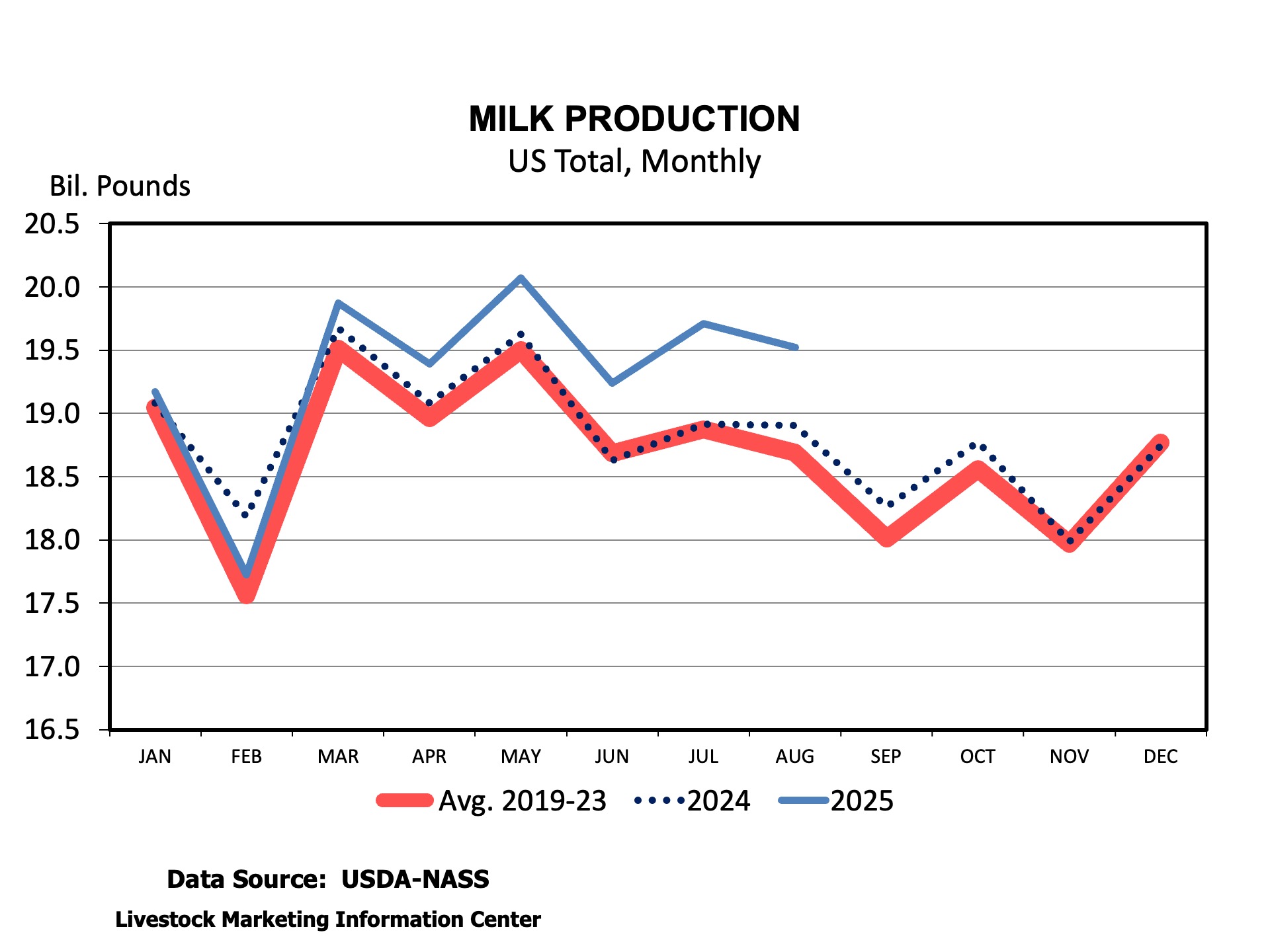

In addition to more cows, milk production per cow has increased since April. Production per cow hit 2,050 pounds in August, the largest August milk production per cow on record, up 1.3 percent compared to August 2024. The combination of more cows and more milk per cow has milk production up 3.6 percent over the last 3 months compared to the same period last year.

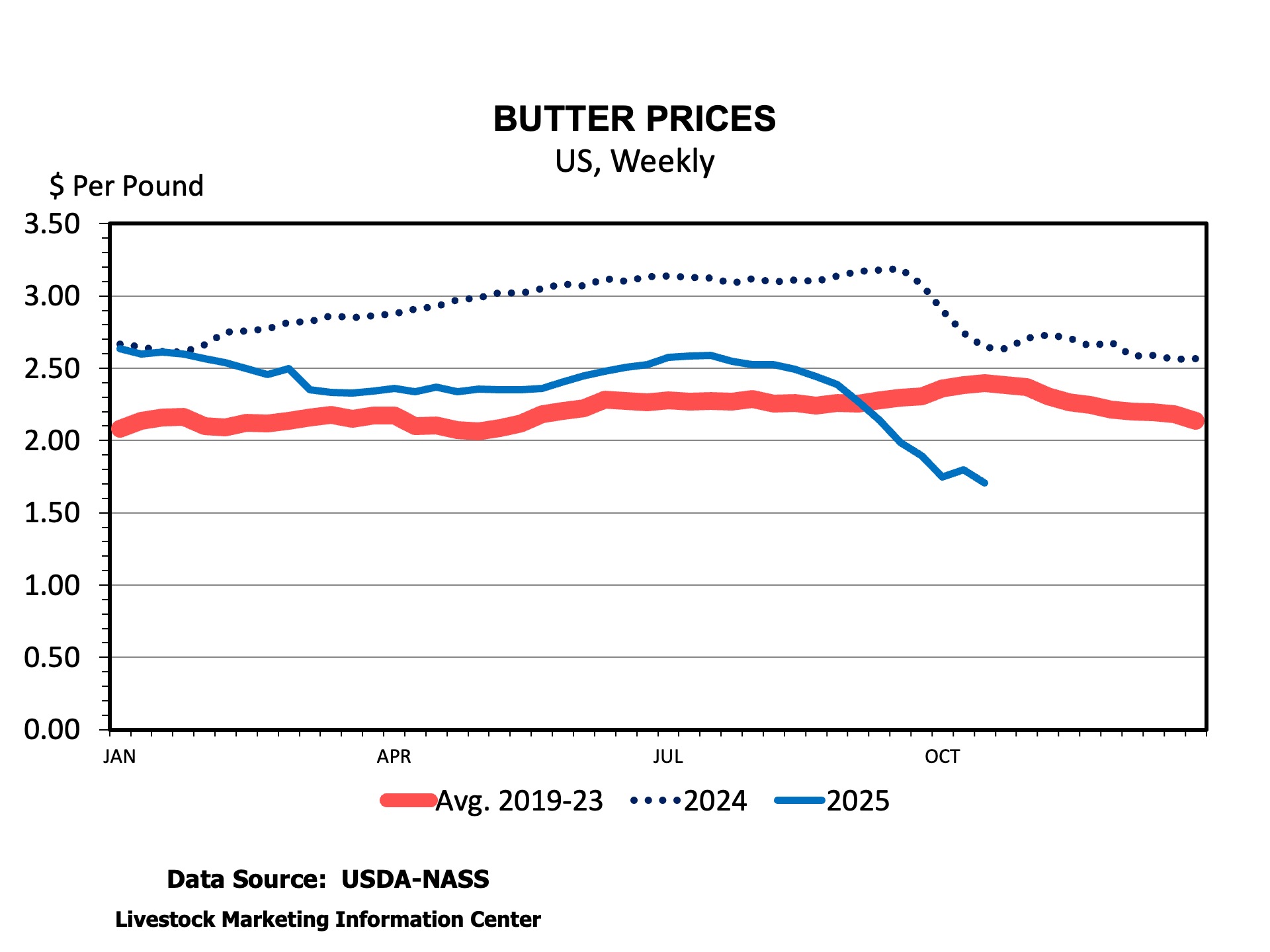

As production has surged, prices are beginning to decline sharply. Cheese, butter, and non-fat dry milk (NFDM) prices are the basic product prices forming federal milk marketing order prices. Cheddar cheese, 40 pound blocks, has moved between about $1.95 and $1.70 per pound all year. While prices should be increasing seasonally, heading into the holidays, they are about $0.30 per pound below a year ago. Butter prices have declined sharply over the last few weeks from $2.50 per pound to about $1.70 in mid-October. NFDM prices have fallen sharply to $1.14 per pound, their lowest price of the year. Lower product prices are filtering through to much lower milk prices to dairy farmers.

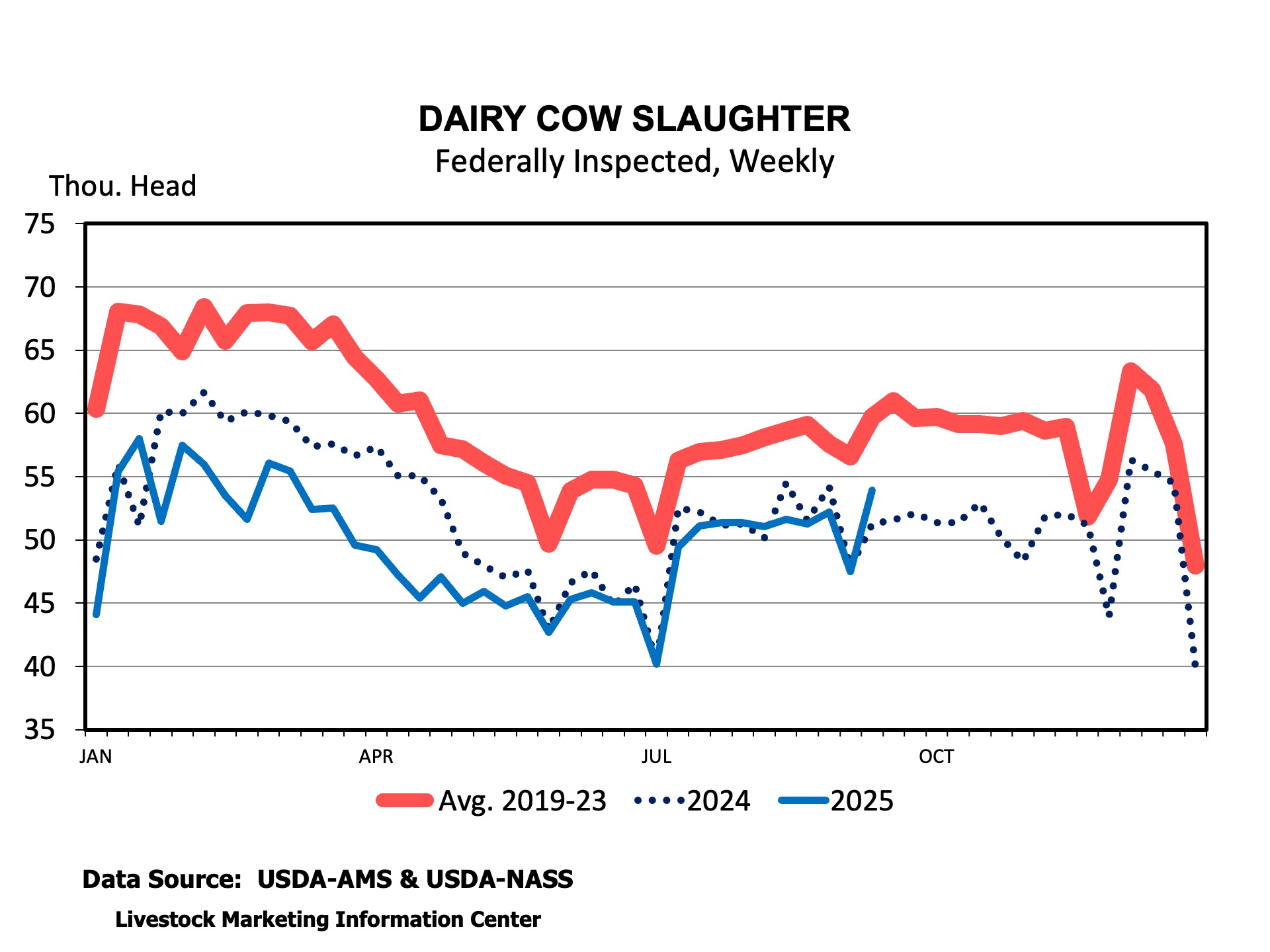

One area of interaction between dairy and beef cows is the cull cow market. While beef cow slaughter remains much lower than last year, dairy cow slaughter is picking up and has been equal to last year since mid-year. More dairy cows in the herd, falling milk prices, and record high cull cow prices will likely cause some more cow culling in the coming weeks. A recent newspaper article quoted a dairy farmer in Wisconsin as saying we really needed more dairy culling to boost milk prices and increase supplies of beef. Harkening back to the 1980s and the dairy herd buyouts, which caused even more worries for many cattle producers. At the moment, there is no government program to encourage dairy cow culling. Unless something changes, it looks like the market will take care of this, too.

Anderson, David. “A Wave of Milk and Slumping Prices.” Southern Ag Today 5(44.2). October 28, 2025. Permalink

Leave a Reply