Brazil is shifting from a bulk commodity supplier to a premium beef exporter. In June 2025, it reached a turning point: certification as free of foot-and-mouth disease (FMD) without vaccination (PAHO, 2025). The upgrade opened doors to high-value markets like Japan and South Korea. A Japanese delegation visited days later, and a deal with Vietnam quickly followed (Brasil, 2025).

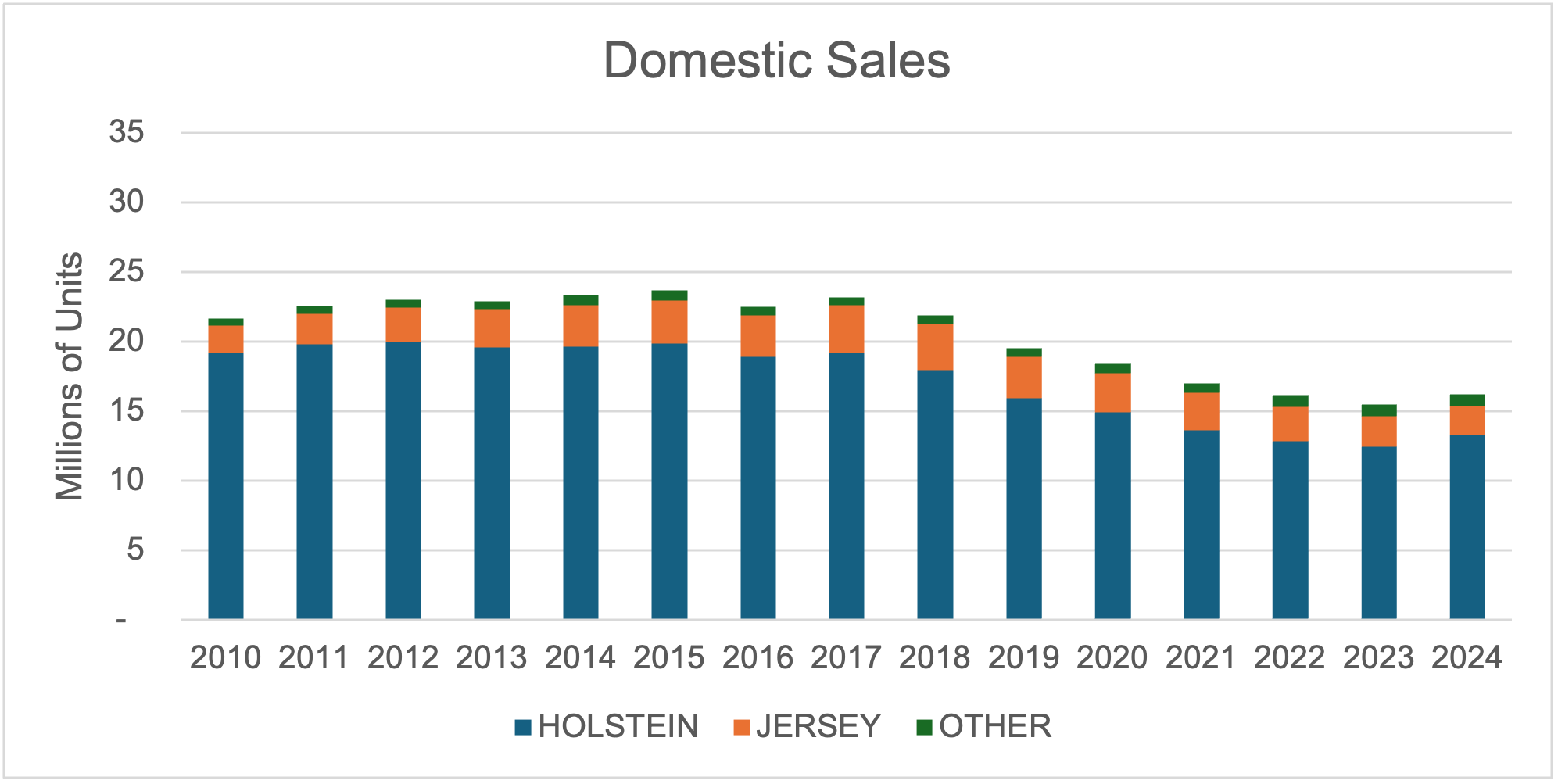

While expanding access to Asia, Brazil also made significant inroads into the U.S. market. In May alone, it shipped 175 million pounds of beef to the U.S., five times the volume of May 2024. As shown in Figure 1, Brazilian beef exports more than doubled year-to-date, driving a 60% surge in total U.S. beef imports (USDA–ERS, 2025).

The U.S. imposed a 50% tariff on imports from Brazil in July. With existing duties, the effective rate jumped to 76.4%. Brazil’s top exporters, Minerva, JBS, and Naturafrig, paused shipments and redirected product to Asia and the Middle East (Reuters, 2025a). Industry losses could top $1 billion in the second half of 2025 (Reuters, 2025b). The U.S. also launched a Section 301 investigation into Brazil’s trade practices (USTR, 2025). Though nearly 700 Brazilian products were exempted, beef remained on the list (The White House, 2025).

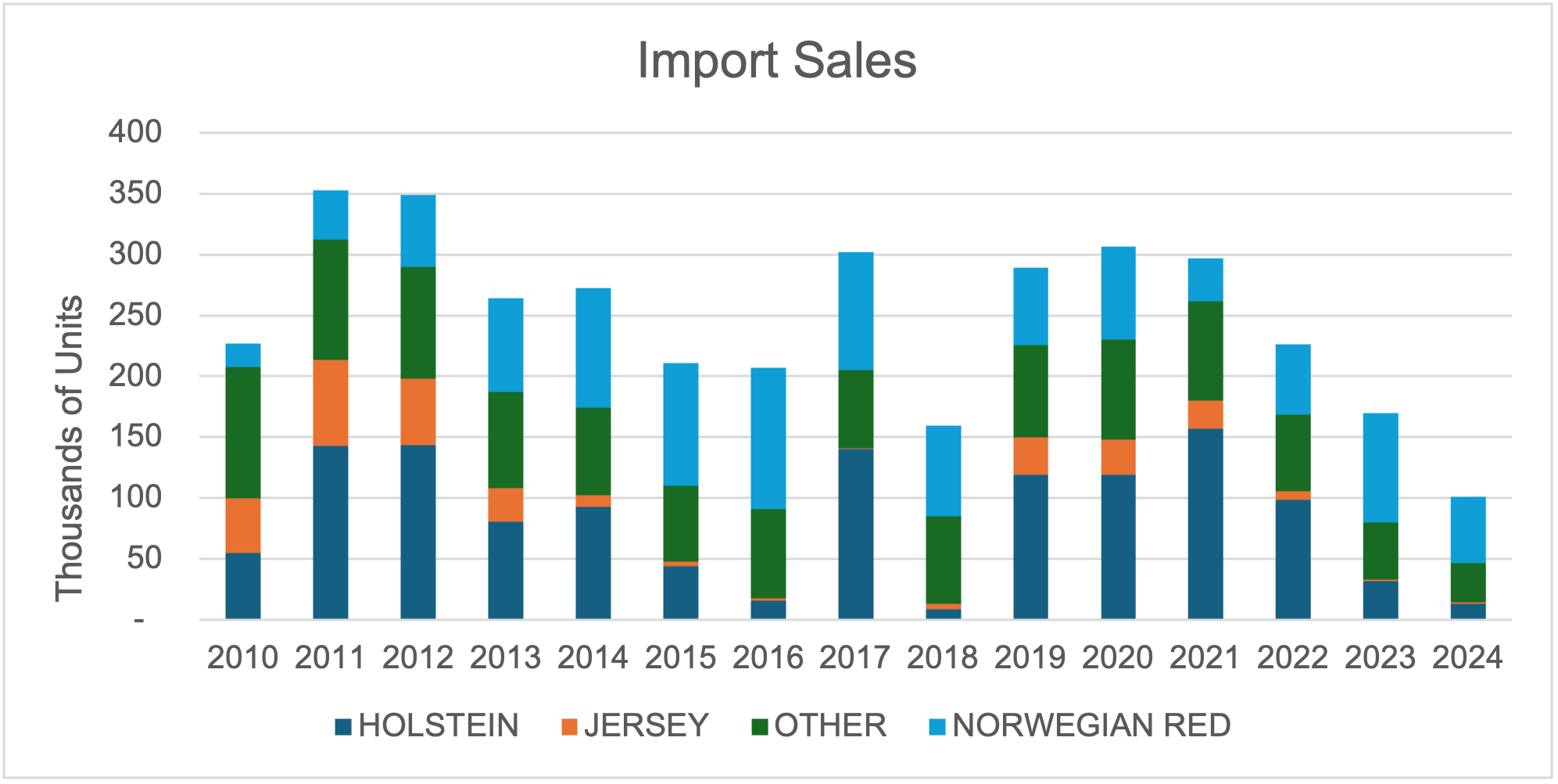

At the same time, the U.S. reinforced its trade presence in Asia, signing new agreements with Japan, the Philippines, and Indonesia. Figure 2 shows Asia remains the top market for U.S. beef exports (USDA–ERS, 2025).

While U.S. beef continues to command a premium, high prices and limited supply may create openings for Brazil in select Asian markets. With lower costs and upgraded health credentials, Brazil could appeal to buyers seeking value without sacrificing quality. Brazil’s pivot toward premium exports positions it to compete on perceived value, not just price. Still, U.S. beef holds strong brand recognition, deep trade ties, and a track record of consistency, advantages that remain critical in Tokyo, Seoul, and Hanoi.

Figure 1. Year-to-date U.S. Beef Imports by Volume (million pounds) and Origin, January-May 2024 and 2025

Figure 2. U.S. Beef Exports by Volume (metric tons) and Countries, 2020 to 2024

References

ASBIA – Associação Brasileira de Inseminação Artificial. (2025). Anuário ASBIA 2025. https://asbia.org.br/wp-content/uploads/Anuario/ASBIA_anuario_2025.pdf

Brasil. Presidência da República. (2025, April 1). President Lula announces opening of Vietnam’s market to Brazilian beef. https://www.gov.br/planalto/en/latest-news/2025/04/president-luiz-inacio-lula-da-silva-announces-opening-of-vietnams-market-to-brazilian-beef

Datamar News. (2025, July 31). Possible opening of Japanese market to Brazilian beef will apply only to five states. https://datamarnews.com/noticias/possible-opening-of-japanese-market-to-brazilian-beef-will-apply-only-to-five-states/

Office of the United States Trade Representative. (2025, July). USTR announces initiation of Section 301 investigation of Brazil’s unfair trading practices. https://ustr.gov/about/policy-offices/press-office/press-releases/2025/july/ustr-announces-initiation-section-301-investigation-brazils-unfair-trading-practices

Pan American Health Organization. (2025, June 6). Bolivia and Brazil certified free of foot-and-mouth disease without vaccination. https://www.paho.org/en/news/6-6-2025-bolivia-and-brazil-certified-free-foot-and-mouth-disease-without-vaccination

Reuters. (2025a, July 30). U.S. tariffs prompt Brazilian meatpackers to reassess beef exports. https://datamarnews.com/noticias/u-s-tariffs-prompt-brazilian-meatpackers-to-reassess-beef-exports-says-abiec/

Reuters. (2025b, July 29). Brazil beef-packers estimate $1 billion in losses if U.S. tariffs apply. https://www.reuters.com/world/americas/brazil-beef-packers-estimate-1-billion-losses-if-us-tariffs-apply-2025-07-29/

The White House. (2025, July 30). Addressing Threats to The United States by The Government of Brazil. The White House. https://www.whitehouse.gov/presidential-auctions/2025/07 /addressing-threats-to-the-us/

U.S. Department of Agriculture, Economic Research Service. (2025, July 17). Livestock, dairy, and poultry outlook: July 2025 (LDP-M-373). https://www.ers.usda.gov/publications/pub-details/?pubid=106890

Calil, Yuri, and Felipe Martins Moreira. “U.S.–Brazil Beef Trade at a Crossroads.” Southern Ag Today 5(32.4). August 7, 2025. Permalink