USDA released its Cattle on Feed and July Cattle inventory reports on Friday, July 25th. These reports are a good opportunity to poll some thoughts from our SAT authors across the South.

Will Secor – University of Georgia

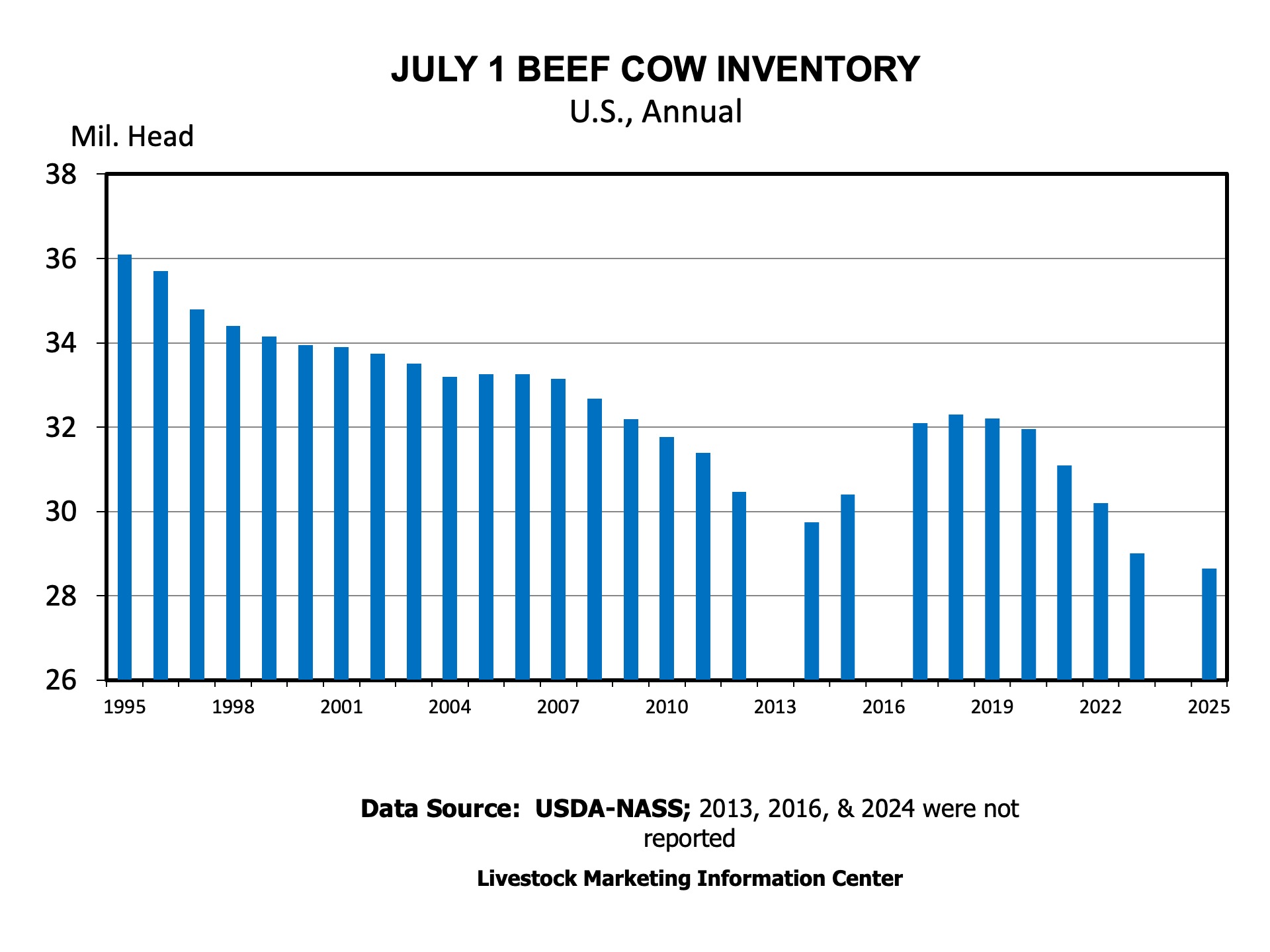

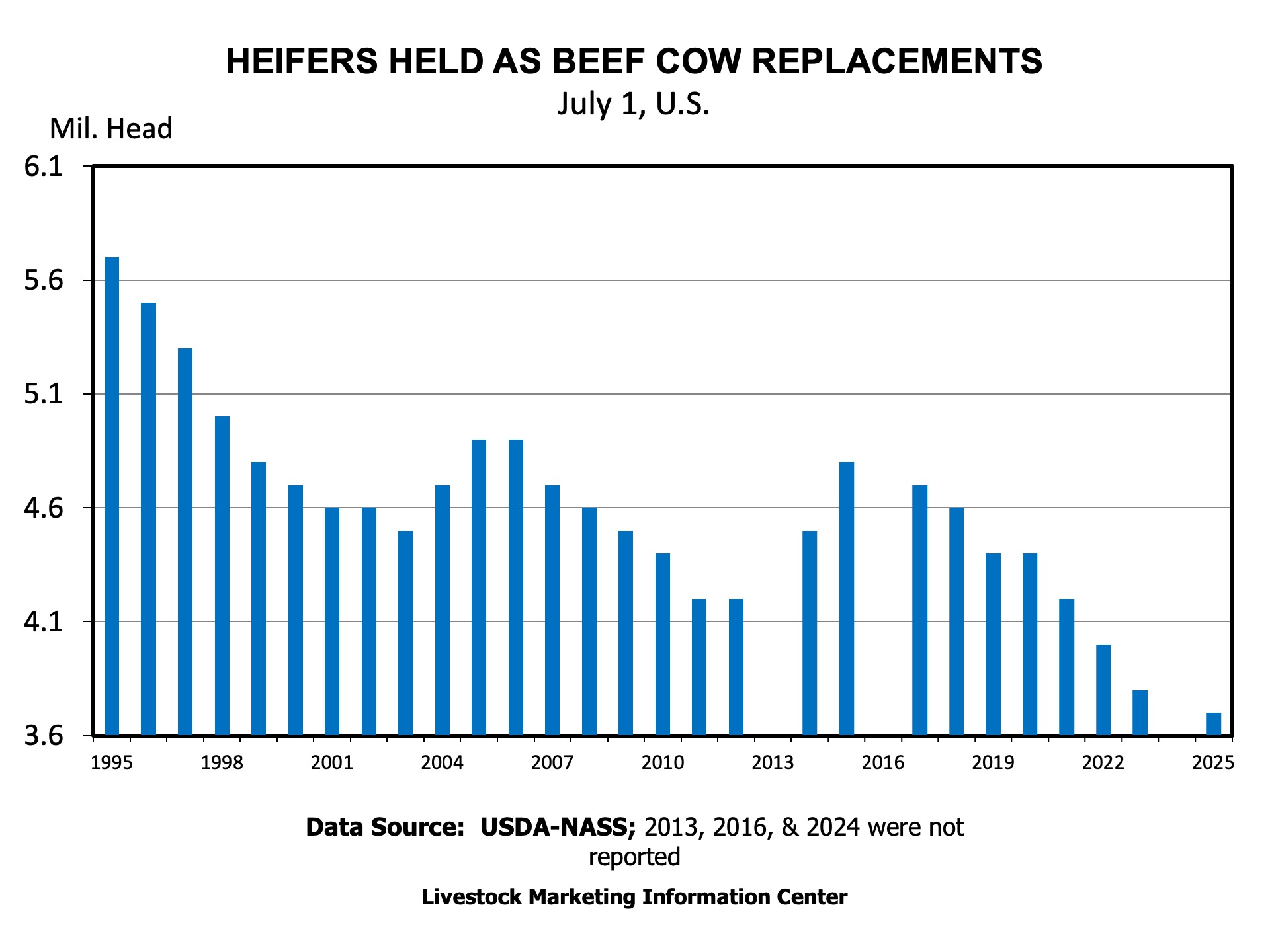

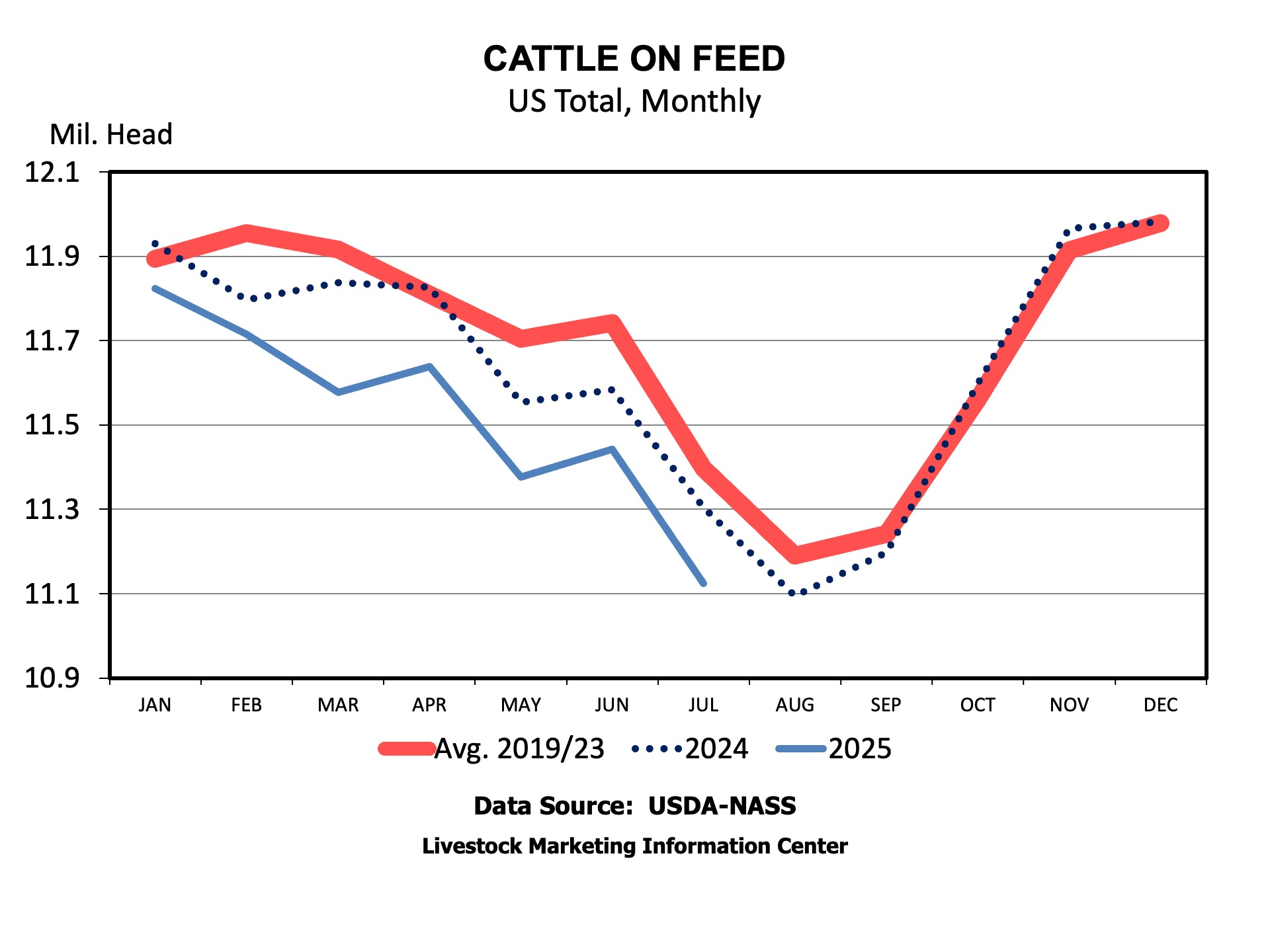

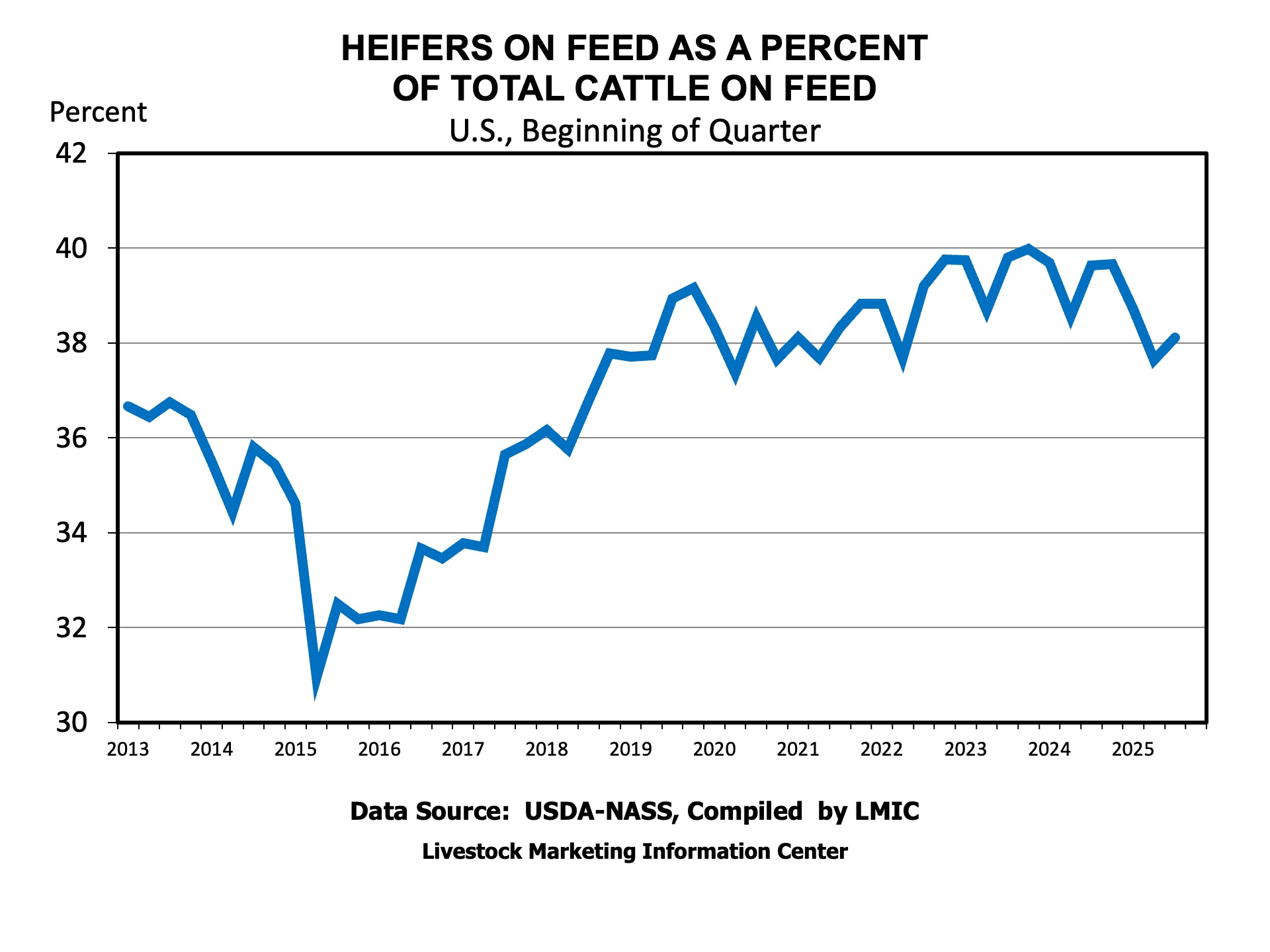

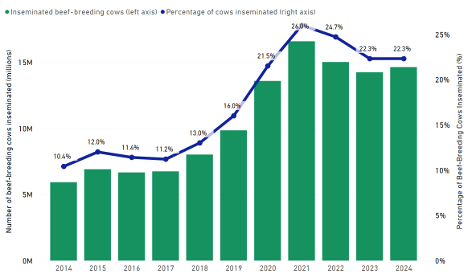

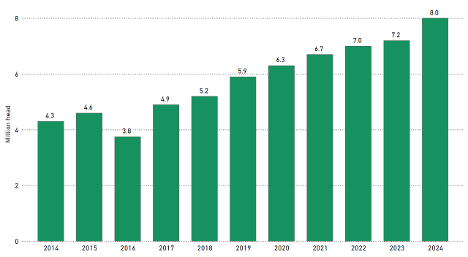

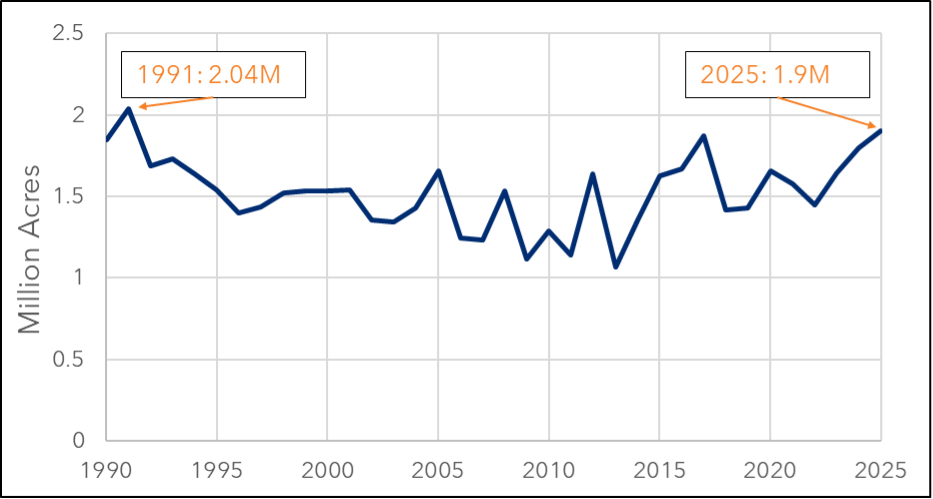

The July Cattle and Cattle on Feed reports from USDA provided indications that the cattle herd is approaching a low in inventory but may not be there just yet. The mid-year Cattle report provided a first estimate of the 2025 calf crop, which is projected to be roughly 1.3 percent smaller than the 2024 calf crop. Combined with January’s report of fewer beef cow replacement heifers, this is an indication that the cattle herd may still be smaller come January 2026. However, the Cattle on Feed report indicates that the share of cattle on feed that are heifers declined again year-over-year to its lowest July reading since 2019. Overall, these reports show a continued decline in the cattle inventory, but they also shed some light on the potential of a rebuild that may be starting soon.

Kenny Burdine – University of Kentucky

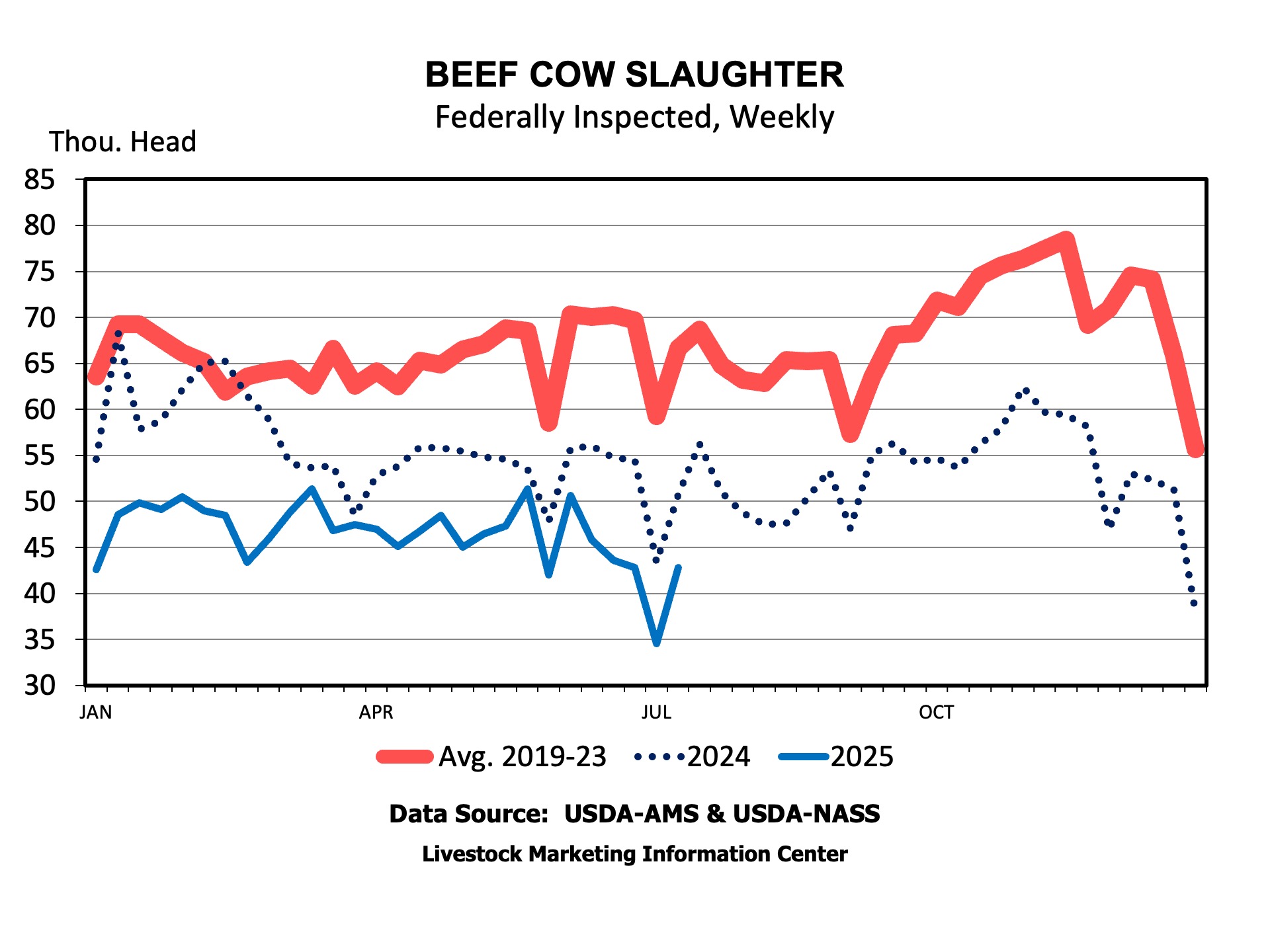

The fact that there was no mid-year inventory report in 2024 makes comparison a bit difficult. Beef cow inventory was down by 1.2% from July of 2023. Most were expecting beef cow inventory to be down a bit more over the last two years, but I think this speaks to how much lower beef cow slaughter has been running. For the 12 months from July 2024 to June 2025, nearly 650,000 fewer beef cows were harvested than from July 2023 to June 2024. I think it’s likely that beef cow inventory was down by more than that from July 2023 to July 2024, but increased over the last 12 months due to lower slaughter levels. Heifers held for beef cow replacement were down 3% from 2023, which is a decrease of 100,00 head. The best way to think about this number is to consider it as a percentage of beef cow inventory. When looking at it that way, our heifer retention pace is lower than it was in 2023.

The surprise of this quarterly cattle-on-feed report was June placements, which were down 8% from 2024 and outside the range of expectations. Marketings continue to suggest we may be pulling cattle ahead, but placements suggest we are not replenishing them at the same pace.

Heifers, as a percentage of on-feed inventory, came in at 38.1%. This is about a percent and a half lower than July 1 of 2024, but up about half a percent from April of this year. Much like the beef replacement heifer estimate from the inventory report, this does not suggest much retention is occurring. Any growth in beef cow numbers is coming from reduced cow slaughter.

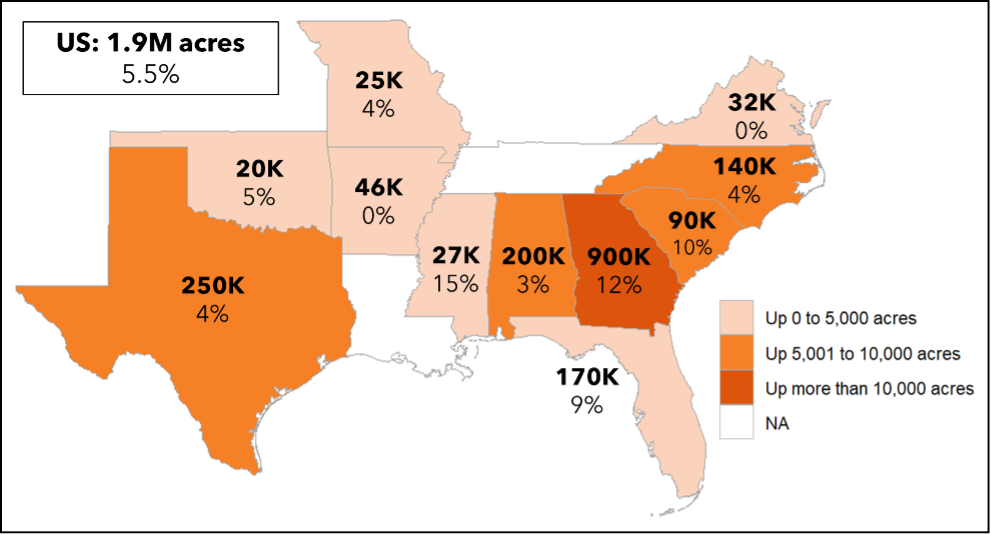

Shifting my focus towards home, I don’t think much retention is occurring in Kentucky at present. Anecdotally, producers tell me they are not keeping heifers at these price levels. I also think interest rates are impacting this decision. I do expect some expansion to occur in the Commonwealth over the next few years, but we are limited by land constraints and land costs.

Andrew Griffith – University of Tennessee

I don’t really know what to say about these reports. A lot of the time we discuss industry estimates compared to USDA estimates. The main thing in this report is we saw lower beef cow numbers, a smaller calf crop, and fewer cattle on feed.

It looks like more heifers are being retained this year and fewer cows are being slaughtered. There is a good chance we see a steady to slightly higher beef cow number come January 1, 2026. Of course, drought could hit once again and further delay rebuilding.

The one thing I feel certain is that the competition for cattle is going to be fierce the next couple of years. I think we will see closures, idling, or consolidation of packing plants and feedlots. Even if that does not happen, capacity utilization is going to be small. This also feeds back to stocker and backgrounders who will be growing a smaller number of cattle than usual, which will influence profitability.

Josh Maples – Mississippi State University

I don’t see significant signs of expansion from these reports. Heifers held for beef cow replacement were down 3% from the 2023 report. The 5% drop in heifers placed into feedlots during the last quarter is the number that jumps out as the question mark. But, taken with all of the other data, I’m not yet ready to call it an obvious sign of expansion. After accounting for fewer imports from Mexico, heifer placement is down 2.5% during the first half of 2025 compared to the first half of 2024. It could just be that we have fewer heifers due to smaller calf crops, and that there are some differences in placement timing. The overall percentage of heifers on feed ticked back up to 38% after dropping in the previous quarter. I think 2025 is likely a stabilization year for beef cow inventory, with 2026 having the higher odds for modest expansion if pasture conditions cooperate.

Hannah Baker – University of Florida

While the 2025 July Inventory Report does not include state breakdowns, the numbers reported in both the inventory and cattle on feed reports reflect what is happening across Florida: some producers are thinking of and starting to retain heifers, but the majority are still capitalizing on record-high calf prices. Beef replacement heifers are down 3 percent from 2023, and the beef cow herd is smaller by 350,000 head. The number of “other heifers over 500 pounds” is also 3 percent lower than 2023, meaning there is also a smaller pool of heifers to pull from for any impulse breeding in the back half of 2025 and early 2026. Signs of slow heifer retention are also shown in the Cattle on Feed report, where the number of heifers on feed was 5% lower than 2024, but the percentage of heifers on feed rose by 0.5% since April to 38.1%.

James Mitchell – University of Arkansas

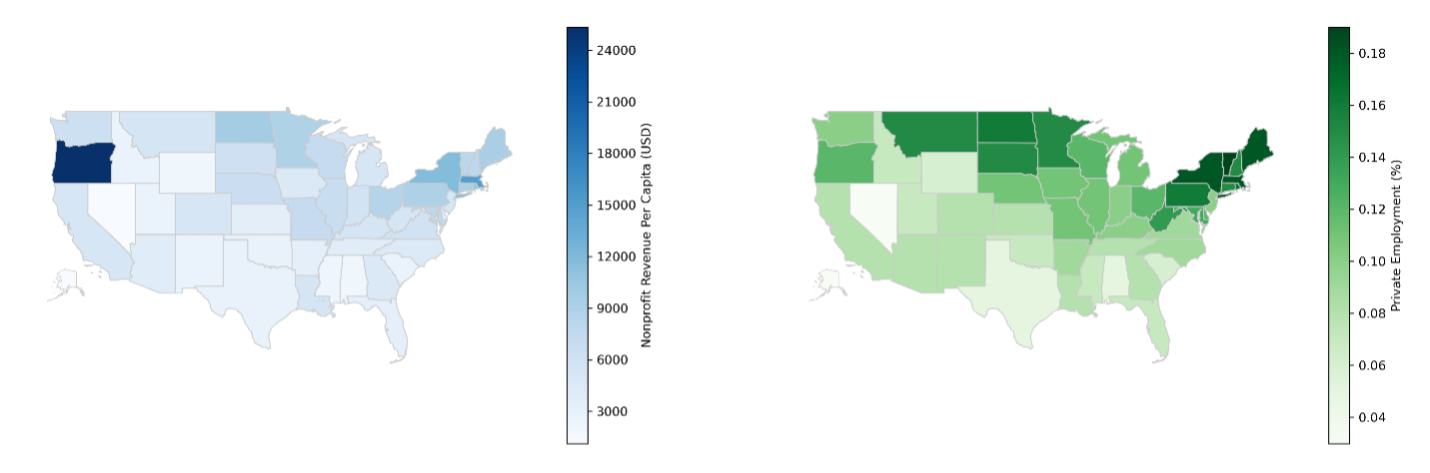

A statistic I like to track is the ratio of July beef replacement heifers relative to the previous year’s calf crop (as estimated in the January report). I use this as a crude indicator of retention and potential herd expansion. The estimate for July 2025 is 11.04%, nearly identical to July 2023 at 11.03%. For comparison, the ratio was 14.32% in July 2015. We’re not there yet, which makes me wonder: with strong profitability over the last few years, are producers reinvesting in other ways – farm infrastructure, equipment, land?

Charley Martinez – University of Tennessee

It’s unfortunate that we didn’t have last year’s July 1 report. But, when looking at the percentage of changes between 2023 and 2025, I think the trends were expected. The most interesting statistic to me was the expected 2025 calf crop of 33.1 million head. The calf crop was 33.56 million in 2023, and 33.52 million in 2024. The calf crop expectation highlights the impacts of the shrinking herd over the last two years, and the expected tighter feeder calf supply signals continued elevated feeder calf prices. This report also starts the excitement for the January 1 report, where we will have statistics and more detailed data.